How to create a company risk register. Risk register project for ABC. A.1 General provisions

Risk accompanies any business activity.

During the implementation of the project, operational activities, investment activities and financial activities are carried out. All types of activities are associated with typical risks of any investment project.

The IP may provide for certain stabilization mechanisms that ensure the protection of IP participants in the event of an unfavorable change in the conditions of its implementation, measures to reduce the level of risks and their compensation. If we are talking about internal risks, then it is possible to reduce the degree of risk itself (due to additional costs for creating reserves and stocks, improving technology and reducing production accidents, due to material incentives to improve product quality, creating reserve capacities, etc.) When implementing IP implementation of IS, it is possible to reduce the degree of risk through financial incentives for IT service workers and other employees involved in working with the new IS, as well as through additional costs for creating reserves and inventories, conducting trial operation of the IS, etc.

The use of any stabilization mechanisms requires additional costs, the amount of which depends on the conditions of the project, the interests of its participants and assessments of the degree of risk. It is necessary to take into account different values of the risk premium depending on the goals of the project and the factors influencing its implementation. The larger the implementation project (for example, a corporate IP implementation project), the higher the level of risk.

All risks associated with the implementation of IP, depending on the sources of occurrence and the possibility of elimination, can be divided into external (objective, systematic, or non-diversifiable) and internal (subjective, non-systematic, or diversifiable).

External and internal risks are interconnected.

External risks do not depend on a specific enterprise or individual entrepreneur. These risks are present at all stages of IP implementation. They arise as a result of external events affecting the market as a whole, affect the income of all enterprises for all individual entrepreneurs and cannot be completely eliminated by diversification.

External risks include: political, legislative, macroeconomic, natural disaster risks (force majeure risks). Country risk is often included in the discount rate to take into account external risks.

Internal risks caused by factors specific to a given enterprise or individual entrepreneur. These risks affect the income of individual enterprises for individual IP and differ at different stages of IP. These can be largely eliminated through diversification.

For IP, specific factors causing internal risks include the following:

exceeding the deadlines for putting the IS into operation and the implementation budget;

a significant increase in the timing of IS implementation;

changes in the need for procurement of software and hardware, lack of human resources, etc.;

interruptions in the supply of purchased hardware, lack of attracted consultants or the level of their competence;

loss of contracts as a result of incorrect debugging or interruptions in the operation of the IS;

accidents and failures in hardware or software, etc.

Based on their structural characteristics, internal risks include:

1 property risks associated with the likelihood of loss of property of an enterprise or individual entrepreneur for various reasons (due to theft, fire, negligence);

2 production risks associated with losses due to production stoppages due to the influence of various factors, and above all damage to fixed and working capital, as well as risks associated with the introduction of new equipment and new technologies into production (for example, the introduction of new IP);

3 commercial risks associated with losses due to delays in payments, refusal to pay during the transportation of goods, non-delivery of raw materials and components or their delivery deviation from the planned terms, etc.;

commercial risks associated with losses due to delays in payments, refusal to pay during the transportation of goods, non-delivery of raw materials and components or their delivery deviation from the planned terms, etc.;

4 financial risks associated with the likelihood of loss of financial resources due to irrational investment of capital.

At different phases of IP implementation, various internal risks occur.

Let's look at typical errors that occur at the decision-making stage on the implementation of IP.

1 Weak development of the automation strategy (the enterprise lacks a holistic long-term IT strategy that corresponds to the scale and growth rate of its business).

2 Passion for fashion trends in relation to certain products when choosing IP.

3 Search for an ideal that perfectly meets the specifics of the enterprise.

4 Lobbying for the implementation of IS by one of the divisions of the enterprise - the consequence may be a discrepancy between the system and the needs of other key divisions.

5 Incorrect preparation of the tender task - the task is drawn up not according to the key requirements for IP, but by simply collecting and summarizing applications from all departments. This approach, as a rule, takes into account only the current requirements of departments, and not the strategic goals of the company as a whole.

The most common mistake when choosing IP is a passion for the technical side of the matter to the detriment of functional expediency, dictated by the final goals of implementation. To ensure that the assessment is not one-sided, it is necessary from the very beginning to involve employees of “subject” departments, as well as senior management of the company, in the selection of the system.

At the implementation stage The most serious risks of the project are the following.

1 Unpreparedness of the enterprise's top management for changes in the enterprise's business processes and organizational structure.

2 Unsuccessful selection of external consultants for the project (based on the principle of minimum cost or based on partnerships with a specific software supplier). When choosing a project executor - consultant, the following criteria must be observed: professionalism, reliability and predictability of results.

3 The influence of the human factor in the process of project implementation (changes in technology, work regulations and formats, the need to take into account the reaction of employees to implementation).

4 Delegation of key management and executive powers to the IT department. The project team must include key employees from all “subject” departments, who will then work with the implemented system.

It should be noted that recommendations for overcoming difficulties in the implementation and operation of information systems should be developed based on the specifics of the activities of a particular enterprise. First of all, the management of the enterprise and the IT service must realize that in the future the enterprise will have to make constant efforts to improve the information system. The transition from the “design mode” of operation to the improvement and modification phase represents a significant problem for some enterprises, the solution of which requires careful study and planning. An important task in risk research is to determine the stage at which a particular risk is more likely to occur.

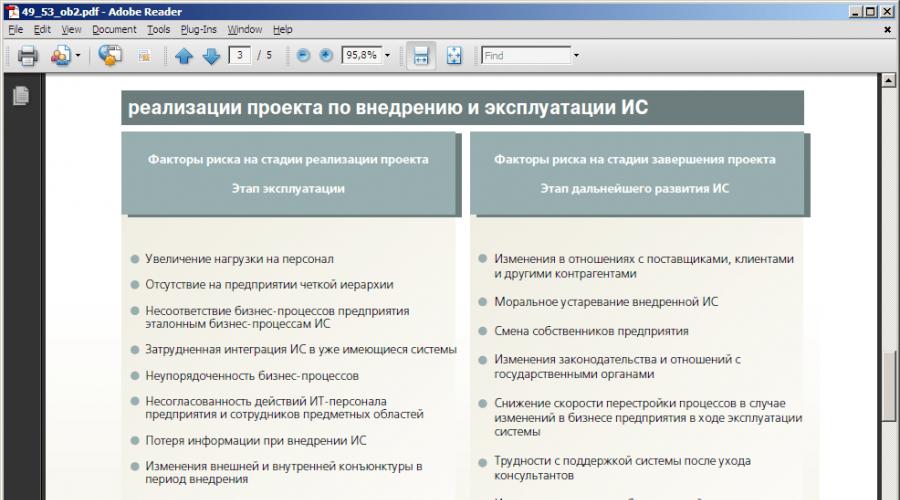

At the implementation stage the risks inherent in the previous stages of the project, the so-called production risks, begin to fully manifest themselves. To these are also added “end-to-end” risks that occur at almost every stage of the project. Cross-cutting risks include, first of all, internal political risks - often an IP implementation project serves as a lever for political struggle in an enterprise. If the project affects the sphere of vital interests of large teams and senior managers who control property, commodity and cash flows, then even with ideal planning and organization of implementation, significant problems may arise.

There is also end-to-end risk associated with the distribution of workload between the client and the consultant. The share of work performed by consultants should decrease during the course of the project, otherwise the customer enterprise will have difficulties in further operating the IS without consultants. The project may also develop poorly due to the influence of the human factor (staff resistance, psychological fatigue from the project), as well as due to ineffective communications established within the enterprise.

Rejection of the project by staff, as a rule, arises due to a lack of information: the management of the enterprise is not aware of what the project team is doing, and employees do not see the point in implementation at all. Timely and regular explanatory work, which should be the responsibility of the project team members, can overcome the negative attitude of staff.

After completion of the project, long-term risks begin to appear that impede the effective use and further development of IP in the enterprise. The main long-term risks arise from inadequate support for external and internal changes. An important long-term risk is associated with the human factor - the end of consultants' participation in the project. In addition, there is a risk of information security violation - a possible leak of commercial information from the company.

Leadership among long-term risks (both in terms of the severity of damage and the complexity of minimization) belongs to factors associated with the reorganization of the enterprise, as well as the loss of flexibility of business processes.

However, long-term risks have a minor impact on the IS life cycle. First of all, competent planning and successful implementation of IS is necessary.

The point of describing the risks of IT projects is to identify these risks in advance and carry out a set of preventive measures before the start of the project. It is advisable to divide the main activities aimed at preventing the occurrence of risk situations in IT projects:

1 mandatory documentation of the project’s goals, as well as all changes in the project documentation that arise during its implementation;

2 increasing employee motivation through financial incentives;

3 attraction of third-party qualified specialists;

4 training team members and senior management of the enterprise in project management methodology, etc.

Among the risks characteristic of all IP implementation, the following can be identified:

1 design risks when creating a system (incorporated during the design of the IS);

2 organizational risks (including the impact of the human factor on the process of implementation and operation of the IS, as a result - incorrect interpretation of data processed using the IS);

3 technical risks consisting of downtime, failures, loss or corruption of data, etc.;

4 risks of business losses (business risks) associated with the operation of the system (arising as a result of technical risks).

Project risks appear at the design or delivery stage of the IP. These may include, for example, the risk of obsolescence of certain software or technical solutions, as well as the risks of delays in the delivery of IS components. However, taking into account the relatively short period of time required for the delivery and implementation of an IS, as well as the conditions for the implementation of such projects, where, as a rule, all issues related to delivery and implementation are resolved by one supplier company, the likelihood of such risks is low.

The cost of organizational risks can be assessed through expert analysis. Many of the organizational risks, with a sufficient probability of occurrence, can reduce the entire effect of automation to zero or even reveal harm from automation, so their analysis must be approached with particular care.

The most obvious organizational risks include the following.

1 Sabotage of personnel. This risk negates all efforts to implement IP. It can arise for many reasons: for example, fear of losing a job due to a planned staff reduction, the desire to hide the real results of the work of a particular employee, to avoid identifying incompetence, etc.

2 Erroneous conclusions drawn based on the analysis of data obtained as a result of the operation of the IS, i.e. incorrect interpretation of data processed in the IS.

3 Transfer of information accumulated in the system to competitors as a result of theft or betrayal by personnel, etc.

The planned work of the enterprise IT service, as well as the strategic development and planning department, should include the development of recommendations for reducing the risks of the IS implementation project. It is also necessary to conduct trial operation of the IS, work with qualified consultants and reliable equipment suppliers, and include additional payments to employees involved in working with the IS in the preliminary cost estimate for the IS implementation project. Important factors for minimizing risks are also: the attentive attitude of top management to IP implementation of IP and the preliminary development of the overall enterprise automation strategy

At the moment, there is no unified classification of enterprise project risks. However, we can highlight the following main risks inherent in the project of opening and developing a corporate training center.

Since it is inappropriate to consider all the risks of creating software at this stage of opening an “It - progress” enterprise, it is necessary to analyze the risks of opening an enterprise engaged in the development and sale of software.

Table 2.1 - Risks of opening a software development enterprise

|

Type of risk |

Risk factors |

Possible reasons |

Likely consequences |

|

Risk of increasing the estimated cost of the project |

Design errors; Inefficient use of resources; Changes in project implementation conditions. |

Insufficient development of the project Inconsistency of work on project implementation Changes in legislation in the software project development industry. |

Loss of revenue |

|

Risk of poor quality of work of the project facility |

Mistakes when planning a project; Design errors; Violation of obligations by the contractor and suppliers. |

Technical impossibility of producing the products necessary for the enterprise; |

Increase in project cost Loss of revenue |

|

Scientific and technical risk: |

Negative results of fundamental and applied research; |

Low technological production capabilities. Inconsistency of personnel with the professional requirements of the project Deviations in the timing of implementation of design stages; The emergence of unforeseen scientific and technical problems. |

Increase in project cost Loss of revenue |

|

Project legal risks |

Wrong choice of territorial markets for patent protection; Insufficiently “dense” patent protection; Failure to obtain or delay patent protection; Limitations on the duration of patent protection; Expiration of licenses for certain types of activities; - “leakage” of individual technical solutions; The emergence of patent-protected competitors. |

Imperfection of the legal system (lack of sufficient legal regulation, inconsistency of legislation, its susceptibility to change, The impossibility of resolving certain issues through negotiations and, as a result, the organization turning to the judicial authorities to resolve them; Violations of contract terms by clients and counterparties of the organization; |

Increasing the payback period of the project Loss of revenue |

Continuation of Table 2.1

|

Type of risk |

Risk factors |

Possible reasons |

Likely consequences |

|

Risks of a commercial offer |

Inconsistency of the company's market strategy with existing conditions; Lack of suppliers of necessary resources and components; Failure of suppliers to fulfill their obligations regarding the timing and quality of deliveries. |

Refusal of traditional suppliers to enter into contracts; Unacceptable contract terms (including prices) for the enterprise; Transition of traditional suppliers to produce other products; Impossibility of purchasing on the world market due to the complexity of customs legislation and lack of currency |

Increase in project cost Increasing the payback period of the project Loss of revenue Breach of contractual obligations |

|

Marketing risk |

Decrease in sales volume Product price reduction |

Insufficient study of market needs Market rejection of a new product Overly optimistic estimate of future sales Lack of the necessary traditions and systems for continuous forecasting of the market environment at the enterprise; Inability to carry out market monitoring; Lack of an effective methodology for predicting the behavior of market entities, as well as meso- and macroeconomic factors. |

Increase in project cost Increasing the payback period of the project Loss of revenue |

|

Economic risk |

General decline in the state's economy; Inflation rate; Changes in taxes, tax payments; Changes in currency exchange rates; Changes in the economic conditions of the project. |

Increase in tax rates Increase in cost and price in the domestic market |

Increase in project cost Increasing the payback period of the project Loss of revenue |

The Liask-T LLC company is an official dealer of leading manufacturers: Danfoss, Grundfos, Ridan. DANFOSS - automation for heat supply systems, pipeline fittings, thermostats. GRUNDFOS - pumping equipment. RIDAN - plate heat exchangers.

Liask-t LLC is a dealer, namely a market participant, carrying out trading activities on its own behalf and at its own expense. The most important feature of a trading and intermediary enterprise is a high degree of turnover, that is, the movement of goods in the sphere of circulation and sales.

Risk is the possibility of the occurrence of any event that, if realized, would have a negative impact on the company’s achievement of its long-term and short-term goals.

At the Liask-T LLC enterprise, the logistics risk assessment is carried out by the head of the logistics department.

The main goal of the head of the logistics department is to combat the negative consequences of risks, that is, to reduce losses from logistics activities at the Liask-T LLC enterprise and, if possible, to increase positive risk, that is, profit. Decisions on specific actions to protect and reduce (increase) risk can only be detailed through careful study and analysis of risk situations that are possible in the future and present.

The entire risk analysis process can be divided into eight stages that help manage risk (reduce its negative consequences).

Let's consider the content of all stages.

1. Risk identification

This stage of logistics risk analysis consists of generating a complete list of adverse events.

When identifying risks, you can obtain both a qualitative and quantitative risk assessment.

To perform these tasks, at the first stage of analysis it is necessary to use all types of risks. Because they all have a certain degree of influence on each other.

At the Liask-T LLC enterprise, risks can be presented in the form of Table 1.

Table 1. Morphological table of logistics risks of the enterprise Liask-T LLC

| Sign | Type of risk |

| 1. Organizational | 1.1 Risks associated with supplier errors, errors of the logistics manager of Liask-T LLC, as well as errors of employees of outsourcing companies. Financial risks examined using the example of Euroceramics LLC1.2 Risks associated with the internal organization of the company’s work |

| 2. Market | 2.1 Risks of decreased demand for products 2.2 Risk of loss of liquidity |

| 3. Entrepreneurial (commercial) | 3.1 Risk associated with acceptance; 3.2 Risk associated with the sale of goods; 3.3 Risk associated with transportation of goods 3.4 Risk of decreased profit; 3.5 Risk of decrease in trade turnover; 3.6 Risk of increasing purchase (wholesale) prices; 3.7 Risk of rising commodity and transport costs; |

| 4. Credit | 4.1 The risk that the counterparty will not fulfill its obligations on time (violation of contractual terms for payment); 4.2 Risks associated with payment terms; |

| 5. Technical | 5.1 Risk of fires, accidents and breakdowns, suspension of network operation. 5.2 Force majeure; |

| 6. Technical and technological | 6.1 Risk associated with breakdown of computer equipment and other equipment with the help of which part of the logistics functions is carried out. |

Figure 1. Morphological chain of risks at the Liask-T LLC enterprise.

The morphological chain presented above shows the influence of risks on each other. By identifying one risk, it is easier to identify other risks that result from it.

For example, if we consider the morphological chain, we can see that “the risk of fires, accidents and breakdowns, suspension of network operation” leads to the emergence of such risks as:

risk associated with acceptance;

risk associated with the sale of goods;

risk associated with transportation of goods;

risks associated with supplier errors, errors of the logistics manager of Liask-T LLC, as well as errors of employees of outsourcing companies.

Next, we highlight logistics risks. Logistics risks are the risks of performing logistics operations of transportation, warehousing, cargo processing and inventory management and the risks of logistics management at all levels, including management risks that arise when performing logistics functions and operations.

In order to identify all logistics risks, the logistician of the Liask-T LLC enterprise needs to identify job responsibilities. These include:

ordering equipment;

planning and coordination of shipment schedules from suppliers; optimization of schemes;

calculation of delivery times and costs;

selection of a carrier and optimal vehicle;

search for new carriers, preparation and conclusion of contracts, preparation of accompanying documents, transportation insurance;

preparation of documentation for the production of certificates;

settlement of controversial issues, work with claims;

control of warehouse operations;

optimization of warehouse stock;

control of completeness and readiness of orders for shipment;

carrying out inventories.

2. Assessing the likelihood of adverse events occurring

3. Determination of the structure of the expected damage

4. Construction of damage distribution laws.

5. Risk assessment

6. Identification and assessment of the effectiveness of possible risk reduction methods

Such methods are divided into groups:

- methods that help avoid risk;

- methods that reduce the likelihood of an adverse event occurring;

- methods that reduce possible damage;

- methods, the essence of which is to transfer risk to other objects;

- methods that are based on compensation for damage received or caused.

7. Deciding on the list of risk management actions

8. Monitoring the effectiveness and results of implementing risk reduction measures.

So, each logistics subsystem of Liask-T LLC can identify its own risks, examples of which we will consider in the table below.

Table 2. Morphological table of logistics risks of the enterprise Liask-T LLC

| Name of logistics subsystems | Risk | Option to solve the problem |

| Procurement | Inconsistency between the price and the quality of the product. Increased costs for the purchase of 1 batch of goods | Functional and price analysis. Compliance with budget restrictions. Optimization (Pareto) of transaction conditions |

| Transportation | Increased transport costs Violation of the delivery schedule. Loss of property | Optimization of routes Dispatching. Property protection. Property insurance. Liability Insurance |

| Storage | Immobilization of material resources. Loss (theft) of property | Inventory Management. Property protection. Fire prevention measures. Property insurance |

| Logistics | Imbalance (discrepancy between the volume of supplies and needs) Inconsistency in the quality of material resources. Situations of shortage. Excessive inventories and illiquid assets | Rationing the consumption of material resources. Incoming control. Inventory management. Operational procurement. Inventory management. Just-in-time deliveries |

Let's look at each of these subsystems.

Based on the invoices issued by the supplier, the responsible logistician checks the correctness of the invoicing by the supplier, as well as the compliance of the supplier’s invoice with the organization’s pricing policy. It is important to check the discounts offered.

Liask-T LLC is an intermediary, which means shortages, mis-grading, and goods of poor quality are what a company may encounter when working with a supplier. If such situations arise, the company's logisticians should write official letters requesting an inventory at the supplier's warehouse, as well as delivery of goods as soon as possible and at the expense of the supplier. If customers impose penalties on Liask-T LLC for failure to meet delivery deadlines, the company has the right to contact the supplier company in writing with a demand for compensation for damages.

Storage:

The warehouse complex of the company Liask-T LLC allows you to place cargo for both short-term and long-term storage periods.

For such a retail warehouse, goods are placed according to size groupings on racks. The warehouse of Liask-T LLC has sections for large and small goods. Different products require different ratios of the numbers of small, medium and large cells in the warehouse, and different cell sizes in depth.

Since 2013, a new system of targeted placement of goods has been introduced into the warehouse, which will avoid loss of goods, mis-grading and losses. This is important to ensure an increase in turnover, eliminate errors in the placement of goods and quickly find them even for new employees after a short briefing. Each storage location will be assigned a code (address) indicating the rack (stack) number, vertical section number and shelf number. When issuing documents for shipment or acceptance of goods, the invoice will indicate the place where the goods should be placed.

In order for all goods to reach your address safe and sound, you should carefully consider the choice of packaging. Packaging materials can be presented in a variety of types: wooden boxes and pallets, plastic containers, cloth bags, plastic rolls and much more. In each specific case, you should choose the appropriate packaging based on the characteristics of the cargo itself and the type of its transportation.

The most important need is inventory in the warehouse:

The main objectives of inventory are:

- identification of the actual availability of property;

- control over the safety of inventory items by comparing actual availability with accounting data;

- identification of inventory items that have lost their original qualities, are stale and not needed by the organization;

- checking compliance with the rules and conditions of storage of inventory items.

Transportation:

The company Liask-T LLC often uses the services of third-party organizations, namely, it shifts the transportation of goods from Omsk to other cities of Russia to transport companies. Using outsourcing services, you may face the risk of delays in delivery times, loss of goods in transit, as well as their damage during transportation or transshipment. To avoid the above consequences, it is necessary to use the services of insurance of goods against damage, loss and damage. For example, when drawing up rational routes, they take into account not only the location of loading and unloading points in the transportation area, but also the type of goods transported, the type of transport used for transportation, work shifts, and the remoteness of motor transport enterprises. Therefore, the company Liask-T LLC has preferences in using the services of transport companies. So, each TC has its own pros and cons.

Conditions by which TC is selected:

- Geography of presence;

- Cost and delivery time of cargo

- Optimization in terms of terms, rates and service

- Picking up cargo on time;

- Cargo pickup on the day of treatment;

- Daily dispatches to any direction;

- Internal cargo recalculation;

- 24/7 tracking of cargo in transit.

- Possibility of “SMS” notification about the location of the cargo;

- Possibility of delivering and receiving cargo on weekends;

- Suspension of delivery services, change in direction of movement, return;

- Availability of official state registration;

- Availability of a license to provide transport services in accordance with the legislation of the Russian Federation;

- Experience in the field of cargo transportation;

- Availability of a standard agreement, the possibility of drawing up additional agreements;

- Availability of an insurance policy for the transport company;

- Good dispatch service;

- Availability of an official website;

- Regularity of flights, etc.;

Each of these conditions must be taken into account in order to eliminate all logistics and other risks arising from them.

When calculating the timing and cost of equipment delivery, the logistician of the Liask-T LLC company must take into account all the conditions. For example, without knowing the delivery dates for equipment, a logistician can indicate a delivery amount of 1000 USD, counting on one delivery, but in fact, the equipment can be delivered in several stages and the cost of its delivery will be significantly higher than the stipulated amount.

Logistics:

To successfully carry out business activities, an enterprise must have a sufficient minimum of its own working capital. The financial position of enterprises largely depends on the state of their own working capital, their safety and proper use.

The risks of inventory management at this enterprise are quite high, since it is the level of inventory that is the main reason for satisfying customer demand. If an enterprise, without forecasting demand, replenishes its warehouse stock, it will be faced with the fact that it will spend money on unsold goods, which in the future can go into the illiquid group. When an enterprise reduces the risk of a shortage of material resources, it tries to increase the level of inventories, but inventories can play a negative role in the enterprise, freezing the financial resources of business organizations in large volumes of inventory items.

Lack of funds is fraught with a decrease in trade turnover and the emergence of debts to suppliers and banks for loans. As a consequence, these debts carry with them the risk of delayed shipments, increased delivery times, and further down the chain the same penalties for untimely delivery of goods to the client.

In order to replenish inventory, a trading enterprise resorts to loans, which means it increases its overall risk. After all, many large client companies purchase goods under a contract based on payment after delivery. This means that the company Liask-T LLC is forced to take out a loan in case of a lack of its own financial resources to purchase the required batch of goods.

As a result, an increase in accounts payable leads to the fact that the company will constantly divert funds from circulation to pay interest on the loan and fines. The enterprise may not have sufficient funds to purchase the quantity of goods corresponding to demand. And this leads to a decrease in trade turnover, and, therefore, profit, and so on along the chain. Lack of necessary goods in stock provokes lost profits.

In order to maintain the company’s own working capital, the logistician needs to predict the warehouse stock, using, for example, economic and mathematical methods and models.

When forecasting demand for durable goods, one cannot do without data on their actual consumption during the analyzed period and without the actual availability of these goods among the population, as well as the patterns of their retirement from use.

So, for example, at the supplier of the company Liask-T LLC, one pumping equipment can be replaced with another more energy-efficient one, the price of which is lower than that of the first.

By examining all the logistics risks inherent in this type of enterprise, the Liask-T LLC company has the opportunity to protect itself from negative consequences at all stages, namely at the stage of supply, transportation and sales.

Enterprise risk factors

The essence of enterprise risk

The activities of any enterprise involve a corresponding set of risks that are specific to a certain type of activity. For this reason, it is customary to first determine the specifics of the company’s activities, which helps determine the types of risks that are inherent in this activity.

All the risks that risk managers face in their work are very diverse, which is characterized by the reasons for the occurrence of risk situations. In this case, the degree of importance of the causes of risks implies an equal degree of significance of the occurrence of risks, so some risks require more careful attention.

The risk factors of an enterprise can relate to any area of its activity, they can be light or have a destructive nature. Risks of a destructive nature must be predicted and taken into account. Mild risk can be everyday in nature without requiring significant investment of time or resources.

Risk factors for banking organizations

The most pressing problem of commercial banks in our country is the management of credit risks, which account for more than 50% of the total risks of banking activities.

The next risk in terms of the degree of influence on banking activities can be called operational risk, since the banking system is currently developing with its transition to electronic communications. Taking this into account, we can note the high degree of influence of market risk on banking activities, since all banking operations belong to the corresponding market categories (exchange rate, level of interest rates, etc.).

There are a number of risks that do not have a great impact on the implementation of banking activities, but which should be taken into account.

Risk management in a company using the example of a company

These risks include liquidity risk monitored by banks.

Comparing the risk factors of an enterprise and the risk factors of banking organizations, it should be noted that internal risks (for example, technical, production) have a significant impact on the enterprise. The enterprise's risk factors are less influenced by the market or external markets in comparison.

Enterprise risk factors

Risks of a manufacturing enterprise are closely related to the risks of other types of business. A lower share of operational risks is typical for the activities of enterprises, while the activities of banks, insurance companies and professional market participants are subject to greater risks. Operational risks that threaten enterprises are not able to directly influence the risks that threaten other areas of business.

The main and highest priority activity of any enterprise is the search for options for minimizing production and technical risks, which are the basis of the operational risks of insurance companies. This happens because many enterprises strive to reduce part of the risk and shift it to third parties (for example, an insurance company).

If a company is not involved in foreign economic activity and is not active in the securities markets, then it is not exposed to a significant share of market risks (for example, currency or interest rates).

Types of factors

Enterprise risk factors can be classified into external and internal factors. Risk factors of an enterprise of an internal nature may include factors of direct and indirect impact.

In turn, internal factors include:

- Low quality of management,

- Errors in the overall strategy of the enterprise,

- Wrong sales strategy

- Financial difficulties,

- Temporary suspension of the company's activities,

- High level of production costs,

- Low qualifications of employees, etc.

Enterprise risk factors also include risks associated with commerce, entrepreneurship, investments, logistics, production risks, credit, personnel and sales risks.

Examples of problem solving

Subject:“Property risks at the enterprise OJSC Saturn”

Introduction……………………………………………………………………………….…..….3

1.Theoretical basis of financial risk management in

enterprise……………………………………………………………………………….….5

1.1. The essence of business risk…………………………………….5

1.2. Definition of business risk……………………………8

1.3. Classification of business risks…………………………..…12

1.4. Risk functions………………………………………………………………..17

1.5. Risk factors………………………………………………………………………………19

1.6. Risk indicators and methods for assessing them…………………………………….. 24

2. Analysis and assessment of the enterprise’s activities……………………………………28

2.1. Organizational and economic characteristics of OJSC “Saturn”…………..28

2.2. Factors of the macro- and microenvironment of the enterprise…………………………………35

2.3. Financial result of the activities of OJSC “Saturn”………………………..42

3. Identification of risks of OJSC “Saturn”………………………………………………………44

3.1. Property risks……………………………………………………….44

3.2. Measures to eliminate the influence of property risks in OJSC

“Saturn”………………………………………………………………………………………59

Conclusion…………………………………………………………………………………..60

References………………………………………………………………………………….61

Applications………………………………………………………………………………….63

Introduction.

Risk is inherent in any sphere of human activity, as it is associated with many conditions and factors that influence the positive outcome of decisions made by people. Any action we take that affects the future has an uncertain outcome. When we transfer money to our account, we do not know what its purchasing power will be at the moment when we want to use it. The future value of shares purchased today is unknown, the cost of the specialty that a student studying at a university wants to obtain is unknown. So, when people are uncertain about the future, they are said to take risks. There are many risk factors in everyday life - the risk of getting into a car accident, the risk of being robbed or getting sick. Risk is a part of life. And no genius, no human ability can eliminate it. People can only partially protect themselves from the consequences of such events by reducing risk, for example by pooling it in the form of insurance.

As we can see, the concept of risk occurs most often when it comes to money and human well-being. Therefore, with the emergence and development of capitalist relations, various theories and sections of risk appear. Thus, financial risk became the founder of an independent discipline in economic theory called risk management.

Until the end of the 80s, the Russian economy was characterized by fairly stable rates of development. The first signs of the crisis were negative processes in the investment sphere (a decrease in the input of fixed production assets), which resulted in a decrease in the volume of national income produced, industrial and agricultural products. Ultimately, it was the incorrect assessment of financial risks that led to the crisis of August 17, 1998.

Today, in our country, with a transitional economy experiencing a crisis, correct risk analysis is extremely important. Thus, in the current economic situation, the problems of economic uncertainty and risk should be approached more thoroughly.

Being social in nature, entrepreneurial activity is aimed at meeting social needs. But the entrepreneur does not take on property risks for charitable reasons. Material interest expressed in income is an incentive for entrepreneurial activity. It should, however, be borne in mind that not every income is the result of entrepreneurship. It appears as such only when it appears to be the result of better use of factors of production. Therefore, various types of rental income and interest on capital cannot be considered as income from business. In reality, entrepreneurial income is represented in the form of economic profit, which is a direct form of motivation for entrepreneurship. What is the goal of an entrepreneur?

The relevance of the chosen topic is that in conditions of market relations, the development and practical use of methods for assessing the effectiveness of financial and economic activities and the level of risks of enterprises become especially important

The object of the study is OJSC Saturn as a business entity.

The purpose of the work is to study the relationship between risk, entrepreneurship and profitability.

In accordance with the goal, the following tasks were set and solved:

- study of theoretical issues related to risk, entrepreneurship and profitability;

- analysis and assessment of the enterprise’s activities using the example of OJSC Saturn and its business;

- identification of measures to achieve effective results of the activities of OJSC Saturn.

1. Theoretical foundations for managing business risks in an enterprise

RISK IDENTIFICATION MODEL USING THE EXAMPLE OF A MANUFACTURING ENTERPRISE

The essence of business risk

It is legally established that entrepreneurial activity is risky, i.e. the actions of business participants in the conditions of existing market relations, competition, and the functioning of the entire system of economic laws cannot be calculated and implemented with complete certainty. Many business decisions have to be made under conditions of uncertainty, when it is necessary to choose a course of action from several possible options, the implementation of which is difficult to predict.

The development experience of all countries shows that ignoring or underestimating economic risk when developing tactics and strategies for economic policy and making specific decisions inevitably hinders the development of society, scientific and technological progress, and dooms the economic system to stagnation. The emergence of interest in the manifestation of risk in economic activity is associated with the implementation of economic reform in Russia. The economic environment is becoming more and more market-oriented, introducing additional elements of uncertainty into business activities, and expanding areas of risk situations. Under these conditions, ambiguity and uncertainty arise in obtaining the expected final result, and, consequently, the degree of entrepreneurial risk increases.

The economic transformations taking place in Russia are characterized by an increase in the number of business structures and the creation of a number of new market instruments. In connection with the processes of demonopolization and privatization, the state rightfully abandoned the role of the sole bearer of risk, shifting all responsibility to business structures. However, a large number of entrepreneurs start their own business under the most unfavorable conditions. The growing crisis of the Russian economy is one of the reasons for increasing business risk, which leads to an increase in the number of unprofitable enterprises.

A significant increase in the number of unprofitable enterprises allows us to conclude that it is impossible not to take into account the risk factor in business activity; without this, it is difficult to obtain operating results that are adequate to real conditions. It is impossible to create an effective mechanism for the functioning of an enterprise based on the concept of risk-free management.

Risk is an objectively inevitable element of making any business decision due to the fact that uncertainty is an inevitable characteristic of business conditions. In the economic literature, there is often no distinction made between the concepts of “risk” and “uncertainty”. They should be differentiated. In fact, the first characterizes a situation when the occurrence of unknown events is very likely and can be assessed quantitatively, and the second - when the probability of the occurrence of such events cannot be assessed in advance. In a real situation, a decision made by an entrepreneur almost always involves risk, which is due to the presence of a number of unforeseen uncertainties.

It should be noted that an entrepreneur has the right to partially shift the risk to other economic entities, but he cannot completely avoid it. It is rightly believed that those who do not take risks do not win. In other words, to obtain economic profit, an entrepreneur must consciously make a risky decision.

It’s safe to say: uncertainty and risk in business play a very important role, containing a contradiction between the planned and the actual, i.e. source of business development. Business risk has an objective basis due to the uncertainty of the external environment in relation to the company. The external environment includes objective economic, social and political conditions within which the company operates and to the dynamics of which it is forced to adapt. The uncertainty of the situation is predetermined by the fact that it depends on many variables, counterparties and individuals, whose behavior cannot always be predicted with acceptable accuracy. It also affects the lack of clarity in defining goals, criteria and indicators for their assessment (shifts in social needs and consumer demand, the emergence of technical and technological innovations, changes in market conditions, unpredictable natural phenomena).

Entrepreneurship is always associated with uncertainty in the economic environment, which stems from the variability of supply and demand for goods, money, factors of production, from the variety of areas for applying capital and the variety of criteria for the preference of investing funds, from limited knowledge about the areas of business and commerce, and many other circumstances.

The economic behavior of an entrepreneur in market relations is based on an individual program of entrepreneurial activity that is chosen, implemented at one’s own risk, within the framework of opportunities that arise from legislative acts. Each participant in market relations is initially deprived of pre-known, clearly defined parameters, guarantees of success: a secured share of participation in the market, access to production resources at fixed prices, the stability of the purchasing power of monetary units, the immutability of norms and regulations and other instruments of economic management.

The presence of entrepreneurial risk is, in fact, the flip side of economic freedom, a kind of payment for it. The freedom of one entrepreneur is simultaneously accompanied by the freedom of other entrepreneurs, therefore, as market relations develop in our country, uncertainty and entrepreneurial risk will increase.

It is impossible to eliminate the uncertainty of the future in entrepreneurial activity, since it is an element of objective reality. Risk is inherent in entrepreneurship and is an integral part of its economic life. Until now, we have paid attention only to the objective side of entrepreneurial risk. Indeed, risk is associated with real processes in the economy. The objectivity of risk is associated with the presence of factors, the existence of which ultimately does not depend on the actions of entrepreneurs.

The perception of risk depends on each individual person with his character, mentality, psychological characteristics, and level of knowledge in his field of activity. For one entrepreneur, this amount of risk is acceptable, while for another it is unacceptable.

Currently, two forms of entrepreneurship can be distinguished. First of all, these are commercial organizations based on old economic ties. In a situation of uncertainty, such entrepreneurs try to avoid risk, trying to adapt to changing business conditions. The second form is newly created entrepreneurial structures, characterized by developed horizontal connections and broad specialization. Such entrepreneurs are ready to take risks; in a risky situation, they maneuver resources and are able to very quickly find new partners.

1.2. Definition of risk

The concept of risk is used in a number of sciences. Law considers risk in connection with its legality. Catastrophe theory uses this term to describe accidents and natural disasters. Research on risk analysis can be found in the literature on psychology, medicine, philosophy; in each of them, the study of risk is based on the subject of research of this science and, naturally, relies on its own approaches and methods. This variety of areas of risk research is explained by the multifaceted nature of this phenomenon.

In domestic economic science, there are essentially no generally accepted theoretical provisions on business risk; in fact, methods for assessing risk in relation to certain production situations and types of business activity have not been developed; there are no recommendations on ways and means of reducing and preventing risk. Although it should be noted that in recent years, scientific works have appeared in which, when considering issues of planning, economic activity of commercial organizations, the relationship between supply and demand, risk issues are addressed, such as: “Risks in modern business” (team of authors); monograph by Raizberg B.G. “ABC of Entrepreneurship”; monograph by Pervozvansky A.A. and Pervozvanskaya T.N. "Financial market: calculation and risk."

Pages:123456789next →

Risks when starting a business

Opening an entrepreneurial business carries with it not only potential profits, but also the risk of losing the funds invested in this business. It's funny, but many aspiring entrepreneurs don't know where to start their business. And at the same time, it can be noted that, according to unspoken statistics, only those who initially focus primarily on survival and only then on profit survive.

When starting a business, there are many different risks and there are quite a lot of options for how you can lose money. These can be both business risks and non-systemic ones, that is, difficult to predict. In the first case, the entrepreneur is faced with the fact that his products may not be in demand, or the costs will be higher than the potential profit, and then he will have to raise prices for goods so much that the business will become uncompetitive and it will either have to be sold or simply closed without hope for the possible restoration, regardless of a change of owner, which is also possible.

Commercial risks of an enterprise: solving the problem in three steps

Among the unpredictable risks there can be anything, from a robbery or a banal fire to some exotic ways of losing money.

It is quite obvious that if you decide to open a business, then you need to take all this into account so as not to burn out. Only in this case will competent management of the process of running your business be ensured. Moreover, it doesn’t matter what kind of company it is, Emozzi production, a toy factory, or just a cigarette stall - risks still need to be taken into account, since they are present in any business. This is due to the probabilistic nature of the world and every event has both a positive and negative side. The same can be said about business. When a new business is opened, it is quite possible to have both a positive outcome, in this case it is making a profit, and a negative one, namely, there is a possibility of losses, and maybe a complete loss of the funds invested in opening the business.

Thus, we can conclude that when you open your own business, it is very important to take into account a variety of options for the development of events and primary attention must be paid to the negative direction, since it will depend on the management of this side of the business whether there will be any chances for something to happen. either positive, or they won’t exist at all.

Identified risks (using risk interview methods, brainstorming, Delphi methods, fault tree analysis or other methods, or a combination thereof) must be processed and visualized in order to carry out further assessment and management work with them. The most visual, simple and popular way is to build cardsorrisk matrices.

The simplest option for presenting information about risks is to compile a list of risks in descending order of the characteristics of their importance.

However, the importance of risk from a management point of view is not determined by one parameter, which is due to its probabilistic nature. Obviously, a risk that, if realized, carries large losses, can be considered dangerous and requires management. But if the probability of this risk occurring is extremely low, then it can be neglected. Accordingly, and vice versa: a risk with a small potential loss, but realized very often, will ultimately lead to significant total damage. Therefore, it is necessary to characterize each identified risk using its two main parameters: the probability of occurrence and the amount of possible damage.

Let us note that although the consequences of the realization of risks are not only financial, but also moral, reputational, accompanied by loss of life and health, etc., in economic situations it is customary to consider financial and material ones as the main ones. This is due to the fact that in economic activity it is this kind of loss that is of greatest importance, and also because in most cases the remaining losses can, although with a certain degree of convention, be expressed in monetary terms.

Thus, each identified risk, if assessed, will be characterized by two values: the probability of its occurrence and the amount of losses. A list of risks can be compiled by arranging the risks in descending order of one of the values, however, it is generally accepted to use both indicators simultaneously with the construction of the so-called risk maps or matrices.

In the event that both quantities - the probability of risk occurrence and potential damage - have a quantitative expression, we can construct risk map.

Risk map– this is a visual representation of identified risks in the form of points on a coordinate plane, where along one of the axes (usually OY), the probabilities of risk occurrence are plotted (in fractions of a unit or as a percentage), and along the other (usually OX) - damage from sales (in monetary units).

Management of production risks at the enterprise

An example of a risk map can be seen in Figure 1.

Figure 1 – Schematic representation of the risk map

As can be seen in the figure, risks 1 and 4 have the same amount of potential damage, but the probability of risk 1 occurring is higher. Risks 2 and 5 have the same probability of occurrence, while the potential damage is higher for risk 5. These pairs of risks can be compared and it can be said which of them has a higher level (if the probability/damage pair is taken as the risk level). However, for other risks such a comparison is difficult. Thus, risk 1 has less damage than risk 5, but the probability of its occurrence is significantly higher.

In order to determine whether a risk is acceptable or not, a risk map can be plotted risk tolerance limit, or risk acceptability limit(see Fig. 1). It represents a curve because risks with high damage even with a low probability may be considered unacceptable, as well as risks with low damage but a high probability. It is built on the basis of ideas about the organization’s risk appetite, and separates the area of acceptable risks, that is, those that the organization accepts and manages, from unacceptable ones.

Unacceptable risks are risks that, if they cannot be managed in such a way that they ultimately fall within the area of acceptable risks, the organization refuses. Depending on the risk management policy and the specific nature of the risks, unacceptable risks can be abandoned immediately, without clarifying the possibilities of managing them.

To improve clarity, risks on the map, in addition to numbers, can be indicated in different colors depending on their type. The risk map must be accompanied by a list of risks.

Thus, the risk map is a very visual and fairly simple to construct image of the risks of an enterprise or organization.

However, in some cases it is not possible to measure the probability and damage in quantitative terms. This is especially true for probability. However, there is a need for some ranking of risks according to the likelihood of their occurrence. In this case, qualitative, attributive probability estimates such as “very likely”, “unlikely”, “incredible”, etc. are used. The number of gradations of the quality scale can be any. Damage is assessed similarly, for example as “high”, “medium” and “low”. The number of gradations on the probability and damage scales can be either equal or different.

Based on this information, a risk matrix is constructed - an image of risks in the form of a table, where the columns are gradations of the amount of damage from the implementation of risks, and the rows are gradations of the probabilities of their implementation. The risks themselves are located in the cells of the table. Each cell has an interpretation in terms of risk level. A clear example of a risk matrix is presented in Table 1.

Table 1 – Risk assessment matrix (example)

In the risk matrix, you can also depict the risk tolerance limit, but more often it is customary to color the table cells in different colors: green - low risk, yellow - medium risk, red - high risk (the more saturated the red color, the higher the risk). This version of the image is more visual.

Also, certain values can be assigned to the cells of the table (see Table 1), reflecting the level of risk. Based on these values, calculations can be made, for example, of the total risk. However, these values are conditional, arbitrary, as are calculations based on them, and they cannot be considered statistical characteristics.

Qualitative estimates of probability and damage for each risk can be obtained in two ways.

In the first case, they can be determined from quantitative estimates, that is, they are a simplification. For example, the risk management policy determines that a risk with a probability from 0 to 0.05 is extremely low, from 0.05 to 0.1 is low, from 0.1 to 0.4 is average, from 0.4 up to 0.7 – high and from 0.7 to 1 – extremely high. Having estimates of the likelihood of the identified risks occurring, we can turn the risk map into a matrix. The same applies to the amount of potential damage. In this case, constructing a risk matrix may be, although perhaps more visual, a less informative way of presenting information about risks than a risk map.

However, more often a risk matrix is constructed when it is not possible to obtain quantitative risk assessments. For example, it is impossible to estimate the probability of risks occurring either using the methods of probability theory or based on relevant statistics. In such cases, so-called subjective probabilities, or expert assessments, or simply the results of processing risk interviews about how often certain risks are (or can be) realized in the opinion of the interviewees can be used. Obviously, in this case, estimates obtained in qualitative rather than quantitative form will be more reliable. In such situations, the use of a risk matrix is not only visual and convenient, but also a fairly reliable (if the rules for obtaining qualitative assessments are followed) way of presenting information about the risks of an enterprise or organization.

It is important to note that the "probability" used to construct the matrix in such cases is generally not probability in the classical or statistical sense. In the English-language literature, the term likelihood is used to denote it, which can be translated as “plausibility”, and in the context of risks – as “the possibility of risks being realized.” Understanding that probability is a measure of the possibility of risks being realized, however, the word “opportunity” can rather be interpreted as a qualitative rather than a quantitative characteristic.

Thus, the map and the risk matrix are, in fact, the same way of presenting information about risks, differing from each other in the type of assessment of risk characteristics.

Literature

1. Sinyavskaya T.G., Tregubova A.A. Economic risk management: theory, organization, methods. Tutorial. / Rostov State Economic University (RINH). – Rostov-on-Don, 2015. – 161 p.

Date of publication: 09/28/2016

LECTURE 32

DESCRIPTION AND RISK ASSESSMENT

The next steps after identifying and generating a list of risks (both new and existing projects) are the description and assessment of the identified risks.

IDENTIFYING THE MAIN RISKS OF ENTERPRISES USING THE EXAMPLE OF PJSC GAZPROM

The standard form for describing and assessing risks is the so-called “risk sheet” - the final product of the description and assessment.

First, a brief description of the key characteristics of the identified risk is formulated. It includes the conditions and causes of the risk and a qualitative description of the negative consequences that its implementation will entail. After this, a risk assessment is carried out: a process of qualitative or quantitative assessment of economic damage as a result of the occurrence of negative consequences is carried out.

The main assessment methods used are: expert assessment; survey of specialists; mathematical and statistical evaluation; the opinion of independent specialist consultants in this field; scenario approach; Monte Carlo simulation; sensitivity analysis of key indicators. Assessment can be both qualitative and quantitative.

Qualitative risk assessment. If a quantitative assessment is impossible or does not make sense for objective reasons, the risk is assessed qualitatively using various rating scales. For example, the following rating scale can be used for losses: minimum ratings - up to USD 10 thousand; low - from USD 10 thousand to USD 100 thousand; medium - from USD 100 thousand to USD 1 million; high – from USD 1 million to USD 100 million; maximum - over USD 100 million.

To assess the likelihood of risks occurring: unlikely - less than once every 5 years; probable - less than once a year, but more often than once every five years; practically possible - once a year or more often.

A qualitative assessment of losses and the likelihood of risks occurring is carried out on the basis of expert data in the area of the assessed risk.

Quantitative risk assessment. When deciding on the choice of risk assessment method, responsible executives for a specific project, as a rule, consult with specialists in the field of corporate finance of the company.

The following lecture and practical exercises discuss the content of each stage of risk management using the example of managing risks associated with the production activities (industrial risks) of a company.

In terms of methodological support for risk management that management faces in the course of its production activities, documents are being developed that determine the procedure for identifying, assessing and managing risks. The documentation also includes a list of participants, their responsibilities, powers and interactions.

All developments in this area are aimed at ensuring industrial risk management within the enterprise’s business processes, including environmental protection, industrial safety and labor protection.

The most important goal in the field of industrial safety, labor protection and the environment is the identification and assessment of industrial hazards and risks, helping to reduce significant industrial risks.

To achieve this goal, the company undertakes, among others, the following obligations:

§ identify and assess industrial hazards and risks, formulate measures to reduce significant industrial risks;

§ ensure compliance of activities with the international standard in the field of environmental management ISO 14001:2004 and OHSAS 18001:1999 specification.

As noted above, the entire risk management process includes three main stages: identification of industrial risks; description and assessment of risks; development of measures to reduce the impact of risks (Fig. 8.1).

Fig.8.1. Main stages of industrial risk management

Industrial risks are understood as risks associated with the activities carried out by the company, which can affect personnel, property and the production environment, the natural environment and the personnel of contractors located in the area of the company's industrial hazards. These are also risks associated with purchased products and/or services that may have similar impacts in the relevant industrial hazard area.

The differences between industrial hazard and industrial risk follow from the following definitions:

§ industrial hazard is a source or situation that can cause damage to human health, property, the company’s production environment, the natural environment, etc.;

§ industrial risk (R=I*P) – a measure of danger, defined as the product of the probability (frequency) of the risk (I) and the potential damage (consequences) from the risk (P) to human health, company property and/or the environment;

§ acceptable industrial risk is a risk reduced to a level that the company can tolerate, taking into account its legal obligations and its own policies in the field of ecology, occupational health and safety;

§ residual level of industrial risk - characteristic of industrial risk after applying risk management methods.

Industrial risk assessment is a comprehensive process of assessing the magnitude of industrial risk and making a decision regarding the acceptability of the risk. Industrial risk management is a set of measures aimed at reducing levels of industrial risks or maintaining risks at practically acceptable risk levels.

Industrial risk management is ensured by solving the following main tasks:

§ analysis of known and identification of potential industrial hazards;

§ assessment of risks associated with identified industrial hazards;

§ determining the acceptability of risks and identifying significant (unacceptable for the company) industrial risks;

§ planning measures to reduce unacceptable industrial risks.

The industrial risk management process includes:

§ uniformity of approaches in the process of identifying and assessing industrial risks;

§ determination of acceptable risk levels;

§ coordination of industrial risk management from a single center;

§ gradual reduction or elimination of significant industrial risks;

§ identification and assessment of industrial risks at newly commissioned and reconstructed facilities before their implementation - a preventive approach;

§ distribution of responsibility for identifying, assessing and maintaining industrial risks at an acceptable level;

§ periodic analysis and reassessment of industrial risks;

§ involvement and participation of personnel in the risk management process;

§ industrial risk insurance.

The main stages of risk management will be discussed in detail during practical classes.

risks that are considered important to the project, but discussion of the risks raised is not allowed. Next, the risks are sorted into categories and specified.Delphi method similar to brainstorming, but the participants do not know each other. The facilitator collects expert responses using a list of questions to elicit ideas about project risks. The experts' responses are then analyzed, categorized and returned to the experts for further comments. Consensus and a list of risks are obtained through several cycles of this process. The Delphi method eliminates peer pressure and the fear of embarrassment when expressing an idea.

| RISK IDENTIFICATION | ||||||||

|---|---|---|---|---|---|---|---|---|

| № | date emergence risk | date registration risk | Name and description risk | Initiator | Causes | Consequences | Risk owner | Risk expiration date |

| . | ||||||||

| . | ||||||||

| Root cause | Condition | Consequence | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Lack of personnel | Can be combined

|