Explanations on VAT in the year. Electronic format for giving explanations on VAT. Under what procedures can a tax authority request clarification?

Read also

From January 1, 2017, a response to a request for clarification on VAT will have to be submitted only electronically via telecommunication channels (TCS). A response to a request sent to the inspectorate in paper form is considered not submitted. This is directly provided for in Article 88 of Federal Law No. 130-FZ dated 05/01/2016. For failure to provide (or untimely submission) explanations, a fine of 5,000 rubles is provided.

As part of a desk tax audit of VAT returns, the inspectorate may send payers a request to clarify any information reflected in the declaration.

From January 1, 2016, taxpayers who submit declarations electronically were required to ensure the acceptance of tax authorities’ demands (Clause 5.1, Article 23 of the Tax Code of the Russian Federation). If this is not done, the suspension of transactions on bank accounts cannot be ruled out (clause 3, clause 1.1 of Article 76 of the Tax Code of the Russian Federation). From January 1, 2017, responses to requirements must be sent electronically.

What requirements are relevant now?

There are three types of requirements for the provision of explanations for VAT, the format of which is formalized by the Federal Tax Service (that is, an electronic document format has been developed and normatively established):- according to control ratios;

- on discrepancies with counterparties;

- about information not included in the sales book ().

After receiving a claim, the payer has six business days to send a receipt for the claim, then another five business days to respond to the claim (weekends and public holidays are not included).

Let's take a closer look at what should be done if a request is received.

Explanation of reference ratios

If the tax authority calculates the control ratios in the declaration and finds inaccuracies.How quickly it will come. Within 1-2 days after sending. Theoretically, the request can be received during all three months of the audit, but in practice the tax authorities cope with the task within a day or two after sending the declarations.

In what format will it come? As a pdf file.

What information does it contain? The request for clarification on control relationships will include the following information:

- Reference ratio number (for example, 1.27).

- Formulation of the violation (for example, “inflating the amount of VAT subject to deduction”).

- Reference to the norm of legislation (Tax Code of the Russian Federation, Art. 171, 172).

- Control ratio (Art. 190 R.3 + sum of Lines 030 and 040 R.4 + Art. 080 and 090 R.5 + Art. 060 R.6 + Art. 090 R.6 + Art. 150 R.6 = Art. 190 R. 8 + [Art. 190 App. 1 to R. 8 - Art. 005 App. 1 to R. 8] if the left side of the equality > right).

- Data reflected in the declaration (1781114.00<=3562595.75).

Explanations for discrepancies with counterparties

In what case will the demand come? Data on invoices of buyers and sellers are automatically reconciled in the information system of the tax office. For this purpose, it contains special algorithms. If during the reconciliation the counterparty is not found or discrepancies are discovered in the data (for example, in VAT), the Federal Tax Service will send the company a request to provide explanations for the discrepancies.How quickly it will come. As a rule, within 2 weeks after sending the declaration.

In what format will it come? In pdf + xml format.

What information does it contain? The request for explanations of discrepancies includes a list of invoices for which discrepancies requiring clarification were found, as well as error codes. The error codes found may be as follows:

- 1—the counterparty does not have a record of the transaction;

- 2 - discrepancy between transaction data between the purchase book and the sales book. In particular, between the data in section 8 (information from the purchase book) or appendix 1 to section 8 (information from additional sheets of the purchase book) and section 9 (information from the sales book) or appendix 1 to section 9 (information from additional sheets of the sales book) taxpayer declarations;

- 3 - discrepancy between transaction data between section 10 (information from the journal of issued invoices) and section 11 (information from the journal of received invoices) of the taxpayer’s declaration;

- 4 (a, b) - an error in columns a, b is possible (the number of the columns in which errors were made is indicated)

What to include in an email response. To avoid problems later, it is wise to provide an explanation for each invoice specified in the request. And in order to figure out what kind of explanation to give, you need to bring up the original invoices mentioned in the requirement. And check the data - further actions depend on the results of the check:

- the data turned out to be correct. Confirm that the data is correct; it would not hurt to attach a scan of the invoice or the original in electronic format (xml). Do not forget to include the attached documents in the inventory;

- An error was detected in the invoice details (date, number, tax identification number, checkpoint or others). Make an amendment in the response to the request (except for the VAT amount);

- error in the tax amount. You will have to submit an updated declaration within the allotted five-day period after sending the receipt.

Explanation of information not included in the sales book

There is no officially approved procedure for responding to demands of this kind. Here we provide expert advice.In what case will the demand come? A request to clarify information not included in the sales book will be sent to the taxpayer in the event that the buyer reflects transactions with the seller in the declaration, but the seller does not do this in his sales book.

How quickly it will come. Theoretically, such demands can be received within the same three months of verification, but it is more likely that the demand will arrive within two weeks from the date of sending the declaration.

In what format will it come? In pdf file format.

What information does it contain? This requirement includes the name, INN and KPP of the buyer who reflected the transaction data, as well as the numbers and dates of invoices.

What to include in an email response. The data must fall into different answer tables is not a requirement depending on the conditions given below.

- The transaction is confirmed, that is, there is an invoice in the declaration, but with data different from the buyer’s data. The invoice then goes into a table that explains the discrepancies. In the table, it is enough to indicate the number, date and TIN of the counterparty; additional information is not necessary.

- The transaction is not confirmed, that is, the seller did not issue this invoice to the buyer. The invoice is included in a table containing data on unconfirmed transactions. The table should reflect the following information:

- invoice number

- invoice date

- Buyer's TIN.

- The payer has the invoice mentioned in the request, but he forgot to reflect it in the sales book. In this case, we advise you to include the invoice in an additional sheet of the sales book and send an updated declaration. Five working days are given for this after sending the receipt of acceptance of the request.

Request for clarification on other grounds

In what case will the demand come? The reasons can be any. In this case, the declaration data must be explained in any form, but in electronic form.In what format will it come? As a pdf file.

What to include in an email response. So, from January 1, 2017, the electronic format of explanations becomes mandatory. However, the corresponding document has not yet been finally approved (see below). The likelihood of document approval is very high. Thus, the answer can contain essentially any explanation, one or several at once. In other words, these can be explanations of discrepancies, control ratios, transactions not included in the sales book, as well as all other explanations in any form.

If nothing changes, then the format of the response in electronic form currently implies only an explanation of the discrepancies.

Getting ready for a new format of explanations

A draft order of the Federal Tax Service on a new format for submitting explanations to the VAT return in electronic form has been submitted for public discussion (http://regulation.gov.ru/projects#npa=53377). The document has successfully passed the stage of the so-called regulatory impact assessment. The new format provides:- Possibility of including explanations of control ratios in the answer.

- Possibility of including in the response explanations for transactions not included in the sales book.

- Possibility of including any other explanations in any form in the answer.

From January 24, 2018, all companies must submit VAT explanations to the Federal Tax Service only in a new electronic format. What has changed and how to prepare a response to the Federal Tax Service’s request for clarification on VAT 2018 is in this article.

- what has changed in the format of VAT explanations since 2018;

- who must respond to the demands;

- what now needs to be explained via the Internet;

- what errors within the declaration should you pay attention to;

- how to respond to the tax office’s requirement to provide explanations on VAT in the electronic document management operator’s program.

Explanations on VAT in electronic form since 2018: what has changed

From January 24, 2018, all companies must submit VAT explanations to the Federal Tax Service only in a new electronic format (Order of the Federal Tax Service of Russia dated December 16, 2016 No. ММВ-7-15/).

If you answer on paper, the inspectors will not accept the document and will fine the company 5 or 20 thousand rubles (Clause 1 of Article 129.1 of the Tax Code of the Russian Federation).

Who submits VAT explanations in electronic format?

Electronic explanations in the approved format are sent by taxpayers who are required to submit a declaration via the Internet (clause 3 of Article 88 of the Tax Code of the Russian Federation). If a company is not a taxpayer or reports on paper, it has the right to provide electronic or paper explanations.

If a company has issued an invoice using the simplified tax system, then it is obliged to remit VAT, but it does not become a taxpayer. And although the company submits the declaration electronically, it has the right to submit explanations on paper.

The format is valid from January 24, 2018. Therefore, if the taxpayer responds to the request on this day or later, it is safer to send explanations using the approved format. To do this, update the operator program.

What needs to be explained and what has changed in the format of VAT explanations

Companies are required to provide electronic explanations of the requirements that tax authorities make on the grounds specified in paragraph 3 of Article 88 of the Tax Code of the Russian Federation. Namely, if:

- the company submitted an amendment in which it reduced the VAT payable;

- inspectors found errors and contradictions in the declaration.

During a desk audit for VAT, inspectors also have the right to demand explanations about benefits (clause 6 of Article 88 of the Tax Code of the Russian Federation). This requirement can be answered on paper.

- The company can clarify the checkpoint of the counterparty: seller, buyer or intermediary.

- The format allows you to clarify errors within the company’s reporting itself. For example, if the deductions in sections 3 and 8 of the declaration do not match.

- A separate form must be filled out to explain transactions that the program did not find in the supplier's declaration.

We have shown in the tables why inspectors will send requirements and how to explain these errors.

Responses to the requirements of the Federal Tax Service in case of discrepancies in the declaration

Errors inside the company declaration

The discrepancies are due to different rules for filling out sections. Cost indicators in sections 1–7 are rounded to full rubles, and deductions in section 8 are shown in rubles and kopecks. The difference is due to rounding

The discrepancies arose due to different VAT rates. The company calculated the advance tax at the rate of 18/118, since it did not know for which goods it received an advance payment.

Shipped goods are taxed at a rate of 10%. The company declared the advance tax deductible in the amount it paid to the budget (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 25, 2011 No. 10120/10)

In lines 010 of Section 8, the company mistakenly wrote down transaction code 20 for the shipment of goods to the EAEU countries (Belarus), the correct code is 19

The company is exempt from VAT under Article 145 of the Tax Code of the Russian Federation, but issued an invoice. By mistake, instead of section 12, the organization filled out the tax in section 9. The tax payable is not underestimated

If there are no errors in the declaration, duplicate the information from the invoice. If the company made a mistake, the response to the claim depends on whether the mistake affected tax.

The error does not affect VAT. For example, the buyer claimed a partial deduction, but wrote the cost of the goods not in full, but corresponding to the deduction. The tax has been calculated correctly. In the explanations, duplicate the data from the declaration, and below write down the full cost of the goods from the invoice.

The error affects VAT. If the buyer inflated the cost and calculated a deduction from it, then submit an updated declaration. Then it is not necessary to explain the discrepancies

Buyer . If everything in the declaration is correct, duplicate the details in response to the request. If there are errors, write down the correct values in the Explanations line. If the buyer erroneously declared a deduction (for example, the supplier canceled the invoice), then submit a clarification.

Provider . If the supplier did not draw up the document, in response to the request, he selects that he does not confirm the invoice and fills in its number, date, INN/KPP of the buyer.

If the supplier himself filled out the data in the declaration incorrectly, then provide an explanation. Write down the invoice details from the request and provide the correct values below. You can clarify the number, date, cost of sales, transaction code, INN/KPP, as well as the section in which the transaction is reflected - 9, 9.1, 10.

If the supplier forgot to include an invoice in the declaration, submit a clarification. Then there is no need to give explanations

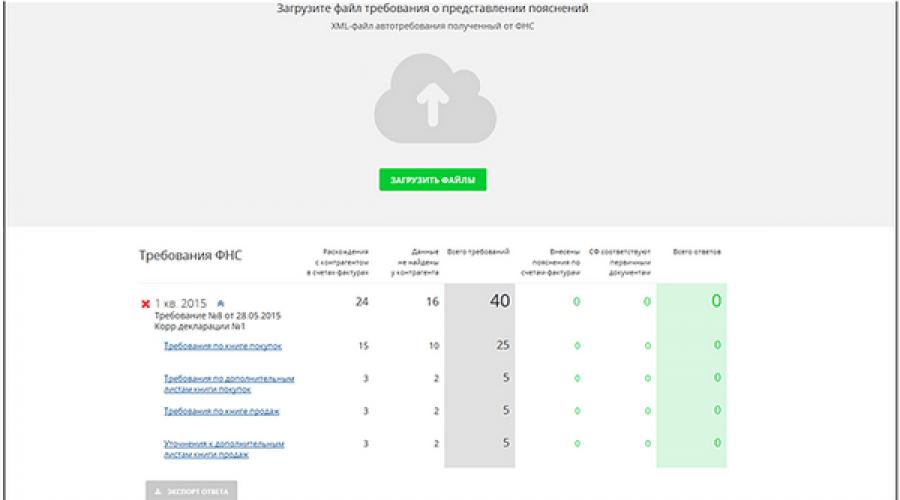

Response to the request of the Federal Tax Service to provide clarifications on VAT through the program

To answer the requirements in document management operator programs “Check!” companies Taxcom and Kontur. Extern" company SKB Kontur, use the following algorithms.

How to write a response to a VAT claim using the “Check It Out!” program

To respond to a request in the online service, check! Taxcom company, the algorithm of actions is as follows.

1. Download the requirement from the accounting program .

From the accounting program, download the inspection request file in xml format to your computer. Then in the Dockliner program:

- go to the “Reconciliation” service;

- select the section “Federal Tax Requirements”;

- click “Upload files”;

- select the requirement xml file.

Wait until the file is loaded into the program. This may take up to 15 minutes depending on the file size. The data from the requirement is displayed at the bottom of the window.

The program distributes requirements by type:

- discrepancies between declarations;

- data that is not found on the counterparty.

The program also distributes discrepancies among sections of the declaration.

Click on a document title to view details and provide explanations

To find a specific counterparty, click on the button with a magnifying glass. All discrepancies with the counterparty can be viewed by clicking on its name.

- If the invoice information is not found in the counterparty's documents, a warning will be displayed: "Invoice not found with the counterparty."

- Please review the discrepancies. If all your details are correct, click “Confirm details”.

If you press this button by mistake, you can cancel the action.

If there are errors, click “Give an explanation.”

In the “Your explanations” column, enter the correct information. To move to the next line, press Tab or click on it.

Explanations can also be canceled.

If there are many discrepancies in the requirement, and explanations are needed for only a few of them, enter the necessary explanations and check the box “mark requirements for which no explanations were provided as corresponding to the primary documents” (at the top of the page).

The action can be canceled by clicking on this item again.

3. Upload the file to send

Once you have explained any discrepancies, return to the “Federal Tax Requirements” page using the link at the top of the page. Verify that any discrepancies in information are explained and click “Export Response.”

Save the file to your computer. Now it can be attached to the response to the request of the Federal Tax Service, document code - 8888.

How to write a response to a VAT claim using the “Contour” program. Extern!

1. Select the requirement you want to respond to

To Contour. Extern go to the "New" menu gt; "Requirements" gt; "All requirements":

In the list, select the requirement to which you want to send a response:

Click on the required requirement. A page with document flow will open. The “Upload and send documents” button may be required if the company wants to send copies of documents to the inspection. This can be done after sending explanations. To prepare explanations, click on the “Fill out a response to the request” button:

After this, the request response form will open.

2. Select annotation type

The response form contains 10 sections - as many as in the Federal Tax Service format. You need to select sections that meet the requirements of the tax authorities.

The first seven sections explain discrepancies and possible errors between the declaration of the supplier and the buyer in different sections of the declaration. Program Contour. The external consultant will transfer the information from the requirement to the required sections.

The last three sections are new. They were not in the recommended format:

- unfulfilled control ratios;

- invoices not included;

- explanatory letter.

Select the section depending on your requirement.

Discrepancies between supplier and buyer declarations

If tax authorities suspect errors in invoices, they need to be explained. Select the sections with errors from the first seven:

After you click on the section, the program itself will fill in the information from the requirement:

Check the invoices that the tax authorities included in the request. Further actions depend on whether there are errors in the documents and declaration.

There are no errors. Do not change the information on the form or check the correct invoice line. This way the company will send information to the tax office that everything is in order on the invoice and declaration.

There is an error in the details. If everything is correct in the invoice, but the company made a mistake when filling out the declaration, clarify the incorrect details. To do this, simply change the columns with errors

The invoice should not be in the declaration. Check the line with the document for deletion. Inspectors will receive information that the invoice is redundant. At the same time, in this case, submit an amendment if you have underestimated the amount of tax payable.

The supplier explains the lack of an invoice. According to the new format, the supplier must fill out separate tables if the tax office did not find an invoice in his declaration. The answer depends on whether the supplier acknowledges the invoice or not.

The supplier made a mistake in the details. In the first table, enter information from the invoices in which the inspection found errors into the cells from the request. Fill in the correct values in the “I have” cells. You can clarify the invoice number, date, sales value, transaction code, information about the buyer and intermediary, as well as the section in which the transaction is reflected - 9, 9.1, 10.

The supplier did not provide such a document. In Table 2, fill in the invoice details if you did not issue the document, but the counterparty claimed deductions. When the inspectors receive an explanation, this will mean that the company does not confirm the invoice.

The company did not include the document in the declaration. Give a clarification instead of an explanation.

The declaration violated the control ratios. The company must explain the discrepancies between sections within the declaration. To do this, fill out a separate form.

- In the first column, enter the number of the control ratio.

- The second contains a short text explanation - no more than 1000 characters.

Other explanations. The format now allows you to send any text explanations. There is no need to send them through informal document flow. In this way, the company will be able to respond electronically to any requirements of the VAT return inspection. For example, about benefits, discrepancies with other declarations, etc.

When the company provides explanations on each issue from the requirement, click on the “Control and Submit” button.

The program will check the forms. After that, click on the “Send report” button, then “Sign and send”.

Taxpayers submitting a tax return in electronic form, from January 24, 2017, must also submit explanations to the VAT return only in electronic form in a format approved by the tax authorities. In addition, tax authorities have developed an algorithm for determining the volume of documents required from a taxpayer when conducting a desk tax audit of a VAT return.

If a desk tax audit reveals errors in the tax return (calculation) and (or) contradictions between the information contained in the submitted documents, or reveals inconsistencies between the information provided by the taxpayer, the information contained in the documents available to the tax authority, and received by it during the tax control, the taxpayer is informed about this with the requirement to provide the necessary explanations within five days or make appropriate corrections within the prescribed period. (Clause 3 of Article 88 of the Tax Code of the Russian Federation).

New format of explanations for VAT returns

One of the cases of requesting documents as part of an ongoing desk audit (clause 8.1 of Article 88 of the Tax Code of the Russian Federation) is the identification in the submitted VAT return of a discrepancy between the information about transactions and the information contained in the declaration of another taxpayer. If a company is required to submit a VAT return in electronic form, then explanations to the declaration must also be submitted in electronic form in the format approved by Order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-15/682@ (entered effective January 24, 2017).

This means that starting from January 24, 2017, “paper” explanations for taxpayers reporting electronically are considered unsubmitted with all the ensuing consequences (a fine of 5 thousand rubles - clause 1 of Article 129.1 of the Tax Code of the Russian Federation, and if repeated violation will be subject to a fine of 20 thousand rubles - clause 2 of Article 129.1 of the Tax Code of the Russian Federation).

What is the electronic format? In essence, this is a set of technical requirements for the sent file, which must be provided by the corresponding electronic document management operator.

Algorithm for determining the volume of documents required during a desk audit

During a desk audit, the tax authority has the right to request additional information or documents from the taxpayer if the amount of VAT to be refunded is declared or tax benefits are claimed.

Often, during an audit, tax authorities request a large volume of documents from the taxpayer.

If the inspected person is unable to submit the requested documents within ten days, he, within the day following the day of receipt of the request for the submission of documents, notifies in writing the inspecting officials of the tax authority about the impossibility of submitting documents within the specified time frame, indicating the reasons why the requested documents cannot be submitted within the established time frame and the time period during which the person being inspected can submit the requested documents (clause 3 of Article 93 of the Tax Code of the Russian Federation).

But what if the tax authorities request copies of documents amounting to thousands or millions of sheets?

Let us note that tax legislation is based on the inadmissibility of causing unlawful harm during tax control measures (Article 35 of the Tax Code of the Russian Federation and Article 103 of the Tax Code of the Russian Federation).

And if, when exercising tax control, tax authorities are guided by unreasonable or inappropriate goals and motives, tax control in such cases can turn from a necessary tool of tax policy into a tool for suppressing economic independence and initiative, excessive restrictions on freedom of enterprise and property rights, which, by virtue of Art. 34, 35 and 55 of the Constitution of the Russian Federation is unacceptable. The actions of tax authorities must not violate the rights and freedoms of others. This approach is formulated in the resolution of the Constitutional Court of the Russian Federation dated July 16, 2004 No. 14-P. And a clear indication of this is the dispute considered in the resolution of the Arbitration Court of the North-Western District dated 06/02/2015 No. A13-5629/2014, when, as part of an on-site tax audit, copies of documents were requested from the bank (assignment agreements (cession) with applications, additional agreements, etc.; credit dossiers on borrowers; agreements on collateral, guarantees, letters of credit, and others; information on the assessment of collateral; accounting and tax records (account statements) confirming the issuance of a loan and payment of the loan, interest, penalties on loans issued, etc.).

The taxpayer estimates that the documents requested represent more than 6,260,000 sheets; this number of copies can be produced on 100 printing devices within more than two months; to make such a number of copies, 12,520 reams of paper will be required with a total cost of 1,800,000 rubles, as well as 1,400,000 rubles. for the purchase of consumables (cartridges, rollers, photo drums) and the corresponding costs associated with the complete or partial replacement of copiers due to their accelerated wear, payment of costs for the delivery of copies of documents from separate divisions of the bank and double pay for employees involved in the work overtime and on weekends; the weight of the requested copies will be about 30 tons, and 20 Gazelle vehicles will be required to transport them.

However, the tax inspectorate refused to allow the bank to submit documents confirming the legality of including in expenses reserve amounts for possible losses on loans under loan agreements for the provision of funds to borrowers. The pre-trial appeal of the tax inspectorate's decision did not lead to positive results.

To successfully appeal the decision to refuse to provide documents in court, the bank made the following calculations: the persons conducting the tax audit (four people) do not have the physical ability to study such a volume of documents within the time frame established for the audit: four tax inspectors will need about 90 months to study the required volume of documents (if one employee reads 100 pages per hour, documents can be read within 15,650 hours (6,260,000: 4: 100), which corresponds to more than 1,950 days (8 hours each)).

The judges sided with the taxpayer, noting that the tax audit was carried out on the territory of the bank (clause 1 of Article 89 of the Tax Code of the Russian Federation). The persons conducting the inspection, having familiarized themselves with the original documents submitted for verification, could not have been unaware of the volume of the bank’s document flow.

Also, these persons could not have been unaware of the number of documents requested from the bank.

Taking into account the possible material and time costs of the bank for making copies of documents, which the inspectors could not help but understand, the court considers the requirements to be inconsistent with the goals and objectives of the tax authorities and violating the rights of the applicant (Resolution of the Arbitration Court of the North-Western District dated 02.06.2015 No. A13-5629 /2014).

One of the most frequent requests from tax authorities carried out during a desk tax audit is the request for documents on preferential transactions, which are reflected in the VAT return in section 7 “Transactions not subject to taxation”.

Let us recall that the right to request documents within the framework of a desk tax audit regarding preferential transactions can be exercised by tax authorities in a situation where the applied benefit is intended only for a certain category of persons (clause 14 of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33, Resolutions of the AS of the Ural District dated 02/24/2015 No. A71-6132/2014, dated 02/17/2015 No. A60-21098/2014, dated 05/23/2014 No. A60-32962/2011, decision of the AS of the Primorsky Territory dated 27.01. 2015 No. A51-30238/2014).

Tax officials have proposed an algorithm for determining the volume of documents required from a taxpayer when conducting a desk tax audit of a VAT return (Letter of the Federal Tax Service of the Russian Federation dated January 26, 2017 No. ED-4-15/1281@).

When conducting desk tax audits, tax authorities must take into account a combination of the following factors:

- the level of tax risk assigned by the Risk Management System of JSC NDS-2;

- the result of previous desk tax audits of VAT tax returns on the issue of the legality of taxpayers using tax benefits (Letter of the Federal Tax Service of the Russian Federation dated January 26, 2017 No. ED-4-15/1281@).

The taxpayer being audited is required to provide the tax authority with explanations of the transactions (for each transaction code) for which tax benefits are applied. The taxpayer has the right to submit Explanations in the form of a register of supporting documents (hereinafter referred to as the Register), as well as a list and forms of standard agreements used by the taxpayer when carrying out transactions under the relevant codes.

Register of documents confirming validity

applications ___________________________________

(name of taxpayer)

tax benefits by transaction codes,

to the Value Added Tax Declaration

for ___ quarter ____ year

|

Operation code |

including: |

Amount of non-taxable transactions by types (groups, areas) of non-taxable transactions reflected in the tax return, rub. |

Name of the counterparty (buyer) |

Documents confirming the validity of the application of tax benefits |

|||||

|

type (group, direction) of non-taxable transaction |

Type of document (agreement, etc.) |

Transaction amount, rub. |

|||||||

Based on the information contained in the Register submitted by the taxpayer, the tax authority will request documents confirming the validity of the application of tax benefits (Article 93 of the Tax Code of the Russian Federation).

The volume of documents to be requested is determined for each transaction code in accordance with the algorithm set out in Appendix No. 2 to the letter from the tax authorities. The number of documents required depends on the level of tax risk assigned to the taxpayer according to the RMS ASK “VAT-2”.

For example, with a high tax risk, the volume of documents to be requested from the taxpayer, broken down by transaction codes, is mandatory 40% for each transaction code.

At the same time, at least 50% of the volume of documents subject to request must confirm the largest amounts of transactions for which tax benefits are applied.

Please note that taxpayers are not required to fill out the above Register.

However, if the company does not submit the Register in the recommended form, then the tax authorities will not be able to implement the algorithm proposed in the letter of the Federal Tax Service of the Russian Federation. This means that if the taxpayer fails to submit the Register or if the Register is not submitted in the recommended form, the documents will be requested without using a risk-based approach (i.e. in a continuous manner).

Therefore, companies that have repeatedly submitted “preferential” documents during desk tax audits and have a low level of tax risk, it makes sense to prepare a Register recommended by tax authorities. Indeed, in this case, when conducting a desk audit, fewer documents will need to be submitted to the tax office.

During a desk audit of a VAT return, the Federal Tax Service has the right to demand from the taxpayer an explanation regarding the data reflected in the document. In this article we will talk about how to correctly draw up an explanation to the tax office regarding VAT and submit it to the Federal Tax Service, as well as analyze common mistakes and answer questions on the topic.

When can the Federal Tax Service request clarification on VAT?

The conditions under which the Federal Tax Service has the right to request clarification from the payer on the VAT return are enshrined in current legislative acts. Regulatory documents also regulate the procedure, timing and form of providing a response to a request.

Legislative acts on the topic

The table below shows regulatory documents that establish the rules for sending requests and providing a response to them.

| No. | Regulatory document | Description |

| 1 | Tax Code (clause 3 of Article 88) | The right of Federal Tax Service employees to demand clarification from the payer regarding VAT is enshrined in the provisions of the Tax Code. According to the document, tax authorities can send a request for clarification if discrepancies and contradictions are identified during a desk audit of the declaration. |

| 2 | Order of the Federal Tax Service No. ММВ-7-2/189 dated 05/08/15 | The document approves the form within which tax authorities send a request to the taxpayer. According to the order, the Federal Tax Service sends the request electronically via telecommunication networks. |

| 3 | Order of the Federal Tax Service No. ММВ-7-2/149 dated 04/15/15 | According to the order, the Federal Tax Service may send a request during a desk audit immediately upon detection of discrepancies/contradictions. |

| 4 | FZ-130 dated 05/01/17 | Federal law establishes requirements regarding the form of explanations. From 01/01/17, the response to the request must be provided only in electronic form. |

| 5 | Letter of the Federal Tax Service No. ED-4-15/5752 dated 04/07/15 | In the letter, the Federal Tax Service approves the electronic format of explanations on the following topics:

|

Main reasons for requesting clarification

As we can see, tax authorities have the right to request clarification only in specific cases - when discrepancies, errors, or inaccuracies in the information specified in the declaration are identified. In practice, tax authorities request clarification in the following situations:

- Arithmetic errors were identified in the calculations of the tax amounts indicated in the declaration.

If the declaration incorrectly indicates the amounts of income, expenses, and tax payable, and the error was made as a result of arithmetic calculations, the Federal Tax Service has the right to request clarification in the prescribed manner. Read also the article: → "". - Inconsistencies were found between the indicators reflected in the declaration and the amounts indicated in the supporting documents.

Another common reason for requests is discrepancies between the declaration data and supporting documents. Some information is not included in the sales/purchase book, the amount of the transaction indicated in the declaration is underestimated compared to the invoice - all these facts are grounds for requesting clarification. - Discrepancies were identified regarding cross-checking.

If discrepancies are identified as a result of comparing the declarations of the taxpayer and counterparties, as well as by cross-checking supporting documents, then the Federal Tax Service has the right to demand clarification in the prescribed manner. - The payer submitted an updated declaration, the amount of tax in which was reduced compared to the originally submitted documents. The taxman has the right to request clarification with the calculation and documents on the basis of which the payer reduced the amount of tax liabilities.

In addition to clarifications of the VAT return, tax authorities often make requests to clarify the data specified in the income tax return.

As in the situation with VAT, if a “clarification” is submitted with the tax amount downward, the Federal Tax Service has the right to request explanations and documents. In addition, the Federal Tax Service authorities request justification in case of filing a “unprofitable” declaration. To be fair, we note: if you submitted a “clarification” with a tax reduction or provided a declaration with losses, then the Federal Tax Service will ask you for clarification in almost 100% of cases. The actions of the Federal Tax Service in such situations are simply explained.

Firstly, the losses reflected in the declaration may be fictitious in order to reduce tax liabilities. Therefore, the fiscal service has every reason to request documents confirming income and expenses, as well as request a written explanation from the payer. As for the “clarification” that reduces the tax, tax authorities in this situation also have the right to receive written justifications and documents.

Step 1. Acceptance of a request from the Federal Tax Service

The first step in the procedure for drawing up and sending an explanation is to receive a request from the Federal Tax Service. According to regulatory documents, tax authorities send demands electronically via telecommunications channels. The fact that the request has been accepted is confirmed by a receipt that the taxpayer sends in response to a request from the Federal Tax Service.

Be careful: You must accept the request and send the receipt no later than 6 business days from the date of receipt. That is, if you received a request on 07/17/17 (Monday), then you must accept it and send a response receipt no later than the following Monday (07/24/17). In case of delay, the Federal Tax Service has every reason to block the organization’s bank accounts and prohibit transfers of funds in any form.

Step 2. Clarify the error code

According to current legislation, the Federal Tax Service's request is sent to the taxpayer indicating the code of the identified error. The code is assigned in accordance with the following classification:

- If you identify discrepancies with counterparties, enter error code “1”. A similar classification is applied to errors in cases where:

- the counterparty did not indicate the entry you reflected in the declaration;

- the partner submitted a “zero” declaration, while you provided data on the existence of transactions with the counterparty;

- The supplier/buyer has not provided a declaration, so there is no possibility of data comparison.

- Discrepancies between sections 2 and 3 of the declaration are classified by code “2”.

- If the Federal Tax Service has identified a discrepancy between the data specified in sections 10 and 11 of the declaration, a request with code “3” will be sent to the payer. As a rule, errors with code “3” are associated with the reflection of intermediary transactions.

- If the Federal Tax Service has identified another error that is not subject to the above classification, then the request will be sent with code “4”. In this case, the number of the line in which the discrepancy was detected will be indicated in parentheses.

Step 3. Study of documents and calculations related to the requirement.

After accepting the request and sending the receipt, study the text of the request, and then proceed to analyze the documents and calculations that led to errors and discrepancies. Depending on the text of the request and the specified code, the following actions are possible on the part of the taxpayer:

- If the Federal Tax Service has identified arithmetic errors in determining the amount of tax, it is necessary to conduct an additional recalculation of the amounts in order to confirm the error.

- Let’s say tax authorities have identified discrepancies with counterparties. In this case, the first step will be to request a reconciliation report, the data of which must be compared with the primary documents issued by the counterparty and received from it. Based on the reconciliation, you can either identify your own errors or detect inaccuracies of your partner (the invoice was issued incorrectly, the amount of the transaction in the accounting does not correspond to the primary documents, etc.).

- One of the most common grounds for a request is a discrepancy in the declaration data (information from the purchase book and sales book). To clarify the reasons for the discrepancies, you will need to review the primary documentation and check the correctness of the data entered. The reason for the discrepancies may be an incorrectly entered amount on the document (the amount on the account does not correspond to the data specified in the declaration) or a lack of information on any transaction (the invoice data is not included in the declaration).

Step 4. Compiling a response to the requirement.

After the cause of the error has been identified, write a response to the request in any form, indicating the required details (data of the Federal Tax Service, name and address of the payer). In the explanatory text, provide a clear and concise answer regarding the reasons for the discrepancies. Support the facts specified in the explanation with documents (it is advisable to indicate in the text the numbers of invoices, reconciliation reports, etc.).

Below is an example of a completed explanation.

To the Head of the Federal Tax Service of the Russian Federation No. 34

Tula Sviridov S.D.

from Carnival LLC

TIN 8574123654

Gearbox 412536874

Legal address:

Tula, st. Sadovaya, 4

account number 741368451284125

at Stolichny Bank

c/s 854168451284133

BIC 884411856.

Ref. No. 18-5 from 07/17/17

at the input No. 74/5-15 from 07.12.17

RESPONSE TO DEMAND

about providing explanations

In response to the request for clarification on the VAT return for the 2nd quarter. 2017, we announce the following:

the discrepancy identified in the amount of 124,330 rubles is due to non-operating income received by Carnival LLC in the 2nd quarter. 2017, including:

- 000 rub. – overdue accounts payable including VAT;

- 330 rub. – interest on loans issued.

The amount of non-operating income (RUB 124,330) is reflected in the income tax return for the 2nd quarter. 2017 (Appendix 1 to sheet 02, line 100). According to the Tax Code (clause 3 of Article 149, clause 1 of Article 146), this amount is not taken into account when calculating the VAT tax base, therefore the amount is not reflected in the VAT return.

General Director of Carnival LLC ______________ Serpukhov D.K.

Step 5. Submitting an explanation to the Federal Tax Service.

After the explanation has been drawn up, the response should be submitted to the Federal Tax Service. Due to changes in legislation, from 01/01/17 the response to the request is transmitted only electronically via telecommunication networks. That is, if you received a request after 01/01/17, then you can submit the answer to it only in electronic format through a special communications operator. You must send an explanation no later than 5 days from the date you sent the receipt of its receipt.

Responsibility for failure to provide an explanation

Changes in legislation affected not only the format for providing explanations of discrepancies discovered during a desk audit, but also the liability provided for violating the procedure for providing a response. So, if you violated the deadline for submitting a response (5 days from the date of sending the receipt), then in this situation a fine of 5,000 rubles is provided. If the procedure is violated again within a year, the amount of the fine increases to 20,000 rubles.

A fine will be charged both in case of delay in submitting an explanation, and in a situation where an answer is not provided at all.

Common mistakes when compiling

Below we will look at the most common mistakes made when preparing an explanation for the VAT return.

Mistake #1. The answer is provided on paper.

Before the legislative changes came into force, that is, before 01/01/17, the payer could choose the form of providing a response to the request - electronic or paper. After 01/01/17, the Federal Tax Service accepts only electronic responses; explanations provided on paper are considered invalid.

Mistake #2. The deadline for providing a response expires 5 days after it is sent by the Federal Tax Service.

The reporting point for the response deadline is the day the request was accepted (the day the receipt was sent). That is, from the moment the Federal Tax Service sends the request, the payer is given a maximum of 11 working days to accept it, as well as to draw up and send a response: 6 days - acceptance of the request plus 5 days - sending an explanation.

Mistake #3. The Federal Tax Service sends requests within 30 days from the date of filing the declaration.

Rubric “Question and answer”

Question No. 1. Satellite LLC received a request to explain the errors that led to an understatement of the VAT tax base. After reconciliation of documents and recalculations carried out by Satellite, the presence of an error was confirmed, that is, the company had indeed underestimated the amount of tax payable. How does Satellite need to adjust the tax amount? How to write a correct response to a requirement?

In this case, Satellite must submit an updated tax return indicating the correct amount of tax to be paid. There is no need to provide an explanation for the request. The deadline for submitting a “clarification” is 5 days from the date of sending the receipt of acceptance of the request.

Question No. 2. During the inspection of the Federal Tax Service, discrepancies were identified between the data in the declaration of Kurs LLC and the information provided by the counterparty. 07/12/17 A demand was sent to the “Course”. During the study of documents by the Kurs accountant, it was revealed that the invoice specified in the counterparty’s declaration was not actually issued by Kurs (there is no transaction). How can a Kurs accountant correctly respond to a requirement?

The fact of an unconfirmed transaction must be reflected in the table, the form of which was approved by order of the Federal Tax Service (MMV-7-2/189 dated 05/08/15). The table should indicate the amount of the transaction that is not confirmed, the details of the counterparty (TIN), the date and invoice number.

What has changed since 2017 in the procedure for submitting clarifications on the VAT return to the tax office? How can I submit explanations during a desk audit now? Is it now necessary to transmit explanations electronically? You will find answers to these and other questions, as well as a sample explanation, in this article.

When asked for clarification

After receiving the VAT return, the tax inspectorate may identify with it (clause 3 of Article 88 of the Tax Code of the Russian Federation):

- errors;

- contradictions with documents;

- inconsistencies with information available to the tax inspectorate.

In such a situation, the tax office has the right to request clarification from the organization or individual entrepreneur that submitted the VAT return. For these purposes, tax authorities send a request for clarification (Appendix No. 1 to the order of the Federal Tax Service of Russia dated May 8, 2015 No. ММВ-7-2/189).

How to submit explanations: step-by-step instructions 2017

Let's assume that in 2017 you received a request from tax authorities to provide explanations on your VAT return. Let’s assume that the tax authorities discovered some contradictions in the declaration. How to proceed? We will explain in the instructions and provide a sample explanation.

Step 1. Submit your claim receipt

First, send the tax authorities an electronic receipt of the request for explanations (clause 14 of the Appendix to the Order of the Federal Tax Service of Russia dated April 15, 2015 No. ММВ-7-2/149).

Submit the receipt within six working days from the date of sending the request (clause 5.1, article 23, clause 6, article 6.1 of the Tax Code of the Russian Federation). If the receipt is not submitted within the specified period, then within 10 working days from the date of expiration of the six-day period, tax authorities will have the right to block bank accounts, as well as electronic money transfers (clause 6 of article 6.1, clause 5.1 of article 23, clause 2 clause 3, clause 2 of clause 11 of Article 76 of the Tax Code of the Russian Federation).

Step 2. Deal with the identified contradictions

Find out which of the operations reflected in the declaration the inspection found contradictions (inconsistencies). A list of such operations must be attached to the received request (Appendix to the Letter of the Federal Tax Service of Russia dated November 6, 2015 No. ED-4-15/19395). For each entry in this list, the tax inspectorate indicates for reference one of four possible error codes, the decoding of which is given in the Appendix to the Letter of the Federal Tax Service of Russia dated November 6, 2015 No. ED-4-15/19395.

Step 3: Double-check your VAT return

Double-check the correctness of filling out the VAT tax return for identified inconsistencies. Thus, in particular, it may be necessary to reconcile declaration entries with invoices. Moreover, pay attention to correctly filling in the details of records for which discrepancies have been established: dates, numbers, totals, correct calculation of the amount of VAT depending on the tax rate and the cost of purchases (sales).

Step 4. Submit clarifications or updated declaration

Once you have double-checked your VAT return, you have two options for further action, namely:

- submit to the Federal Tax Service an updated tax return with correct information (if errors are identified and they lead to an understatement of the amount of VAT payable);

- provide explanations to the Federal Tax Service (if the identified errors or contradictions did not affect the VAT amount or if, in your opinion, there were no errors at all).

Explanations or an updated VAT return must be submitted to the tax authorities within five working days from the date of receipt of the request.

Since 2017, explanations are only in electronic form

Since 2017, explanations on the VAT return can be submitted exclusively in electronic form via telecommunication channels through an electronic document management operator. When providing explanations on paper, such explanations are not considered submitted since 2017. That is, submitting explanations “on paper” completely loses all meaning. This is provided for by the new paragraph 4 of paragraph 3 of Article 88 of the Tax Code of the Russian Federation.

Note that until 2017, the Federal Tax Service of Russia believed that explanations for the VAT return can be submitted in free form on paper or in a formalized form via telecommunication channels through an electronic document management operator (Appendix to the Letter of the Federal Tax Service of Russia dated November 6, 2015 No. ED-4 -15/19395). Since 2017, the “paper” option is completely eliminated.

The format of the explanations, which will be intended for the transmission of explanations in 2017, was approved by order of the Federal Tax Service dated December 16, 2016 No. ММВ-7-15/682. (paragraph 4 of paragraph 3 of Article 88 of the Tax Code of the Russian Federation). The Ministry of Justice registered the order on January 13. It came into force 10 days later – January 24, 2017. In this regard, when creating explanations using this format, there may be some peculiarities. However, in general, a sample of explanations on the VAT return, which may need to be submitted to the Federal Tax Service in 2017, may look like this:

New fine from 2017

If, as part of a desk audit of the VAT return, the tax authorities requested clarifications (clause 3 of Article 88 of the Tax Code of the Russian Federation), then they must be submitted within five days. However, previously tax legislation did not contain any liability for failure to comply with the requirement to provide explanations. And some taxpayers simply ignored requests from tax inspectors.

From January 1, 2017 the situation will change. For failure to provide (untimely submission) explanations, a fine of 5,000 rubles was introduced, and for a repeated violation within a calendar year - 20,000 rubles. This is provided for by the new wording of Article 129.1 of the Tax Code of the Russian Federation, which was introduced by paragraph 13 of Article 1 of Federal Law No. 130-FZ dated May 1, 2016.