Financial results report form in Word. The procedure for filling out the financial results report. Financial results report, thousand rubles

Read also

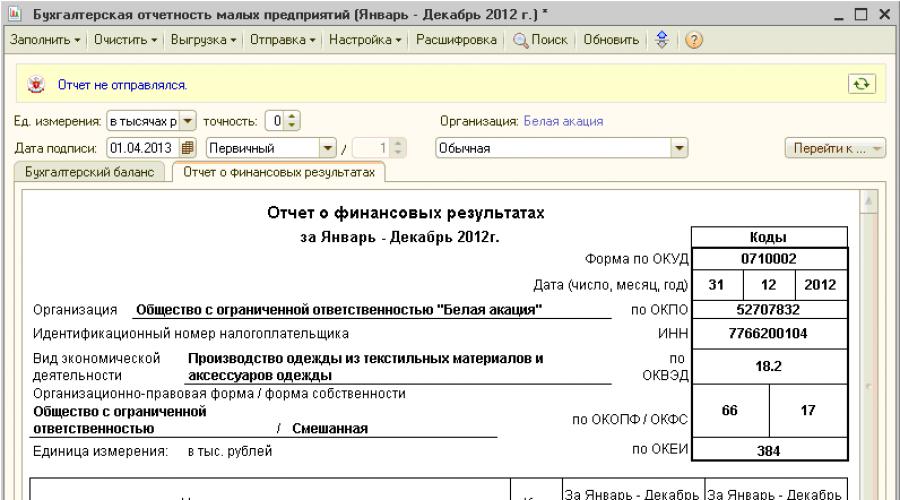

The profit and loss statement form 2 from January 1, 2013 is called the financial performance statement. You will find how to fill out Form 2 in the article below; we invite you to download a sample of how to fill out a profit and loss statement using the example of 2013. You can download the financial results report form that is relevant when filling out the financial statements for 2013 in the article below. In this article we will look at the structure and content of the financial results report.

Form 2 of the financial statements reflects the financial results and expenses for the purchase of fixed and working capital, financial transfers, and tax obligations. Since 2013, this report has been compiled once a year and submitted within the first 3 months of the next year. Enterprises on the simplified tax system display only those income and expenses that relate to taxation. Along with Form 2, it is also necessary to fill out and submit the completed balance sheet, Form 1. A sample of filling out the balance sheet of enterprises can be downloaded from, and here you can download the form itself, Form 1. For small businesses there is its own (balance sheet and profit and loss statement).

Data in the financial results statement form must be entered for two years: the reporting year and the previous one; when filling out the form for 2013, data at the end of 2012 and 2013 is indicated.

Sample of filling out a financial results report

Line by line filling out form 2:

Revenue (2110) – all cash received as a result of operating activities. Excise tax and export duty must be deducted.

Cost (2120)– expenses for core activities (income from them is displayed in the “Revenue” line), the composition depends on the type of activity:

- for a manufacturing enterprise this is;

- in trade – purchased;

- for the service sector - costs of performing work.

The entire amount on the second line of the income statement is enclosed in parentheses.

Gross profit (2100)– the difference between revenue and cost reflected in the two lines above.

Commercial expenses (2210)- all costs associated with sales (in trade - turnover costs). This is the sum of all transactions in which the debit is “Cost”, and the credit is “Sales Expenses”. The number is enclosed in parentheses.

Administrative expenses (2220)– the calculation depends on the accounting policy of the enterprise. If the enterprise operates according to the full cost system, then the expenses are displayed in the registers with the debit “Production expenses”. This means that all management costs are already included in the second line. If the enterprise has a reduced cost system, then management costs are written off immediately, that is, they are not distributed by type of product, they are displayed in the fifth line and are enclosed in parentheses.

Profit from goods sold (2200)– the numbers entered in the fourth and fifth lines are subtracted from the number entered in the third line.

Income from other enterprises(2310) - fill out only those enterprises that, during the reporting period, invested funds in other enterprises and received income from these investments.

Interest to be received(2320) – interest on deposits and securities that the enterprise must receive.

Interest to be paid (2330)– interest expenses on loans or credits that need to be paid. The number is enclosed in parentheses.

Other income (2340) – amounts received for the sale of non-current and working capital, fines received, interest, income from equity participation.

Other expenses (2350)– paid fines, interest, debts. The number must be enclosed in parentheses.

Profit (before taxes) (2300)– this line of the financial results statement reflects the amount of profit before tax; this value is determined as follows: profit from goods sold + income from other enterprises + interest to be received – interest to be paid + other income – other expenses. If the line displays a loss, the number is enclosed in parentheses.

Income tax (current)(2410) – accrued (if it is accrued according to PBU 18/02). If Form 2 is filled out by a small business entity, then this line remains blank.

Including permanent tax liabilities (2421)– to be filled in if, when summing up the results, there is a difference in tax and accounting. The amount in this line is the difference by which the amount of income tax determined to be paid will increase or decrease.

Changes in the amount of deferred tax payments(2430) – to be filled in if the enterprise has income or expenses that were accounted for in one period, and the tax on them is calculated in the subsequent period.

Management at every enterprise strives to generate income, increase sales, and solve other similar problems. Any activity must have an essence that boils down to a certain result. Reports are needed to document any type of financial transactions.

This document is the basis for the work of the accounting department. It describes the financial performance of the enterprise over a certain period of time. Such periods are called reporting periods.

Most of the information is related to expenses and income.

And direct results of activity, expressed in financial indicators.

The document requires the reflection of the expenses of any group - management and commerce, production of finished products.

The document must be submitted to the tax organization no later than three months after the end of the reporting period.

Step-by-step instructions for filling out the document

Without the ability to calculate economic indicators, correctly filling out a report becomes impossible. There are quite a lot of such indicators in report form number 2. And each of the indicators has an individual code.

Let's start with a general listing of data that must be present in the report:

- Information for reference only.

- Indicators of net profit with a loss.

- Data on deferred assets, annual changes.

- Indicators of profit and loss before taxation.

- Losses or profits from sales.

- Group with other income and expense items for the year.

- Interest that has been received or has already been paid.

- Gross profit, loss for the past year.

- Expenses for commerce and administrative activities.

- Cost level of branded sales.

- How much revenue was received during the year?

Excise taxes and VAT are not included in all indicators mentioned in the report. This is especially important for the income group.

Where can I download a sample form?

When drafting a document, it is better to look at an example. The financial results report form is available.

Posting any negative indicators does not require the use of a minus sign. To indicate a negative value, simply use parentheses.

Data for the current period are necessarily compared with what was before.

How to fill in lines?

You can also use an electronic form or tables to fill it out. Then this process will be much easier.

You must enter your values literally on every line.

- 2460. Here they write about amounts that are not included in the previous lines.

- 2450. Deals with changes in tax-deferred assets.

- 2430. Changes in IT.

- 2421. Residue of PNO.

- 2410. With income tax based on the data referred to in the declaration.

- 2350. The result of subtracting the value of line 2330 from expenses.

- 2340. Other income minus VAT and excise taxes, values from lines 2310 and 2320.

- 2330. Dedicated to the interest that is paid for using loans.

- 2310. Dividends and property received by the organization. To calculate them, we take the balance amount of the debit of account 91, analyze this type of income, use the correspondence of account 76.

- 2100. Gross profit minus commercial expenses.

- 2210. Income from core activities, commercial type

- 2120. Excise taxes with VAT are deducted from the amount of expenses from core activities.

- 2110. Here they write about the revenue generated by operating activities. Only taxes and other fees, VAT and excise taxes are not taken into account.

What data should be reflected in the report on the flow of funds in foreign accounts? Rules for filling out the document are in.

Comparison of indicators in the report

Previously, it was reported about the need for comparisons between the indicators of the current period and previous ones.

This means that all figures that are included in the report are generated using uniform rules.

There are two main reasons why disparate data types appear:

- Serious errors in previous years identified during the reporting period.

- Changes in the accounting policies of organizations.

Last year's data needs to be corrected, until a match is achieved with the situation in which the enterprise is now. You should not make changes to reports compiled for previous years.

There is no line numbering in approved form No. 2. The encoding of strings is separately specified based on Order No. 66n of 2010.

Typically, accountants rely on the fourth appendix to this document. Line numbering is mandatory for those who plan to submit a report to statistical authorities and the Federal Tax Service.

The main thing is to take into account the features that are characteristic of a particular legal entity. For example, a special type of form No. 2 exists for entities working in small businesses.

It is with them that the introduction of enlarged data is associated. These are supplemented by a large number of lines included in the standard form.

It is unacceptable for different copies to have signatures that differ from each other.

If the report is sent to regulatory authorities in electronic form, then there is no need to duplicate it in paper form.

Submitting a document to the tax authorities and possible fines

The document is submitted to the inspection along with other elements of the financial statements. There is also an intermediate option, which is formed a maximum of a month after the reporting period has ended.

Fines apply only to those organizations that do not comply with the requirements of current legislation. The main thing is to carefully approach filling out the document.

Then there will be no problems in the future. Reporting is useful for those who want to identify reserves that can improve the efficiency of current work.

For the nuances of preparing a financial results report, watch this video:

The general form of the financial results statement is given in Appendix No. 1 to Order No. 66n.

The financial results report provides data for the current and previous years.

In column 1 “Explanations” indicate the number of the explanation to the corresponding line of the statement of financial results.

Column 3 must be added independently to indicate the line code in it.

General rules for filling out the financial results report

The annual income statement reflects data on income and expenses recognized in the company's accounting records for the reporting and previous years.Last year's data should be taken from last year's income statement.

To fill out the lines with indicators for the reporting year, you will need:

- balance sheet for the reporting year;

- balance sheet for the subaccount “Other income” to account 91 “Other income and expenses” (with breakdown by subaccount) for the reporting year;

- balance sheet for the subaccount “Other expenses” to account 91 “Other income and expenses” (with breakdown by subaccount) for the reporting year.

The procedure for filling out individual lines of the financial results statement

Let's consider what should be reflected according to certain indicators given in the financial results report.IN line 2110 reflect income from ordinary activities - revenue for goods sold, work performed, services rendered. Please note: income must be indicated excluding VAT and excise taxes.

The cost of goods sold (work performed, services provided) corresponds to the indicator for line 2120. When calculating the total, it is taken into account with a minus sign, therefore it is enclosed in parentheses.

IN line 2100 indicate the amount of gross profit (the difference between the indicators of lines 2110 and 2120), in line 2210- commercial expenses, in line 2220— administrative expenses.

The financial result from the sale of goods (performance of work, provision of services) (sum of lines 2100, 2210 and 2220) is recorded in line 2200. If it is negative, it means the organization was operating at a loss.

Income resulting from participation in the authorized capitals of other organizations (dividends on shares) and joint activities is indicated in line 2310, but only if such income is not the main one. Otherwise, its value should be in line 2110.

IN line 2320 combined amounts of interest that the organization received in the reporting period on bonds, deposits, government securities, funds stored in a current account, issued loans and borrowings. And the amounts accrued for payment already on their bonds and bills, as well as on loans taken out, are contributed to line 2330. This is an expense, so write the amount in parentheses.

IN lines 2340 And 2350 provide other income and expenses that were not included in the figures of the previous lines.

IN line 2300 calculate profit before tax by summing lines 2200 - 2350 and taking into account that expenses are indicated with a minus sign.

Lines 2410 - 2450 are intended for income tax payers, so “simplified” people put dashes in them and move on to the next line - 2460. It, in particular, reflects the tax paid under the simplified taxation system (in brackets), as well as penalties and fines accrued for violations of tax laws.

IN line 2400 calculate net profit (or loss) for the reporting year. For “simplified” people, this will be profit minus the accrued single tax under the simplified system. By the way, the indicator on line 2400 of the financial results statement must coincide with the indicator of retained earnings (uncovered loss) from section. III balance sheet liabilities for this year (minus the same indicator for last year).

The following is background information. By line 2510 show the result of the revaluation of the organization’s non-current assets carried out in the reporting period. Note that this line indicates only the change in additional capital that arose due to the revaluation of non-current assets carried out in the reporting period. The amounts of revaluation (depreciation) of fixed assets and intangible assets included in the financial result as other income (other expenses) are shown in line 2340 “Other income” or 2350 “Other expenses”.

By line 2520 show the result of other operations that are not included in the net profit (loss) of the period.

IN line 2500 indicate the total financial result of the period. The indicator is determined as follows: line 2400 + line 2510 + line 2520.

Index lines 2900 represents the profit due for the reporting period to holders of ordinary shares. The indicator is calculated using the formula:

Basic profit (loss)

per share

Basic profit

(lesion)

Weighted average number of shares

The weighted average is the quotient of the total number of shares outstanding on the 1st day of each month of the reporting year divided by the number of months in it.

Another indicator related to the stock market, diluted earnings (loss) per share is reflected in line 2910. It is calculated like this:

Diluted profit (loss)

per share

Net profit - Dividends on preferred shares

Weighted average number of ordinary shares

The figures are provided by shareholders holding convertible securities.

Now we offer a scheme, which helps determine the report indicators (Dt and Kt mean debit and credit turnover for the reporting period according to the accounting accounts).

Line 2110 “Revenue” (minus VAT, excise taxes and other similar mandatory payments)= Kt 90, subaccount “Revenue”, - Dt 90 subaccounts “VAT”, “Excise taxes”, “Export duties”.

Line 2120 “Cost of sales”= Dt 90, subaccount “Cost of sales”, in correspondence with accounts 20, 41, 43 and 45. Enclose the indicator in brackets.

Line 2100 “Gross profit”= line 2110 + line 2120.

Line 2210 “Business expenses”= Dt 90, subaccount “Cost of sales”, in correspondence with account 44. Enclose the indicator in brackets.

Line 2220 “Administrative expenses”= Dt 90, subaccount “Cost of sales”, in correspondence with account 26. Enclose the indicator in brackets. Please note that it is more convenient to organize a separate subaccount of the same name on account 90.

Line 2200 “Profit (loss) from sales”= sum of lines 2100 - 2220.

Line 2310 “Income from participation in other organizations”= Kt 91, subaccount “Other income”, in the amount of income from equity participation.

Line 2320 “Interest receivable”= Kt 91, subaccount “Other income”, in the amount of interest receivable.

Line 2330 “Interest payable”= Dt 91, subaccount “Other expenses”, in the amount of interest payable. Enclose the indicator in parentheses.

Line 2340 “Other income”= Kt 91, subaccount “Other income”, minus interest receivable.

Line 2350 “Other expenses”= Dt 91, subaccount “Other expenses”, minus interest payable. Enclose the indicator in parentheses.

Line 2300 “Profit (loss) before tax”= sum of lines 2200 - 2350. If there is a loss during the reporting period, the value is indicated in parentheses.

Line 2460 "Other"= Dt 99 regarding the tax paid under the simplified tax system. Enclose the indicator in parentheses.

Line 2400 “Net profit (loss) of the reporting period”= sum of lines 2300 - 2460. Indicate the resulting loss in parentheses.

Example. Completing the financial results report

An LLC registered in 2016 applies the simplified tax system.

Accounting data for 2016 is shown in the table.

LLC accounting data as of December 31, 2016

The financial results report for 2016 in the general form will be completed as follows:

| Explanations | Indicator name | Code | For 2016 | For 2015 |

|---|---|---|---|---|

| - | Revenue | 2110 | 400 | - |

| - | Cost of sales | 2120 | (150) | (-) |

| - | Gross profit (loss) | 2100 | 250 | - |

| - | Business expenses | 2210 | (45) | (-) |

| - | Administrative expenses | 2220 | (25) | (-) |

| - | Profit (loss) from sales | 2200 | 180 | - |

| - | Income from participation in other organizations | 2310 | - | - |

| - | Interest receivable | 2320 | - | - |

| - | Percentage to be paid | 2330 | (-) | (-) |

| - | Other income | 2340 | - | - |

| - | other expenses | 2350 | (-) | (-) |

| - | Profit (loss) before tax | 2300 | 176 | - |

| - | Current income tax | 2410 | (-) | (-) |

| - | incl. permanent tax liabilities (assets) | 2421 | - | - |

| - | Change in deferred tax liabilities | 2430 | - | - |

| - | Change in deferred tax assets | 2450 | - | - |

| - | Other | 2460 | (27) | - |

| - | Net income (loss) | 2400 | 153 | - |

The accountant crossed out the lines in column 1. This is possible since the company does not draw up explanations for the financial statements, the numbers of which are indicated in this column.

Column 4 is the only one that requires filling out by the newly created organization. The accountant entered indicators into this column based on the data given in the table. Column 3 has also been added to indicate line codes.

So, in line 2110 The accountant showed the revenue. Value - 400 thousand rubles.

IN line 2120— cost of sales — 150 thousand rubles. This indicator is in brackets, that is, negative.

IN line 2210 commercial expenses are reflected - 45 thousand rubles.

IN line 2220— management — 25 thousand rubles.

Index lines 2200“Profit (loss) from sales” is equal to 180 thousand rubles. (45 thousand rubles - 25 thousand rubles).

IN line 2300“Profit (loss) before tax” duplicates the indicator from lines 2200— 180 thousand rubles.

IN line 2460 The accountant entered the amount of the accrued “simplified” tax - 27 thousand rubles. The indicator is enclosed in parentheses.

IN line 2400 The company's net profit is calculated. It is equal to 153 (180 thousand rubles (line 2300) - 27 thousand rubles (line 2460)).

In the reference section of the report on line 2500 the total financial result of the reporting period is indicated - 153 thousand rubles.

All unfilled lines in column 4 have dashes.

The financial results report in 2019 is a form in which the organization’s income, expenses and financial results for 2018 are presented. In the article we provided a table with a breakdown of the report articles. You will also find samples and examples of filling out the form, you can download the form and sample, and also fill out the report online.

What is an income statement

The financial results report is a mandatory form that is part of the accounting. The Ministry of Finance enshrined this rule in PBU 4/99 and approved it by order No. 43n dated 07/06/1999).

In the regulation, officials indicated what is included in the reporting: “accounting statements consist of a balance sheet, a profit and loss statement, appendices and an explanatory note, as well as an auditor’s report.” You can create a report online and without leaving the article.

Income Statement and Profit and Loss Statement for 2018

The Ministry of Finance in its regulations on accounting gives the name “profit and loss statement”. However, this is the old name for the financial results report. Back in 2015, the Ministry of Finance renamed the form by its order No. 57n dated 04/06/2015. Many accountants, out of habit, call the form in the old way.

Experts explain the composition of financial statements. Read the full course in the program "". And in the section “Form of the financial results report” you can download the form for both the typical form and the simplified one.

Who signs the OFR

Accounting statements (form 2) are considered prepared after its paper version is signed by the head of the company (Part 8, Article 13 of Law No. 402-FZ). But officials allow reports to be signed by any other employee by proxy instead of the director. The chief accountant is no exception. But all copies of reporting must be signed by the same representative of the organization. That is, both the Federal Tax Service and Rosstat must submit reports with the same signatures.

Tax authorities agree with this approach, as stated in the letter of the Federal Tax Service of Russia dated June 26, 2013 No. ED-4-3/11569@. The document is posted on the official website of the service and communicated to lower inspections.

In any case, the annual reports must be signed on paper. If you send it to the inspectorate electronically, then you don’t need to submit the paper version either. But in case of verification, the printed signed version must be kept in the accounting department.

Where to submit the report

Company forms are submitted to tax and statistics offices as part of annual tax reporting. The report is also viewed by other users, for example, shareholders. The rules for compiling a report in such cases vary.

Elena Popova answers,

State Advisor to the Tax Service of the Russian Federation, 1st rank

“In the standard form, the lines are not numbered. Look at the codes for the lines in Appendix 4 to the order of the Ministry of Finance dated 07/02/2010 No. 66n. You only need to number the lines if you submit reports to the statistics department and the tax office.

However, there are specific features for certain categories of organizations. For example, small businesses reflect aggregated indicators in their balance sheets, which include several indicators. In this case, enter the line code according to the indicator that is larger in value than others included in this line.

If you prepare reports for shareholders……..”

Financial report submission deadline

Companies must submit accounting forms to the tax office no later than three months after the end of the reporting year (Article 23 of the Tax Code, Article 18 of the Federal Law of December 6, 2011 No. 402-FZ).

For 2018, the form will be filled out in 2019, and the due date will move to April, since March 31 is Sunday. The next working day is Monday, April 1st.

Financial results report form

The annual financial statements consist of the Balance Sheet and Form 2, as well as appendices to them (Part 1 of Article 14 of the Federal Law of December 6, 2011 No. 402-FZ).

The balance sheet and financial report are submitted on standard or simplified forms. Both of them were approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. For information on how to fill out the lines, see the section below.

The financial results report reflects the following indicators:

- revenue;

- cost of sales;

- Gross profit (loss);

- commercial and administrative expenses;

- profit (loss) from sales;

- interest receivable and payable;

- other income and expenses;

- profit (loss) before tax;

- changes in deferred tax assets and liabilities;

- Net income (loss);

- reference Information.

We will provide a sample report on the financial activities of the enterprise (form 2) in the next section.

Sample of filling out the financial results report in 2019

How to fill out an income statement

When compiling the Financial Results Report (Form 2 or FPR) for 2018 in 2019, see the recommendations of the Russian Ministry of Finance for conducting an audit for the reporting period.

All income in the report should be shown minus VAT and excise taxes (clause 3 of PBU 9/99). Indicate all expenses, as well as negative indicators, in parentheses, without the minus sign.

Comparability of income statement indicators

The indicators for the reporting period must be comparable with the indicators for the same period last year. That is, they must be formed according to the same rules. Incomparability of indicators may arise if significant errors from previous years were identified in the reporting period or the accounting policies of the organization have changed. In this case, in Form 2 of the balance sheet for the current period, last year’s indicators will have to be adjusted based on the current conditions. But reports for previous periods do not need to be corrected.

If any balance sheet information requires detailed decoding, it is entered in a separate form - Explanations to the Balance Sheet and the Financial Results Report. And in the Report, in the “Explanations” column, a link is made to the corresponding table or number of explanations of this form.

Please note: errors identified in accounting and financial statements must be corrected. Experts explain how to make corrections.

Income tax in line 2410-2400

The third category includes organizations that do not pay income tax according to the law, but must keep accounting records (clause 1 of PBU 18/02). These are, for example, payers of UTII or gambling tax. Such organizations may use dashes when filling out lines , , .

The amount of UTII or gambling tax that reduces the indicator in line 2300 “Profit (loss) before tax” is indicated in line 2460 “Other”. In this case, the organization has the right to determine the details of this line independently. The same rules should be followed by organizations that combine the general taxation system with the payment of UTII or gambling tax.

On which line should the simplified single tax or UTII be reflected:

Net profit in line 2400

On line 2400 “Net profit (loss)”, indicate the result calculated using the formula:

Check that the net profit (loss) reflected in the Report at the end of the year coincides with the closing balance in account 99 “Profits and losses” (including rounding ). It should be written off to account 84“Retained earnings (uncovered loss)” when reforming the balance sheet (form No. 1).

Transcript of report articles

In the table we have given the articles of the financial performance report and the indicators that are reflected for each line of Form 2.

|

Title of report articles |

Line codes |

Accounting accounts |

Note |

|---|---|---|---|

|

Total turnover on credit account 90 “Sales” subaccount “Revenue”; |

Revenue is income from ordinary activities, which include the sale of products and goods, performance of work, and provision of services. The list of such income is given in paragraph 5 of PBU 9/99 |

||

|

Cost of sales |

Total turnover in the debit of account 90 “Sales” subaccount “Cost of sales” in correspondence with the accounts: |

||

|

Gross profit (loss) |

The difference between the amounts reflected in lines 2110 and 2120 |

||

|

Business expenses |

Total turnover in the debit of account 90 “Sales” subaccount “Cost of sales” in correspondence with account 44 “Sales expenses” |

Indicate the indicator in parentheses (without the minus sign) |

|

|

Administrative expenses |

Total turnover in the debit of account 90 “Sales” subaccount “Cost of sales” in correspondence with account 26 “General business expenses” |

Fill out this line if the accounting policy provides for the write-off of general business expenses directly to the debit of account 90 “Sales”. |

|

|

Profit (loss) from sales |

The difference between the amounts reflected on lines 2100, 2210 and 2220 |

The indicator must correspond to the difference between the total turnover for the reporting period in the debit and credit of account 90 “Sales”, subaccount “Profit (loss) from sales” in correspondence with account 99 “Profits and losses”. |

|

|

Income from participation in other organizations |

Total turnover on the credit of account 91 “Other income and expenses” subaccount “Other income” in correspondence with account 76 “Settlements with various debtors and creditors” subaccount “Settlements for due dividends and other income” |

||

|

Interest receivable |

Total turnover on the credit of account 91 “Other income and expenses” subaccount “Other income” in correspondence with the accrued interest accounts: |

||

|

Percentage to be paid |

Total turnover in the debit of account 91 “Other income and expenses” subaccount “Other expenses” in correspondence with the accounting accounts: |

Indicate the indicator in parentheses (without the minus sign) |

|

|

Other income |

Total turnover on the credit of account 91 “Other income and expenses” subaccount “Other income” minus: |

The list of other income is given in paragraph 7 of PBU 9/99. At the same time, accrued VAT, excise taxes and other similar payments are not income (clause 3 of PBU 9/99). Therefore, these amounts must be excluded when determining the indicator on line 2340 |

|

|

other expenses |

Total turnover in the debit of account 91 “Other income and expenses” subaccount “Other expenses” minus: |

Indicate the indicator in parentheses (without the minus sign) |

|

|

Profit (loss) before tax |

Sum of data on lines 2200, 2310, 2320, 2340 minus data on lines 2330 and 2350 |

Indicate the negative value of the indicator in parentheses (without the minus sign) |

|

|

Current income tax |

The difference between the total turnover in the debit and credit of account 68 “Calculations for taxes and fees” subaccount “Calculations for current income tax” in correspondence with the accounts: |

The indicator must correspond to the amount of income tax reflected on line 180 of sheet 02 of the income tax return, approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/572. |

|

|

Including permanent tax liabilities (assets) |

The difference between the total turnover in the debit and credit of account 99 “Profits and losses” subaccount “Fixed tax liabilities (assets)” in correspondence with account 68 “Calculations for taxes and fees” |

If the turnover on the debit of account 99 “Profits and losses” subaccount “Fixed tax liabilities (assets)” is less than the turnover on the loan, indicate the permanent tax asset - without brackets If the turnover in the debit of account 99 “Profits and losses” subaccount “Fixed tax liabilities (assets)” is greater than the turnover on the loan, indicate the permanent tax liability - in parentheses |

|

|

Change in deferred tax liabilities |

The difference between the total turnover on the credit and debit of account 77 “Deferred tax liabilities” in correspondence with account 68 “Calculations for taxes and fees” subaccount “Calculations for current income tax” |

If the credit turnover of account 77 “Deferred tax liabilities” is less than the debit turnover, then indicate the difference without brackets If the credit turnover of account 77 “Deferred tax liabilities” is greater than the debit turnover, then indicate the difference in parentheses |

|

|

Change in deferred tax assets |

The difference between the total turnover in the debit and credit of account 09 “Deferred tax assets” in correspondence with account 68 “Calculations for taxes and fees” subaccount “Calculations for current income tax” |

If the turnover on the debit of account 09 “Deferred tax assets” is greater than the turnover on the loan, then indicate the difference without brackets If the turnover on the debit of account 09 “Deferred tax assets” is less than the turnover on the loan, then indicate the difference in parentheses |

|

|

Turnovers in account 99 “Profits and losses” not reflected in the previous lines |

Indicate the negative value of the indicator in parentheses (without the minus sign) |

||

|

Net income (loss) |

Line 2300 + (-) line 2430 + (-) line 2450 - line 2410 + (-) line 2460 |

The indicator should be equal to the final balance in account 99 “Profits and losses”, which, when reforming the balance sheet, is written off to account 84 “Retained earnings (uncovered loss)”. |

|

|

For information Result from the revaluation of non-current assets, not included in net profit (loss) |

Turnovers on the debit and credit of accounts 83 “Additional capital” in correspondence with accounts 01 and 04 |

||

|

Result from other operations not included in the net profit (loss) of the period |

Turnovers on capital accounts (excluding revaluation of non-current assets) |

Currently, the accounting legislation does not define the concept of aggregate financial result. And there are no established rules for calculating the result of other operations that are not included in net profit, but affect the overall result. Therefore, when filling out line 2520, organizations need to be guided by the rules established by IFRS (clause 7 of PBU 1/2008). Organizations that do not apply IFRS may not fill out this line. |

|

|

Total financial result of the period |

Sum of data by rows 2400, 2510, 2520 |

||

|

Basic earnings (loss) per share |

The calculation procedure is defined in Section II of the Methodological Recommendations approved by Order of the Ministry of Finance of Russia dated March 21, 2000 No. 29n |

||

|

Diluted earnings (loss) per share |

The calculation procedure is defined in Section III of the Methodological Recommendations approved by Order of the Ministry of Finance of Russia dated March 21, 2000 No. 29n |

Calculate joint stock companies |

Income statement- one of the main forms of accounting reporting, which characterizes the financial results of the organization for the reporting period and contains data on income, expenses and financial results in cumulative total from the beginning of the year to the reporting date. The report reflects the amount of balance sheet profit or loss and the individual components of this indicator:

profit/loss from product sales;

operating income and expenses (positive and negative exchange rate differences);

income and expenses from other non-operating activities (fines, bad debts).

Also presented:

enterprise costs for the production of sold products at full or production cost;

commercial expenses, administrative expenses;

net revenue from product sales;

the amount of income tax, deferred tax liabilities, assets and permanent tax liabilities (assets);

net profit.

When preparing a report, the calculation of revenue and other income, as well as expenses, is carried out using the accrual method, that is, revenue is accrued when consumers have obligations to pay for the company’s products or services. Most often, this occurs at the time of shipment of products or provision of services to the consumer, and is accompanied by the presentation by the buyer (customer) of the relevant payment documents.

The financial results report is the most important source for analyzing the profitability of an enterprise, the profitability of products sold, the profitability of production, as well as for determining the amount of net profit.

The main purpose of the Profit and Loss Statement (Form No. 2) is to characterize the indicators of the financial performance of the organization for the reporting period, such as:

gross profit;

profit (loss) from sales:

profit (loss) before tax;

net profit (loss) of the reporting period.

In table 1 shows the composition and characteristics of the profit and loss statement indicators.

The notes to the balance sheet and income statement disclose information relevant to the entity's accounting policies, providing users with additional data that is not appropriate to include in the balance sheet and income statement, but which they need to realistically assess the financial position of the entity, financial the results of its activities.

Composition and purpose of profit and loss statement indicators

|

Index |

Characteristics of the indicator |

|

|

Income and expenses from ordinary activities |

||

|

Revenue from the sale of goods, products, works, services minus VAT, excise taxes and similar mandatory payments is reflected in account 90 “Sales” to identify the financial results from the sale |

||

|

Cost of sales |

Actual costs associated with the production of products and services are reflected, excluding commercial and administrative expenses. |

|

|

Gross profit (1-2) |

The difference between the proceeds from the sale of goods, products, works, services minus VAT is recorded. excise taxes and similar mandatory payments and the cost of goods, products, works and services sold |

|

|

Business expenses |

For production organizations - expenses for the sale of products are reflected in account 44 “Sales expenses” and related to sold products, works and services (D-t 90 K-t 44) For trading, supply and sales and other intermediary organizations - sales expenses (distribution costs), accounted for in account 44 “Sales expenses” and attributable to goods sold (D-t 90 K-t 44) |

|

|

Administrative expenses |

Entries are made by those organizations that, in accordance with the adopted accounting policy, write off the amounts reflected in account 26 “General business expenses” to account 90 (Dt 90 Kt 26). For trade, supply and sales organizations, this indicator is not filled in |

|

|

Profit (loss) from sales (3-4-5) |

Reflects the difference between revenue from the sale of goods, products, works and services and the amount of cost, commercial and administrative expenses |

|

|

Other income and expenses |

||

|

Income from participation in other organizations |

Income receivable: for securities invested in other organizations; from participation in joint activities without forming a legal entity (under a simple partnership agreement), etc. |

|

|

Interest receivable |

Amounts to be received: dividends (interest) on bonds, deposits, recorded in account 91 “Other income and expenses”; from credit institutions for the use of balances in the organization’s accounts; interest payable for providing an organization with funds (credits, borrowings) for use |

|

|

Percentage to be paid |

Amounts payable on grounds similar to those specified in clause 7 |

|

|

Other income |

Income from the sale (disposal) of fixed assets, intangible assets, tangible assets and other property; from providing non-current assets of the organization for temporary use for a fee; from participation in the authorized capitals of other organizations (together with interest and other income and expenses on securities), including joint activities under a simple partnership agreement. received fines, penalties, penalties for violation of contract terms; assets received free of charge, including under a gift agreement; proceeds to compensate for losses caused to the organization; profit of previous years identified in the reporting year; amounts of accounts payable and depositors for which the statute of limitations has expired; exchange differences; amount of revaluation of assets, etc. |

|

|

other expenses |

Paid fines, penalties, penalties for violation of contracts; compensation for losses caused by the organization; past losses. recognized in the reporting year; amounts of receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection; exchange differences; the amount of depreciation of assets and other expenses for operations similar to those given en. 10 |

|

|

Profit (loss) before tax (6 + 7 - 8 + 9 + 10 - 11 + 12 - 13) |

The amount of profit (loss) from sales, interest receivable minus interest payable, income from participation in other organizations, other income minus expenses of this type. In accordance with PBU 18/02, on the basis of this indicator, the conditional income tax expense is determined (D-t 99 K-t 68) |

|

|

Current income tax |

The amount of income tax for tax purposes, determined based on the amount of the contingent income tax expense, adjusted for the amounts of the permanent tax liability (plus), deferred tax asset (plus) and deferred tax liability (minus) of the reporting period. |

|

|

Including: permanent tax liabilities (assets) |

Income (expenses) that form accounting profit (loss), but are never taken into account, but are excluded when calculating taxable profit and lead to an increase in the organization's tax payments for income tax in the reporting period. In accounting, permanent tax liabilities are reflected in account 99 “Profit and Loss”, subaccount “Permanent Tax Liability” D-t 99 K-t 68) |

|

|

Change in deferred tax liabilities |

Part of deferred income tax, which leads to an increase in the organization's tax payable to the budget in the period following the reporting or subsequent periods (underpayment to the budget). Accounting is maintained on account 77 “Deferred tax liabilities” |

|

|

Change in deferred tax assets |

Part of the deferred income tax, which should lead to a reduction in the organization's tax payable to the budget in the following or subsequent reporting periods (overpayment to the budget). Accounting is maintained on account 09 “Deferred tax assets” |

|

Net profit (loss) of the reporting period (12 - 13 - 15 + 16) |

To determine net profit (loss), the difference between profit (loss) before tax, current income tax and deferred tax liabilities is determined, to which the amount of deferred tax assets is added. The write-off of the loss of the reporting year from the balance sheet is reflected at the expense of: reserve capital funds (D-t 82 K-t 84). bringing the amount of the authorized capital to the value of net assets (D-t 80 K-t 84). repayment of the loss of a simple partnership at the expense of targeted contributions of its participants (D-t 75 K-t 84) |

|

|

Net income (loss) |

Net profit (loss) of the reporting period |

|

|

Basic earnings (loss) per share |

Basic earnings (loss) per share is determined as the ratio of basic earnings (loss) for the reporting period to the weighted average number of ordinary shares outstanding during the reporting period. The basic profit (loss) of the reporting period is determined by reducing (increasing) the profit (loss) of the reporting period remaining at the disposal of the organization after taxation and other obligatory payments to the budget and extra-budgetary funds by the amount of dividends on preferred shares accrued to their owners for the reporting period. When calculating the basic profit (loss) of the reporting period, dividends on preferred shares, including cumulative ones, for previous reporting periods that were paid or declared during the reporting period are not taken into account. |

|

|

Diluted earnings (loss) per share |

The amount of diluted profit (loss) per act" shows the maximum possible degree of reduction in profit (increase in loss) per one ordinary share of a joint-stock company in the following cases: conversion of all convertible securities of the joint-stock company into ordinary shares (hereinafter referred to as convertible securities); upon execution of all contracts for the purchase and sale of ordinary shares from the issuer at a price below their market value. Profit dilution means its decrease (increase in loss) per one ordinary share as a result of the possible future issue of additional ordinary shares without a corresponding increase in the company’s assets |

The financial results statement (form No. 2) of Volchanskoe OJSC reflects the enterprise's revenue with an accrual total, the cost of products sold, the enterprise's gross profit is calculated, commercial expenses, interest payable (on existing loans), other expenses (bank services, sick leave) are highlighted sheets, etc.), other income (federal and regional subsidies), the profit of the enterprise is calculated.

Revenue - Cost - Selling expenses - Interest payable - Other expenses + Other income = NET PROFIT (Appendix No. 34)

Based on the financial statements, an analysis of the production and financial activities of the enterprise is compiled, economic efficiency and profitability of the enterprise are calculated. (Appendix No. 35)