Average margin. Margin: what is it in simple words? Types of margin. Application of margin in banking

The concepts of markup and margin, which many have heard, are often denoted by one concept - profit. In general terms, of course, they are similar, but still the difference between them is striking. In our article, we will understand these concepts in detail, so that these two concepts are not “combed with the same brush,” and we will also figure out how to correctly calculate the margin.

Dear reader! Our articles talk about typical ways to resolve legal issues, but each case is unique.

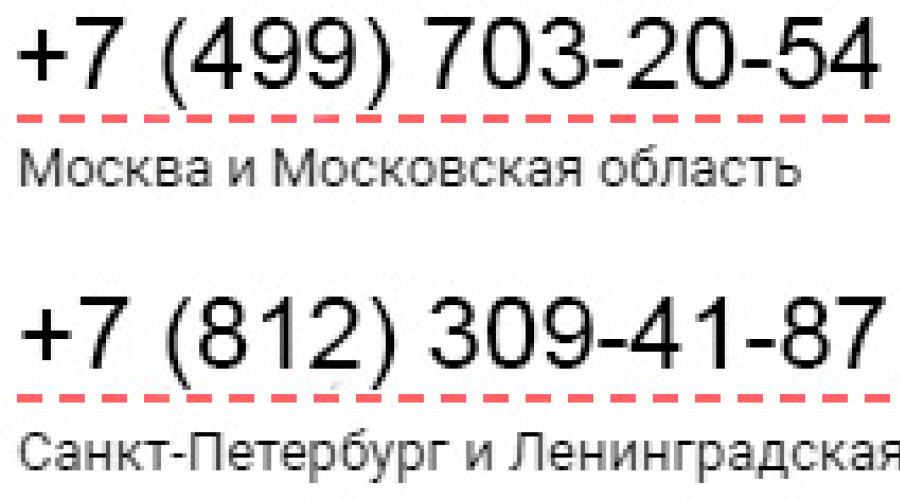

If you want to know how to solve exactly your problem - contact the online consultant form on the right or call by phone.

It's fast and free!

What is the difference between markup and margin?

Margin is the ratio between the price of a product on the market to the profit from its sale, the main income of the company after all expenses, measured as a percentage, have been subtracted. Due to the calculation features, the margin cannot be equal to 100%.

Extra charge- this is the amount of the difference between the product and its selling price at which it is sold to the buyer. The markup is aimed at covering the costs incurred by the seller or manufacturer in connection with the production, storage, sale and delivery of goods. The size of the markup is formed by the market, but is regulated by administrative methods.

For example, a product that was purchased for 100 rubles is sold for 150 rubles, in this case:

- (150-100)/150=0.33, as a percentage 33.3% – margin;

- (150-100)/100=0.5, as a percentage 50% – markup;

From these examples it follows that a markup is just an addition to the cost of a product, and a margin is the total income that the company will receive after deducting all mandatory payments.

Differences between margin and markup:

- Maximum permissible volume– the margin cannot be equal to 100%, but the markup can.

- Essence. The margin reflects income after deducting necessary expenses, and the markup is an addition to the cost of the product.

- Calculation. The margin is calculated based on the organization’s income, and the markup is calculated based on the cost of the product.

- Ratio. If the markup is higher, then the margin will be higher, but the second indicator will always be lower.

Calculation

Margin is calculated using the following formula:

OTs – SS = PE (margin);

Explanation of indicators used when calculating margin:

- PE– margin (profit per unit of goods);

- OC

- JV– cost of goods;

Formula for calculating margin or percentage of profitability:

- TO– profitability ratio as a percentage;

- P. – income received per unit of goods;

- OC– the cost of the product at which it is sold to the buyer;

In modern economics and marketing, when it comes to margins, experts note the importance of taking into account the difference between the two indicators. These indicators are the profitability ratio from sales and profit per unit of goods.

When talking about margins, economists and marketers note the importance of the difference between profit per unit of goods and the overall profitability ratio for sales. Margin is an important indicator, as it is a key factor in pricing, the profitability of marketing spend, as well as analyzing client profitability and forecasting overall profitability.

How to use a formula in Excel?

First you need to create a document in Exc format.

An example of a calculation would be the price of a product at 110 rubles, while the cost of the product will be 80 rubles;

Markups are calculated using the formula:

N = (CP – SS)/SS*100

Gde:

- N– markup;

- CPU- Selling price;

- SS– cost of goods;

Margins are calculated using the formula:

M = (CP – SS)/CP*100;

- M– margin;

- CPU- Selling price;

- SS– cost;

Let's start creating formulas for calculations in the table.

Calculation of markup

Select a cell in the table and click on it.

We write the sign corresponding to the formula without a space or activate the cells using the following formula (follow according to the instructions):

- =(price – cost)/ cost * 100 (press ENTER);

If you fill out the markup field correctly, the value should be 37.5.

Margin calculation

- =(price – cost)/ price * 100 (press ENTER);

If you fill out the formula correctly, you should get 27.27.

When receiving an unclear value, for example 27, 272727…. You need to select the required number of decimal places in the “cell format” option in the “number” function.

When making calculations, you must always choose the values: “financial, numerical or monetary”. If other values are selected in the cell format, the calculation will not be performed or will be calculated incorrectly.

Gross margin in Russia and Europe

The concept of gross margin in Russia refers to the profit earned by an organization from the sale of goods and the variable costs of its production, maintenance, sales and storage.

There is also a formula to calculate gross margin.

She looks like this:

VR – Zper = gross margin

- VR– the profit the organization receives from the sale of goods;

- Zper. – costs of production, maintenance, storage, sales and delivery of goods;

This indicator is the main state of the enterprise at the time of calculation. The amount invested by the organization in production, on the so-called variable costs, shows marginal gross income.

Gross margin, or margin in other words, in Europe, is a percentage of the total income of an enterprise from the sale of goods after paying all necessary expenses. Gross margin calculations in Europe are calculated as percentages.

Differences between exchange and margin in trading

To begin with, let’s say that such a concept as margin exists in different areas, such as trading and the stock exchange:

- Margin in trading– a fairly common concept due to trading activities.

- Exchange margin– a specific concept used exclusively on exchanges.

For many, these two concepts are completely identical.

But this is not so, due to significant differences, such as:

- the relationship between the price of a product on the market and profit - margin;

- the ratio of the initial cost of goods and profit - markup;

The difference between the concepts of the price of a product and its cost, which is calculated by the formula: (price of the product - cost) / price of the product x 100% = margin - this is exactly what is widely used in economics.

When calculating using this formula, absolutely any currencies can be used.

Use of settlements in exchange activities

When selling futures on an exchange, the concept of exchange margin is often used. Margin on exchanges is the difference in changes in quotes. After opening a position, margin calculation begins.

When selling futures on an exchange, the concept of exchange margin is often used. Margin on exchanges is the difference in changes in quotes. After opening a position, margin calculation begins.

To make it clearer, let’s look at one example:

The cost of the futures that you purchased is 110,000 points on the RTS index. Literally five minutes later the cost increased to 110,100 points.

The total size of the variation margin was 110000-110100=100 points. If in rubles, your profit is 67 rubles. With an open position at the end of the session, the trading margin will move into the accumulated income. The next day everything will repeat again according to the same pattern.

So, to summarize, there are differences between these concepts. For a person without economic education and work in this field, these concepts will be identical. And yet, now we know that this is not so.

For the convenience of studying the material, we divide the article margin into topics:

According to the criterion of relativity of the parameters used to determine the exchange rate difference, the variation margin is divided into types:

Futures variation margin at the beginning of the trading session (initial);

futures variation margin during the trading session (operational);

futures variation margin upon execution of a settlement futures contract (total);

option variation margin when exercising an option on a futures contract (strike);

option variation margin upon execution of a settlement futures contract (total).

2.4. The formula for calculating the variation margin for futures contracts, formed by positions held at the beginning of the trading session (initial) has the form:

Мp = (Q – Qp) x P x Np,

Where

Q - quoted price for opening the trading session;

Qp - quoted closing price of the previous trading session;

P is the cost of a basis point, calculated by multiplying the number of futures contracts in a transaction by the size of the basis point;

Np - the number of positions held at the beginning of the trading session.

2.5. The formula for calculating the variation margin for futures contracts, formed by positions opened during the trading session (operational), is as follows:

Мb = (Q – Qb) x P x Nb,

Where

Qb is the price of concluding a transaction with a futures contract;

Nb - the number of futures contracts in the concluded transaction.

2.6. The formula for calculating the variation margin for futures contracts, resulting from the execution of the settlement futures contract (final) has the form:

Мd = (Qd – Qf) x P x Nd,

Where

Qd is the price of the underlying asset on the day the futures contract is executed;

Qf is the quoted price of the last day of trading in the futures contract;

Nd is the number of futures contracts to be executed.

2.7. The formula for calculating the variation margin for option contracts, which is formed when an option on a futures contract (strike) is exercised, has the form:

Mo = (Qf – Qo) x P x No,

Where

Qo - option strike price;

2.8. The formula for calculating the variation margin for option contracts resulting from the execution of a settlement option (final) has the form:

Mo = (Q – Qo) x P x No,

Where

Q is the price of the underlying asset on the day of execution of the option contract;

Qo - option strike price;

No - number of option contracts to be exercised.

3. Features and consequences of the calculation

3.1. The calculation results are used to bring the current quotation price (including the closing price of a position) to the price of concluding a transaction (opening a position) at each point in time at which the quotation price changes until the contract is executed by withholding and accruing variation margin.

3.2. For the buyer of futures contracts, the buyer of call options and the seller of put options, a positive variation margin is credited to the trading account, and a negative variation margin is debited.

3.3. For the seller of futures contracts, the seller of call options and the buyer of put options, positive variation margin is debited from the trading account, and negative variation margin is credited.

3.4. If the value calculated using the above formulas is not a multiple of the basis point, then it is rounded to a multiple of the basis point according to the rules of arithmetic rounding.

Margin formula

In addition to income, expenses and profit, you, of course, have heard about such an indicator as margin or profitability. Since we will have to use this indicator quite often in further discussions and calculations, let's figure out how it is calculated and what it means.Margin = Profit / Revenue * 100

Margin is a relative indicator, so it is measured as a percentage, and the formula multiplies by 100.

Margin shows the ratio of profit to income, in other words, the efficiency of converting income into profit.

If you hear that an enterprise has a 20% margin, this means that for every ruble earned, the enterprise has 20 kopecks in profit and 80 kopecks in expenses.

Formula for calculating margin + determining margin on Forex

Calculation of funds required for Forex trading:

Necessary Margin (Margin, or Necessary Margin) is the free amount on the trading account that you must have in order to open a position of the specified volume. For example, with a leverage of 1:100, the required margin will be 1% of the transaction size, with a leverage of 1:50 - 2%, with a leverage of 1:25 - 4%, etc.

Free Margin is funds in a trading account, unencumbered as collateral for open positions (in the form of the required margin). Calculated using the formula: Equity - Margin.

Equity - current account status. Determined by the formula: Balance + Floating Profit - Floating Loss, where:

Floating Profit and Floating Loss are unfixed profits and losses on open positions, calculated based on current quotes.

Balance (Balance) - the total financial result of all completed transactions (closed transactions) and non-trading operations (deposit/withdrawal operations) on a trading account.

Variation margin

Variation margin is the sum of profits and/or losses on all open positions of a participant in the derivatives market of the Exchange, determined during the market adjustment. Variation margin for one position is the profit or loss for this position when recalculating its value at the settlement price of the current trading day. The variation margin for a position is equal to: a) for a long position: VM= (Tsr - Tst) x Sim: Im; b) for a short position: VM= - (Tsr-Tt) x Sim: Im, where: VM - variation margin for this position; CR - the settlement price of a given trading day for the corresponding series of a derivatives instrument; Ct - current price of this position; They are the minimum price change in accordance with the Specification of the derivatives instrument; Sim - cost estimate of the minimum price change (in rubles) in accordance with the Specification of a derivatives instrument.The calculation of the financial result of our transaction begins immediately after we open a trading position. Variation margin will be all changes in your position in monetary terms. The margin is called “variational”, because it has many variations - that is, it is constantly changing.

The final value of the variation margin is usually calculated based on the results of the trading session. Of course, during the day you can observe changes in the variation margin in your trading terminal.

If a trader makes a correct forecast regarding market movement, then the variation will be positive. If the market moves against the trader, then the margin, accordingly, will be negative. However, it is worth noting that until the trading session has ended, the accrued variation margin will not be credited to your deposit (or written off from it). We will talk directly about the process of writing off and accruing your profit (loss) in the following posts, because there are also many interesting points there.

If you hold your position for one trading session, then your final result on the trade will coincide with the variation margin. However, if your position is longer-term, then each new trading day the variation margin will be accrued anew and will already differ from the entire transaction total.

We can say that variation margin is the result of your transaction within one trading session. And the final (financial) result is the entire total profit (loss) on the transaction for the entire holding period, that is, the sum of all variation profits or losses.

Let’s imagine that on the day of August 1st we opened a long position at a price of 137,000. At the end of the trading session, the price rose to 142,000, thereby our variation margin became +5,000 points. And the total for the day was also +5,000 points. We did not close the position and moved it to the next day.

On August 2, the market was not as favorable as yesterday, and by the end of the trading session it closed at 140,000 points. Pay attention here. On August 2, our variation margin became (-2,000) points. That is, it turns out that within this day our position was opened not at 137,000, but at 142,000, since this was the closing price of the previous day. From here we get that 140,000-142,000= (-2000) points. However, this is only the result for August 2.

In general, the result for our entire position is 140,000-137,000 = +3,000 points. Thus, it turns out that the variation margin for the day is negative, and the result of the transaction is positive due to the fact that on August 1 we made a good profit.

We again did not close the position and moved it to the next day. On August 3, the market pleased us again and at the close of the trading session it was at the level of 143,500. Thus, the variation margin for the day turned out to be 143,500-140,000 = +3,500, and the final result of the transaction was 143,500 – 137,000 = +6,500 On this happy note, we decided to close our long position.

I hope now it is clearer to you what variation margin is. As you can see, a negative variation margin is not always an indicator of a unprofitable transaction. This is just part of the overall result of a transaction within one trading session. The main thing is that the final result of the transaction is positive

Margin level

The margin level is the relative size of the loan provided by the Bank to the client. This value is calculated in real time. The loan is provided to the client in both cash and securities (“short” sale).On the Russian stock market, the margin level is calculated using the following formula:

UM = (LSP)/(DS + CB)x100%

Where:

LST (portfolio liquidation value) = DS + CB - ZK

DS - cash

Central Bank - securities

ZK - the client's debt to the broker for funds and securities sold short.

If the client does not use borrowed funds, then his margin level is 100% (or 1).

As new margin positions are opened, the account margin level begins to gradually decrease. Here it is also necessary to take into account the market situation: if the market moves in the direction desired by the client, the margin level decreases either slightly, or may not change at all, or even increase; in the event of an unfavorable course of trading for the client, this value can change almost as rapidly as prices move in the opposite direction to the client.

If the margin level falls below 50% or 0.5 (the restrictive margin level for leverage equal to 2, i.e. where the client receives a ruble of borrowed funds from the bank for every ruble of his own funds), the bank DOES NOT have the RIGHT to provide the opportunity to open new margin positions.

If the margin level drops to the level for sending a request (35% or 0.35), the bank sends a notification to the client about the need to urgently replenish the account or about the need to urgently close part of the open positions. The client must take these actions in order to bring the margin level to the restrictive level (i.e. 50% or 0.5) or higher. If the client does not take the necessary actions within 1 minute after receiving the relevant notification to bring the margin level to a value not lower than 50% or 0.5, the bank automatically closes part of the client’s open positions without notifying the client.

Carryover level is the minimum margin level for performing special repo transactions.

The client's debt to the broker (loan) consists of debt on cash (DC) and debt on securities (CB) sold short:

ZK = DS + CB

Where:

DS = Sum of long positions (Long) - Sum of short positions (Short) - LSP;

CB = Amount of client's short positions

If the value of the DS (or CB) turns out to be negative or equal to zero, the client has no obligation to the broker for borrowed funds (or for the delivery of securities).

Profit margin

The profit/margin indicator when evaluating a trading system is often used by advertisers when they report the profit received. Typically, this is not the best or most correct way to represent the system. Since, as stated above, many high-yield trading systems have long periods of leverage, the entire system becomes unacceptable to many traders. It may turn out that the same system cannot be abandoned because the margin/profit ratio looks quite good. Who wants to give up a system that brings 300% profit? Often commercial trading systems of this type are focused on a specific instrument; therefore, results may be “asymmetrical” to the margin needs of that particular instrument. A trading system that makes the same profit in the S&P 500 as in Soybeans would look better in Soybeans due to lower margin requirements. Often this combination of facts can make the profit/margin ratio a misleading number.Despite what has been said above, comparing systems based on the profit/margin ratio will provide some benefit to traders. It can help them determine whether their account equity is correct. In short, the margin required to enter into a single trade is capital that cannot be used to open new positions. This money could be used as margin in other systems or as capital at risk on new entry signals. Analyzing various systems based on profit/margin ratios allows traders to maximize the benefit of their account capital. Assuming that the trading system will earn the same amount on two different instruments, it would be reasonable to trade the instrument with the minimum margin requirement. This approach will give traders the opportunity to take on more trades and/or include more units/contracts per trade than they would otherwise be able to when trading an instrument with a higher margin requirement.

Of course, creating strategies that limit the need for margin may not be suitable for all traders. For professional traders, margin is usually of little interest since only a portion of the account is at risk in any given period of time. In such cases, financial managers do not necessarily maximize the return on their margin capital. In fact, this can work against a trader's overall risk/reward objectives, tempting them to take more trades than would be possible under a certain risk criterion.

On the other hand, greater financial leverage will allow small and aggressive traders to get more bang for their buck. To give an example, small traders would only be able to enter into one contract in the S&P due to high margin needs ($12,000+ or -) with a potential profit of $3,500 per trade. If these traders had looked at other markets, such as the Canadian Dollar ($400+ or - margin required), they would have been able to take on thirty times as many contracts. One contract may only "make" $250, but when you combine them together, you will "make" more money than trading just one S&P contract. In general, profit/margin can be useful to traders to some extent, but it is important to remember those aspects that profit/margin analysis does not tell you. The profit/margin analysis method says relatively little about the risk an account may be exposed to and does not always provide a clear picture of an account's profitability as margin needs vary widely. It can outline how effectively traders use margin, but even this is not applicable to all traders' needs.

Margin lending

Clients have the opportunity to significantly increase their income from transactions in the stock market using margin trading tools.Margin lending is lending to clients with cash or securities secured by the current value of assets (that is, the collateral is the client's cash or securities). This means that for a certain fee, the company temporarily lends the client either cash or securities. With the help of margin trading, a client who is confident in the market trend has the opportunity to increase the size of his position by attracting additional funds.

The principle of operation of margin lending is as follows: the financial result of operations is increased through the use of financial “leverage” - by completing a transaction using a loan, you can receive significantly more income than the income that could be obtained using only your own funds. This type of transaction is very popular because it allows you to make money even on small market fluctuations, and on significant market fluctuations, clients’ income increases several times.

Transactions using raised funds provide the opportunity to obtain additional income in both growing and falling markets. In a rising market, the client buys securities using not only his own funds, but also additional funds received in the form of a margin loan. The client then sells the securities at a higher price, repays the loan and receives a return greater than what could have been obtained using only his own funds. In a falling market, the client borrows shares, sells them on the market, and subsequently repays the loan, later purchasing the same shares at a lower price and receiving income from the price difference.

Risks arising from margin trading

If clients borrow any assets, they must meet strict requirements regarding the ratio of the size of their own funds to the value of open positions. If the market moves unfavorably (in the direction opposite to the client’s expectations) and the amount of the client’s debt exceeds the amount of the provided collateral by a set amount, the client is sent a request to increase the amount of collateral (Margin Call). When a certain critical margin level is reached, the client's positions are forced to be closed.

Terminology

Collateral level, or margin level, is the percentage ratio of the client's capital to the client's long position. When calculating the level of collateral, capital means the difference between the client's long and short positions.

A long position is defined as the sum of the client's own funds and the market value of the client's own margin securities.

A short position is defined as the sum of the client's borrowed funds and the market value of the client's borrowed securities.

The initial margin level, or leverage, established by the Federal Financial Markets Service of Russia does not exceed 1:1, that is, for every ruble of own funds, the client can receive 1 ruble of borrowed funds from the company. For clients with a high level of risk, the maximum leverage does not exceed 1:3.

Restrictive margin level is a standard value of the collateral level, which means that operations cannot be carried out on the client’s account that would lead to a decrease in the collateral level below 50% (for clients with leverage 1:1) or below 25% (for clients with leverage 1: 3). The client cannot make transactions and operations that lead to a decrease in the margin level below this level.

The margin level for sending a request to the client, or the Margin Call level – the margin level on the client’s account equal to 35% (for clients with a leverage of 1:1) and 20% (for clients with a leverage of 1:3), upon reaching which the broker sends a request to the client asking him to take measures to restore the margin level to the restrictive level.

A client wishing to avoid forced closure, in this case, can deposit funds into his account or sell securities that are not collateral for the loan issued.

Liquidation margin level is the minimum acceptable value of the margin level, which means that if the margin level decreases below the standard value, the client’s position is closed (sale of securities or purchase of securities at the expense of the client’s funds) forcibly to pay off the client’s debt to the company.

The liquidation margin level is 25% for clients with 1:1 leverage or 15% for clients with 1:3 leverage. Forced closure of the client's positions is carried out to restore the margin level to the Margin Call level.

Net Margin

The term has the following meanings:1. The difference between the average price of finance attracted. resources and average return on invested capital. (The key word of the term is 'interest', since the cost of attracting capital and its effectiveness are expressed in a single form - the annual interest rate).

2. The ratio of net interest income to all profitable assets of the bank, which is an indicator of the efficiency of banking activities.

The accounting model for liabilities assumes maximizing or at least stabilizing the bank's margin (the difference between interest income and interest costs) at an acceptable level of risk. This value should be distinguished from the spread, a price indicator characterizing the difference between rates on placed and attracted funds.

The critical parameters of ALM are the net interest income (NII) indicator and its relative value in the form of the net interest margin (NIM). The value of these parameters must be maintained at a fixed level.

NPD = OPD-OPI,

Where OPD is the total interest income on loans and investments;

OPI - total interest costs on deposits and other borrowed funds;

Factors affecting the NIM value:

1. Increase or decrease in interest rates;

2. Change in spread - the difference between the return on assets and the costs of servicing the bank’s liabilities (which is reflected in a change in the shape of the yield curve or the relationship between long-term and short-term interest rates, since many bank liabilities are short-term, and a significant part of bank assets have longer maturities) ;

3. Changes in the structure of interest income and interest expenses;

4. Changes in the volume of income-producing assets (performing assets) that the bank holds as it expands or reduces the overall scale of its activities;

5. Changes in the volume of liabilities, characterized by the costs of interest rates, which the bank uses to finance its income-generating portfolio of assets when expanding or contracting its overall scale of activity;

6. Changes in the ratios that management of each bank uses when choosing between assets and liabilities with fixed and variable interest rates, long and short maturities, and between assets with high and low expected returns (for example, when converting large amounts of cash into loans or when moving from high-yield consumer loans and loans secured by real estate to low-yield commercial loans).

If the NIM value received by the bank is satisfactory to the management, then to fix it, it will use various methods of hedging the risk of changes in interest rates, thereby helping to stabilize net income. If interest rates on a bank's liabilities rise faster than income on loans and securities, the NIM will decrease, which will reduce profits. If interest rates fall and cause income on loans and securities to decrease faster than the reduction in interest costs on borrowed funds, then the bank's NIM will also decrease. In this case, management will need to look for ways to reduce risk to reduce the significant increase in borrowing costs relative to interest income, which will negatively impact the NIM.

However, NPV and NIM serve only as guidelines for managing assets and liabilities, while true balance sheet management from the perspective of the accounting model is carried out mainly by controlling the gap1.

Bank margin

Interest margin is the difference between interest earnings and bank expenses, between interest purchased and paid. It is considered the main source of the bank and is designed to cover taxes, the expense of funds from speculative operations and the “burden” - the excess of interest-free earnings over interest-free expenses, as well as banking dangers.

rate for active bank operations;

With the cash method, the interest accrued by the creditor bank is credited to profitable accounts only upon the actual receipt of funds, that is, on the date of crediting to the correspondent account of funds debited from the payer's account, or on the date of receipt of funds at the cash desk. The borrowing bank assigns interest accrued on borrowed resources to its expense accounts on the date of payment. Payment means debiting funds from the bank and crediting them to the client’s account or giving him cash from the cash register. Interest accrued, although not purchased or not paid by the bank, is provided for in the profit or expense accounts of future periods.

Under the cash method, there are always carryover amounts of interest.

Interest margin is the difference between interest earnings and bank expenses, between interest purchased and paid. It is considered the main source of profit for the bank and is designed to cover taxes, the expense of funds from speculative operations and the “burden” - the excess of interest-free earnings over interest-free expenses, as well as banking dangers.

The size of the margin can be characterized by an unconditional value in rubles. and close to money odds.

The absolute value of the margin can be calculated as the difference between the single amount of interest earnings and expenses of the bank, as well as between interest earnings for certain types of active operations and interest expenses associated with the resources that are used for these operations. For example, between interest payments on loans and interest expense on credit resources.

The dynamics of the unconditional value of the interest margin is guided by several factors:

The volume of credit investments and other intensive operations generating interest income;

refinancing rate for active bank operations;

interest rate on passive bank operations;

the difference between interest rates on active and passive operations (spread);

shares of interest-free loans in the bank’s credit portfolio;

shares of risk-intensive operations that generate interest income;

the relationship between your condition and attracted resources;

structure of attracted resources;

method of calculating and collecting interest;

system of formation and accounting of earnings and costs;

the rate of economic stagnation.

There are differences between Russian and foreign stereotypes of accounting for interest profits and bank expenses, which have a great impact on the volume of interest margin.

There are two different methods of accounting for transactions related to the attribution of accrued interest on borrowed and allocated foreign currency funds to the bank's cost and earnings accounts: the cash method and the "accruals" ("accumulation" method).

With the cash method, the interest accrued by the creditor bank is credited to profitable accounts only upon the actual receipt of funds, that is, on the date of crediting to the correspondent account of funds debited from the payer's account, or on the date of receipt of funds at the cash desk. The borrowing bank assigns interest accrued on borrowed resources to its expense accounts on the date of payment. Payment means debiting funds from the bank's correspondent account and crediting them to the client's account or issuing cash from the cash desk. Interest accrued, although not purchased or not paid by the bank, is provided for in the profit or expense accounts of future periods.

The “accruals” method means that all interest accrued this month is included in the bank’s profits or expenses, regardless of whether they are debited from the visitor’s account or credited to it.

The practice of forming interest earnings and expenses of foreign banks is based on the “accruals” method.

In Russian banking practice until 1998, the cash method of accounting for accrued interest was used exclusively. At present, the use of two methods has been taken into account following the instructions of the Central Bank of the Russian Federation. The accrual method is prohibited from being used to reflect the order of accounting for accrued interest: 1) for loans classified as 2nd, 3rd and 4th risk groups; 2) on the overdue principal debt of the loan; 3) on the allocated funds, once on the final working day of the month, interest payments were overdue under this agreement.

Under the cash method there is always carryover interest.

Profit margin

It is difficult for a financial director to assess the performance of a trading company if it has many clients from different regions. Let's say one of the partners is further away than the others. Consequently, the cost of delivering goods to it is higher. But the trade margin is also higher. Is it profitable to work with him? Calculating the marginal profitability of a transaction will help answer this question.It is important for trading companies to calculate the efficiency of sales activities. The financial director can use for calculations such indicators as turnover, trade margins, collection period, data on the conditions of working with the client (deferments, discounts, etc.), variable costs, etc.

Let's give a simple example that illustrates the problem under discussion.

A trading company works with client A, who purchases a monthly shipment of goods worth 100,000 rubles with a 30 percent markup on deferred payment terms for 14 days. And the company also has client B, who buys for 80,000 rubles a month. But his markup is 20 percent higher, and he pays not on credit, but after the fact. The question arises: which client is more interesting?

This task can be complicated by introducing additional parameters. Client A is located in the Leningrad region. The cost of delivery of goods at the expense of the seller is 1000 rubles per month. Client B is located in the city of Magadan. The goods are delivered to him by air, and it costs the trading company 5,000 rubles per month. Client B participates in a marketing campaign. Upon reaching a quarterly turnover of 300,000 rubles, he receives a bonus of 10,000 rubles. Client A has a debt of 70,000 rubles. He offers to repay it early if he is given a 3 percent discount.

You can come up with a lot of such conditions. Therefore, a trading company needs to have a single criterion for assessing certain conditions of working with customers. With its help, you can find out, for example, that client A is “more interesting” than client B by x rubles, and this or that operation is unprofitable, since the profit from the client will decrease by y rubles.

Such a single criterion is marginal profitability. It is calculated as the ratio of marginal income to the amount of sales for the reporting period. This indicator characterizes the efficiency of the company's sales activities and its cost structure.

Performance indicators

There are several main indicators of sales performance. The main ones are: trading margin (TM), marginal profitability (MR), gross profit margin (GPR) and net profit margin (NPR). Why is contribution margin the most useful of these?

As you know, most businesses strive to make the maximum possible profit. It is defined as the difference between a firm's income and its expenses. Expenses, in turn, are divided into variable (depending on sales volume) and constant (do not depend on turnover).

Thus, we can derive a simple formula:

Profit = (Revenue – Variable expenses) – Fixed expenses = Margin – Fixed expenses.

So, there are two main ways to increase profits. First, increase margins. Secondly, reduce fixed costs. What's easier to do? The answer is obvious - increase margins. After all, in an efficient company, fixed costs are a priori at a fairly reasonable level, and the potential for their reduction is small compared to the possibilities for margin growth.

Margin calculation example

Let's use the marginal income formula:

Margin = Sales – Sales / (1 + Trade margin) – Variable costs.

Accordingly, in order to increase the margin, we need to increase turnover, raise trade margins or reduce variable costs. Or do all of the above at the same time. The results of these activities can be assessed by calculating marginal profit (as an amount in rubles) and marginal profitability (as a percentage of turnover).

Let's consider one of the practical examples of using this approach: analyzing the effectiveness of marketing campaigns and other sales promotion activities.

Companies often hold various competitions, promotions and provide bonuses to customers. Marketing campaigns, as a rule, are expensive. Therefore, it is very important to monitor the effectiveness of the use of funds that are aimed at carrying out such activities.

First, a marketing campaign is effective if the increase in margin (defined as the trading margin minus direct costs) exceeds the cost per promotion. Secondly, the cost per share should include all costs that are associated with the share. This includes the waste of time of company employees on holding the event, and an increase in indirect costs in connection with the event (for example, the cost of telephone conversations).

If such an analysis can be carried out, it becomes possible to determine the true attractiveness of the client to the company. To do this, you first need to calculate the turnover of transactions with the client for the reporting period (for example, a month). Then the turnover is divided by the actual markup percentage. We receive a trade margin per client. From it you need to subtract all direct costs associated with the client (transport, storage, etc.). This way we will find out the amount of margin for the client. From it you need to subtract the costs for the client that are associated with marketing campaigns. The final figure (adjusted margin) is divided by the client’s turnover. We get the true profitability of sales for this partner.

This indicator can already be actively used in pricing and financial policies. It happens that the customer who buys at the highest prices is not the most profitable for the company, since there are many direct costs associated with him. Let's say a partner is located in a remote region and the transportation costs for delivering goods to him are very high. He actively participates in promotions, and the costs simply “eat up” the high markup. And based on the criterion of profitability and adjusted margin, it is already possible to carry out individual work with clients, offer them various bonuses, individual conditions, etc.

You can analyze the effectiveness of marketing campaigns:

For each client;

for the event as a whole.

The most convenient way is to analyze performance by client. Let's look at this approach using a simple example.

Let's return to client A, who provides a turnover of 100,000 rubles per month. The trade margin is 30 percent, and direct costs are 5 percent of turnover. There is an opportunity to attract a client to a marketing campaign. At the same time, its turnover next month will increase to 180,000 rubles while maintaining the markup and the share of direct costs. The price of the share is 10,000 rubles. Is it advisable to carry it out?

Currently, the client margin is 100,000 – (100,000 / 1.30) – (100,000 x 0.05) = RUB 8,077. After the promotion, the turnover will increase, and the margin will be 180,000 - (180,000 / 1.30) - (180,000 x 0.05) = 32,538 rubles. Since the increase in margin (14,461 rubles) is greater than the cost per share (10,000 rubles), it is advisable to carry it out.

Special Marketing Promotions

The CFO cannot always conduct a performance analysis for each client. Some marketing campaigns apply to such a wide range of participants that it is simply impossible to attribute them to someone specifically. For example, a large-scale advertising campaign in the media. Advertising reaches many. This is clearly not happening for the organization that hosts it. But the company can see the effect only by increasing turnover. Moreover, for all clients at once, including new clients who appeared as a result of the promotion.

In this case, the analysis technique will be different. There are also two options here. If the circle of clients who are involved in the promotion is finite and known, then the analysis technique is similar to the analysis of individual clients, which we discussed above. The financial director determines the turnover for the group under study, calculates the trading margin, and subtracts direct costs. As a result, he receives a margin for a group of clients. From it you need to subtract the cost per share. The result will be the adjusted margin for the customer group. If the margin growth was higher than the cost per share, then the latter was effective.

Margin growth across the group can be distributed to individual clients. Then, when making calculations, the CFO will have the chance to take advantage of knowing the exact margin for each client. For this purpose, different distribution bases can be used. The most suitable of them are ranking by turnover or, which is sold to each client.

If the list of clients is endless, then first you need to take the current turnover of the company (before the promotion). Then you need to estimate future turnover and margin if the promotion is not carried out. Then it is necessary to determine the true turnover and margin of the company after the promotion. Finally, from the margin increase (the difference between the expected margin without the promotion and the actual margin after the promotion), subtract the direct expenses per share. As a result, we will find out the effect of the action. If it is positive, the stock was profitable for the company.

In this case, the most difficult thing is to estimate what the margin will be if the promotion is not carried out. Only those companies whose products do not experience seasonal fluctuations in demand, and whose sales dynamics are stable and predictable, can limit themselves to calculating turnover for the previous period.

Thus, marginal income and marginal profitability are the most adequate indicators that characterize the results of a company’s efforts to maximize profits from sales activities.

Specific marginal profitability

“Specific marginal profitability is calculated as the ratio of marginal profitability to the duration of the financial cycle.

The duration of the latter includes the time from the moment of receipt of raw materials until the moment of receipt of money for the goods. From this time the time from the purchase of raw materials to their payment is subtracted.

Let's say a company sells two types of products. The company's specialists calculated the marginal profitability and received: product A - 47 percent, product B - 316 percent. The duration of the financial cycle is 32 and 46 days, respectively. The specific marginal profitability will be 1.46 percent (A) and 6.87 percent (B). Based on this, the company decided to shorten the duration of the financial cycle of product A and reduce sales volume. Expenses for it will decrease in corresponding proportion. Margin data will not show any change. And the specific marginal profitability indicator will increase, since the numerator will remain the same and the denominator will decrease.

Based on this indicator, the company can calculate how to reduce sales volume while maintaining marginal profitability at the same level.”

Trade margin = Sales – Cost

Gross Profit Margin = Gross Profit/Turnover

Gross Profit = Contribution Margin – Fixed Costs

Marginal income = Trading margin – Variable costs

Net profit = Gross profit + Non-operating and extraordinary income – Non-operating and extraordinary expenses

Net profit margin = Net profit/Turnover

Marginal profitability = Marginal income/Turnover

Trading Margin

Trade margins are words that are well known and understandable to every accountant, especially an accountant of a trading enterprise. However, their accounting understanding can have a significant impact on the firm's reported financial position and how it is perceived by stakeholders.Now they love imported words. Instead of the well-understood phrase “trade margin,” young people prefer the word “margin.” This word contains the sound of the western breeze.

When we talk about markups, a lot becomes clear to us.

We bought goods and want to sell them. As a rule, if we are not thinking about a charity event, we want to sell it for more than we bought it for. And this is where accountants immediately face a problem: the employer bought valuables for x rubles. per unit, but wants to sell for rubles. At the same time, an accountant, what is x rub. knows, but about the rub. may not even guess. However, once the goods are purchased and brought to the store, it means they must arrive, but, one wonders, at a price of x rubles. or according to rub. If the accountant talks about rubles. doesn't know, then there is no problem. But this is only so, it seems, because a new problem immediately arises: do goods need to arrive at a price? rub. or should it be according to their entire cost price, i.e. should we add, say, expenses (costs) for delivery, i.e. according to the value y + xx?

If at the purchase price, i.e. x rubles, then it is very easy, simple and understandable. Transport costs, more correctly speaking for the balance of goods (theoretically, they can include not only the costs of importing goods), should in this case be taken into account separately, not by the registration method, but by calculating the average percentage once per reporting period.

However, those who disagree? taken into account separately, usually, in justification, they talk about big science: inventories (and incoming goods increase their cost) must reflect the amount of capital invested by the owner, and he invests not only in the purchase price, but also in their entire delivery, i.e. and in?, and in?.

And in fact, it happens in life, when? > ?.

Science was created to facilitate man’s work and save his labor.

And for an accountant, the labor costs are often enormous.

This is where what wise scientists came up with before the war comes to his aid: ? record as costs and calculate only for the balance, and in the debit of the “Goods” account write receipts only at purchase prices. What science gives:

1) the accounting nomenclature is being reduced, because otherwise the number of valuation options at cost will increase, compared to purchase prices, exorbitantly;

2) the accountant’s work will sharply decrease, since in this case there is no need to make meaningless calculations for each invoice.

Indeed:

A) goods of twenty items were delivered on the invoice, but delivery costs are not indicated, how to capitalize the goods at cost? So they don’t come, they’re waiting for bills.

And during the waiting time, goods can already be sold;

b) let’s say the accompanying sales document contains the same twenty names of goods plus transport costs (?). The question immediately arises: how? distribute among twenty items. The problem has been solved since the times of the Ancient Roman Empire and they were convinced of one thing: there is no correct solution. And there were attempts:

1) divided in proportion to the cost of each item (meaningless, because let’s say that nineteen types of goods were vegetables, and the twentieth was a small diamond);

2) distributed? proportional to weight, theoretically it seems to be correct, but in this case the entire cost will fall on vegetables and the importance of the most significant product will disappear.

As accountants have learned over the centuries, how much unnecessary work they do is pointless.

Keeping records of purchase valuations allows accountants to avoid the extensive labor-intensive work of revaluing goods. Naturally, the management of trading enterprises constantly revaluates goods, and if they are accounted for in sales prices, then the accountant must always do the work of revaluing them.

Therefore, if someone asks at what prices to take into account goods in trade, one must answer: according to? and without?.

From the point of view of the organization, the fact that in this case there is no place for the “Trade margin” account in the workbook becomes of great importance.

But in life there is not a single virtue without a flaw. This was once called dialectics (the struggle of opposites). If goods are taken into account at purchase prices, other important points disappear:

1) it is impossible to carry out automatic collation, i.e., reconciliation of written-off goods (commodity report) with capitalized revenue (cash report). The presence of a single commodity and cash report deprives accounting of an important control point;

2) when using a computer, the cashier automatically records the fact that goods are written off exactly at sales prices. But, on the other hand, introducing a margin, a trading margin, into accounting allows you to reveal the potential expected profit.

The above points are of great importance and force accountants to think about what option for accounting for goods should be included in the order on accounting policies.

What is the meaning of margin

When we think about the nature, about the economic content of the margin, we are surprised to recognize its paradoxical nature. If we proceed from the idea of a dynamic balance, then in margin accounting there is no account 42 “Trade margin” and there should not be.

This is due to the fact that the “Goods” account is in both accounting options, how? And How? + ?, demonstrates the asset as actually invested capital. These are, in essence, deferred expenses, because money and/or obligations to pay them are invested in values, expenses are capitalized, and there is no place in this concept for future income. However, if account 42 “Trade margin” is introduced into the chart of accounts, then it does not create a source of own funds, but can, as was customary in Soviet accounting, perform the function of a counter-active account. He only refines the valuation of goods, bringing it to the selling price.

Static balance is another matter. Products in it are initially shown at sales prices of the current reporting day.

And, as required by aifharez, it is interpreted not as deferred expenses, but as deferred income. And indeed, it is obvious that the assets, one way or another, will either be sold or will contribute to this sale, therefore, the entire asset will turn into money and will bring either profit or loss. Hence account 42 “Trade margin” is a source of own funds, these are potential future profits, and not at all some kind of regulation.

In Soviet accounting, and many even now, understanding the balance in the light of a static concept, they use account 42 “Trade margin” as a regulator, and this in practice leads to big financial errors. The fact is that almost all accountants, financiers and administrators confuse the static balance sheet with the dynamic one, and when determining solvency, they use data on inventory without trade margins.

Ifharez should be defined as the process of transferring the national accounting system to international standards.

If we are talking about a dynamic balance sheet, then there are reasons for this, but in terms of a static balance sheet, this is incorrect and seriously deteriorates the company. There are cases where banks have refused a loan to good applicants on this basis. The former lost money and profits, the latter lost good clients.

At the same time, there is a huge danger here. To obtain a loan, it is very easy to carry out a fictitious revaluation of goods, artificially increase the credit turnover of account 42 “Trade margin” and ensure for yourself the required level of solvency. Some people, convinced that the bank’s people will not get into the general ledger, will perform this operation directly on the balance sheet.

But that’s why there are analysts in the bank, these “pike in the river so that the crucian carp don’t sleep.”

How to describe a markdown

Based on the dynamic concept, then all markdowns should be written off to the Profit and Loss account. (The losses are already evident.) If you adhere to static balance, then the following options are possible:

1) if the trade margin is greater than the markdown, then the latter is debited to account 42 “Trade margin”. This is understandable, since the accountant simply shows that the profit did not reach the expected level;

2) if the trade margin is less than the revaluation, then the latter is also reflected in the debit of account 42. And now it becomes clear that this account is active-passive in nature, and its debit balance means losses that will be reflected upon the sale of goods.

These are potential losses. This, of course, contradicts the principle of prudence (), but it correctly reflects the idea of temporary recording of facts of economic life and prevents abuses that accounting conservatism provokes.

In fact, if someone wants to hide profits, he will conduct a fictitious valuation of goods, evading taxes, and create so-called pseudo-losses.

And this is correct if the margin is understood as a fund, but if we talk about it as a regulator, then everything changes. In the event of any markdown, we must write off only the share of the assessment in debit 42 “Trade margin”, and the main part - to the profit and loss account. In this account, all losses relate to the reporting period in which they arose. But only.

The most important result comes down to the fact that in life results appear that, on the one hand, we create with our labor, physical and mental, on the other, the financial result is a consequence of the resourcefulness of the mind that God has endowed us with. By choosing an accounting policy, we predetermine the financial result.

Types of margin

1. Initial, or initial, margin is the amount of equity capital required to carry out a margin transaction in accordance with current legislation. Initial margin is calculated using the formulaMn = C / Tso x 100%,

Where Mn is the initial margin, %; C – the client’s own funds invested in the transaction; Tso – the total cost of the margin transaction at the time of its conclusion.

2. Actual margin is the share of the client’s own monetary capital in the value of the margin transaction as of the current date. It is calculated daily separately for each type of margin transaction, but its general essence is as follows:

Мф = Сф / Цфх 100%,

Where Mf is the actual margin, % as of the current date; Sf – the client’s own funds in the capital of the transaction as of the current date; Tsf – the total cost of the margin transaction as of the current date.

If the actual margin level exceeds the initial margin level, this means that the client (speculator) has excess margin, which he can use either to make new (additional) margin transactions or to reduce the size of the broker's loan.

3. Minimum margin is the maximum permissible level of own monetary capital (equity) in the cost of a margin transaction.

If the price situation on the market has developed in such a way that the share of the client’s own funds has decreased to the level of the minimum margin (or even lower), then the broker has the right to require the client to make up for the shortfall in his security deposit. Otherwise, the broker has the right to independently sell part of the client’s securities (for a short purchase) or to buy back the required number of securities using the client’s funds available on the margin account (for a short sale).

4. Variation margin, or support margin, is the amount of funds that the client must add to the margin account in order to fulfill the broker's requirement to restore his guarantee deposit (margin level). Variation margin is defined as the difference between the margin level required by the broker and its actual level, resulting from the actual situation on the market (from the actual level of the market price).

Up

The economic term “margin” is used not only in trade and stock exchange operations, but also in insurance and banking. This term describes the difference between the trade value of a product, which is paid by the buyer, and its cost, which consists of production costs. For each field of activity, the term will have its own specific use: in stock exchange activities, this concept describes the difference in securities rates, interest rates, quotes or other indicators. This is a rather unique, non-standard indicator for stock exchange transactions. In terms of brokerage operations on stock markets, margin acts as collateral, and trading is called “margin”.

In the activities of commercial banks, margin describes the difference between interest on issued loan products and existing deposits. One of the popular concepts in banking is “credit margin”. This term helps describe the difference obtained if the agreed amount is subtracted from the final loan amount issued to bank clients. Another indicator that directly describes the efficiency of banking activities can be considered “net margin” expressed as percentages. The calculation is made by finding the difference between capital and net income, measured as a percentage. For any bank, net income is generated through the sale of credit and investment products. When issuing a loan amount secured by property, to determine the profitability of the transaction, the “guarantee margin” is calculated: the amount of the loan amount is subtracted from the value of the collateral property.

This term simplifies the concept of profit. The indicator can be expressed in:

- percent (calculated as the ratio between the difference between the cost and the cost of the product to the cost);

- in absolute terms - rubles (calculated as a trade margin);

- ratio of shares (for example, 1:4, used less frequently than the first two).

Thanks to this indicator, the costs of delivery, product rejection, and sales organization, which are not reflected in the cost of the product, are reimbursed. It is also at its expense that the company’s profit is generated.

If the margin does not increase with an increase in trading value, this means that the cost of goods is increasing faster, and the company risks soon becoming unprofitable. To prevent this from happening, the pricing of the product must be adjusted.

This indicator is relevant for calculations for both large and small organizations. Let's summarize why it is needed:

- analysis of the organization's profitability;

- analysis of the financial condition of the organization, its dynamics;

- when making a responsible decision, in order to justify it;

- forecasting the profitability of possible clients of the organization;

- formation of pricing policies for certain groups of goods.

It is used in the analysis of financial activities along with net and gross profit for both individual goods or their groups, and the entire organization as a whole.

Gross margin is revenue from sales of products for a certain period from which variable costs allocated for the production of these products are subtracted. This is an analytical indicator, which, when calculated, may include income from other activities of the enterprise: the provision of non-production services, income from the commercial use of housing and communal services and other activities. The net profit indicator and the fund allocated for production development depend on the gross margin. That is, in an economic analysis of the activities of the entire enterprise, it will reflect its profitability through the share of profit in the total volume of proceeds.

How to calculate margin

The margin is calculated based on the ratio in which the final result will be expressed: absolute or percentage.

The calculation can be made if the trade margin and the final cost of the goods are accurately indicated. These data make it possible to determine mathematically the margin, expressed as a percentage, since these two indicators are interrelated. First, the cost is determined:

Total cost of goods – Trade margin = Cost of goods.

Then we calculate the margin itself:

(Total cost – Product cost)/Total cost X 100% = Margin.

Due to different approaches to understanding margin (as a profit ratio or as net profit), there are different methods for calculating this indicator. But both methods help in the assessment:

— the possible profitability of the launched project and its prospects for development and existence;

— the value of the product life cycle;

— determining the effective volumes of production of goods and products.

Margin formula

If we need to express the indicator through percentages, in trading operations the formula is used to determine the margin:

Margin = (Product Cost – Product Cost) / Product Cost X 100%.

If we express the indicator in absolute values (foreign or national currency), we use the formula:

Margin = Product Cost – Product Cost.

What is marginality

Most often, marginality describes the increase in capital in monetary terms per unit of production. In general terms, this is the difference between production costs and the profit received as a result of product sales.

Marginality in commerce is the marginal profit of a product, subject to the minimum cost and the maximum possible markup. In this case, they talk about the high profitability of the enterprise. If a product is sold at a high price, the investment in production is large, but with all this, the profit barely compensates for the costs - we are talking about low margin, since in this case the profitability ratio (margin) will be quite low. Using the concept of “profitability ratio,” we take 100% of the cost of the product paid by the consumer. The profitability of the enterprise is higher, the higher this ratio is.

The marginality of a business or enterprise is its ability to obtain net income from invested capital for a certain period, measured as percentage.

The procedure for determining margin is carried out not only at the initial stage of launching a product (or a company as a whole), but also throughout the entire production period. Constant calculation of margin allows you to adequately assess the possible influx of income and the more sustainable the business development will be.

It should be noted that in Russia and Europe there are different approaches to understanding marginality. For Russia, a more typical approach is where this concept is considered to be net gross income. Another analogue of this concept is the amount of coverage. In this case, the emphasis is on this amount as part of the revenue that forms the profit of the enterprise and is responsible for covering costs. The main principle here is to increase the organization’s profit in proportion to the reimbursement of production costs.

The European approach tends to reflect the gross margin as a percentage of the total income received after the sale of the product, from which the costs associated with the production of the product have already been deducted.

The main difference between the approaches is that the Russian one operates with net profit in monetary units, the European one relies on percentage indicators and is more objective in assessing the financial well-being of the organization.

When calculating marginality, economists pursue the following goals:

- assessment of the prospects of a specific product on the market;

- what is its “lifespan” on the market;

- the relationship between the prospects or risks of introducing a product to the market and the success of the launched enterprise.

It is important to calculate the marginality of a product for those companies that produce several types or groups of goods. At the same time, we obtain marginality indicators that can clearly show which of the goods have a better chance of future production, and the production of which can, or even should, be abandoned.

Margin and markup - their difference

If we express the margin as a percentage, then in this case it is impossible to say that it can be equated to a markup. When calculating in this case, the markup will always be greater than the margin. Also in this case it can be more than 100% (unlike the expression in absolute values, where it cannot be more than 100%). Example:

Markup = (price of goods (2000 rubles) - cost of goods (1500 rubles)) / cost of goods (1500 rubles) X 100 = 33.3%

Margin = price of the product (2000 rub.) – cost of the product (1500 rub.) = 500 rub.

Margin = (product price (2000 rubles) – cost of goods (1500 rubles))/product price (2000 rubles) X 100 = 25%

If we consider in absolute terms, then 500 rubles. – this is margin = markup, but when calculated as a percentage, margin (25%) ≠ markup (33.3%).

The markup as a result means the ratio of profit to the cost, and the margin is the ratio of profit to the trading value of the product.

Another nuance through which you can identify the difference between the concepts of “markup” and “margin”: the markup can be considered as the difference between the wholesale and retail cost of a product, and the margin as the difference between cost and cost.

In professional economic analysis, it is important not only to calculate the indicator mathematically correctly, but also to take the initial data necessary for specific circumstances and correctly use the results obtained. Using certain calculation methods, you can obtain data that differs from each other. But taking into account the conventionality of the considered indicators, in order to fully and effectively describe the economic state of the organization, additional analysis is performed on other indicators.

Today, the term “margin” is widely used in stock exchange, trading, and banking. Its main idea is to indicate the difference between the selling price and the cost per unit of product, which can be expressed either as profit per unit of production or as a percentage of the selling price (profitability ratio). What is marginality? In other words, this is the return on sales. And the coefficient presented above serves as the main indicator, because it determines the profitability of the enterprise as a whole.

What is the commercial meaning and meaning of this term? The higher the ratio, the more profitable the company. This means that the success of a particular business structure is determined by its high margins. That is why it is advisable to base all decisions in the field of marketing strategies, which, as a rule, are made by managers, on the analysis of the indicator in question.

What is marginality? It should be remembered: margin is also a key factor in predicting the profitability of potential clients, developing pricing policies and, of course, the profitability of marketing in general. It is important to note that in Russia marginal profit is often called gross profit. In any case, it represents the difference between the profit from the sale of the product (without excise taxes and VAT) and the costs of the production process. Coverage amount is the second name of the concept being studied. It is defined as the portion of revenue that goes directly to generating profit and covering costs. Thus, the main idea is to increase the profit of the enterprise in direct proportion to the rate of recovery of production costs.

To begin with, it should be noted that the calculation of marginal profit is made per unit of manufactured and sold product. It is he who makes it clear whether we should expect an increase in profit due to the release of the next product unit. The marginal profit indicator is not a characteristic of the economic structure as a whole, but it allows one to identify the most profitable (and most unprofitable) types of product in relation to the possible profit from them. Thus, marginal profit depends on price and variable production costs. To achieve the maximum indicator, you should either increase the markup on products or increase sales volumes.

So, the marginality of a product can be calculated by using the following formula: MR = TR - TVC (TR is the total profit from the sale of the product; TVC is variable costs). For example, the production volume is 100 units of goods, and the price of each of them is 1000 rubles. In turn, variable costs, including raw materials, wages to employees and transportation, amount to 50,000 rubles. Then MR = 100 * 1000 – 50,000 = 50,000 rubles.

To calculate additional revenue, you need to apply another formula: MR = TR(V+1) - TR(V) (TR(V) – profit from sales of products at current production volume; TR(V+1) – profit in case increase in output by one unit of goods).

Marginal profit and break-even point

It is important to note that the margin (formula presented above) is calculated in accordance with the division of fixed and variable costs in the pricing process. Fixed costs are those that would remain the same even if there was zero output. This should include rent, some tax payments, salaries of employees in the accounting department, human resources department, managers and maintenance personnel, as well as repayment of loans and borrowings.

The situation in which the contribution to the covering is equal to the amount of fixed costs is called the break-even point.

At the break-even point, the volume of sales of goods is such that the company has the opportunity to fully recoup the costs of producing the product without making a profit. In the figure above, the break-even point corresponds to 20 units of product. Thus, the income line crosses the cost line, and the profit line crosses the origin and moves into a zone where all values are positive. In turn, the marginal profit line crosses the line of fixed production costs.

Methods for increasing marginal profit

The question of what marginality is and how to calculate it is discussed in detail. But how to increase marginal profit and is it a priori possible? Methods for raising the MR level are mostly similar to methods for increasing the overall level of income or direct profit. These include participation in tenders of various types, increasing production output to distribute fixed costs between large volumes of product, studying new market sectors, optimizing the use of raw materials, searching for the cheapest sources of raw materials, as well as an innovative advertising policy. It should be noted that, in general, the fundamentals of the marketing industry do not change. But the advertising industry is constantly undergoing some changes, but the main reason for its existence and application remains the same.

In the economic sphere, there are many concepts that people rarely encounter in everyday life. Sometimes we come across them while listening to economic news or reading a newspaper, but we only imagine the general meaning. If you have just started your entrepreneurial activity, you will have to familiarize yourself with them in more detail in order to correctly draw up a business plan and easily understand what your partners are talking about. One such term is the word margin.

In trade "Margin" expressed as the ratio of sales proceeds to the cost of the product sold. This is a percentage indicator, it shows your profit when selling. Net profit is calculated based on margin indicators. It’s very easy to find out the margin indicator

Margin=Profit/Sales Price * 100%

For example, you bought a product for 80 rubles, and the selling price was 100. The profit is 20 rubles. Let's do the calculation

20/100*100%=20%.

The margin was 20%. If you have to work with European colleagues, it is worth considering that in the West the margin is calculated differently than in our country. The formula is the same, but net income is used instead of sales proceeds.

This word is widespread not only in trade, but also on stock exchanges and among bankers. In these industries, it means the difference in securities prices and the bank’s net profit, the difference in interest rates on deposits and loans. For different areas of the economy, there are different types of margin.

Margin at the enterprise

The term gross margin is used in businesses. It means the difference between profit and variable costs. It is used to calculate net income. Variable costs include equipment maintenance costs, labor costs, and utilities. If we are talking about production, then gross margin is the product of labor. It also includes non-operating services that are profitable from outside. This is an identifier of a company's profitability. From it various monetary bases are formed to expand and improve production.

Margin in banking

Credit margin– the difference between the commodity value and the amount allocated by the bank for its purchase. For example, you take out a table worth 1000 rubles on credit for a year. After a year, you pay back 1,500 rubles in total with interest. Based on the formula above, the margin on your loan for the bank will be 33%. Credit margin indicators for the bank as a whole affect the interest rate on loans.

Banking– the difference between the interest rate coefficients on deposits and issued loans. The higher the interest rate on loans and the lower the interest rate on deposits, the greater the bank margin.

Net interest– the difference between interest income and expense in a bank in relation to its assets. In other words, we subtract the bank's expenses (paid loans) from income (profit on deposits) and divide by the amount of deposits. This indicator is the main one when calculating the bank’s profitability. It defines stability and is freely available to interested investors.

Warranty– the difference between the probable value of the collateral and the loan issued against it. Determines the level of profitability in case of non-return of money.

Margin on the exchange

Among traders participating in exchange trading, the concept of variation margin is common. This is the difference between the prices of the purchased futures in the morning and in the evening. A trader buys futures for a certain amount in the morning at the beginning of trading, and in the evening, when trading closes, the morning price is compared with the evening price. If the price has increased, the margin is positive; if it has decreased, the margin is negative. It is taken into account daily. If analysis is needed over several days, the indicators are added up and the average value is found.

The difference between margin and net income