Fill in RSV 1 in 1s 8.3. Accounting info. Updated calculation of insurance premiums

Quite recently, the next period for submitting reports to the Pension Fund of the Russian Federation began, and therefore I decided on the pages of this site to talk about how the regulated RSV-1 report is prepared in 1C ZUP edition 3.0.

This article will primarily discuss the sequence of report preparation in 3.0 and, of course, some features that should be checked and taken into account for the correct generation of the DAM. In this regard, I think the article will be useful for both beginners and experienced users of the ZUP 3.0 program (By the way, for beginners of edition 3.0 or for those who want to learn how to eat useful material).

For those who have not yet implemented and are still working in ZUP 2.5, there is also similar material that can be found by clicking on. I published it a little earlier, but it is still relevant today.

Sequence of preparation of the RSV-1 report in ZUP 3.0

✅

✅

✅

To begin with, I will tell you in general how to prepare a regulated report to the Pension Fund.

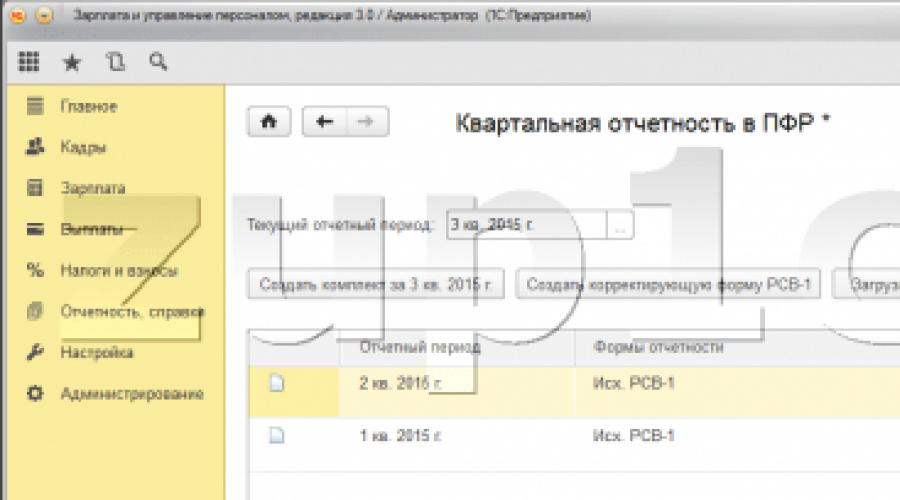

Everything related to regulated reporting (not only to the Pension Fund, but also to the Social Insurance Fund, Federal Tax Service, etc.) can be found in the main menu section "Reporting, certificates". To generate the RSV-1 report, you need to use a specialized workstation, which can be launched from this section via the link “Quarterly reporting to the Pension Fund of Russia”.

The main thing here is to use this workbook, and not the 1C-Reporting magazine (in the picture just above). Of course, it will be possible to create an RSV-1 from it, but this report will not contain individual information, they simply will not be filled out with this method of creation. Therefore, it should be used specifically in the workplace “Quarterly reporting to the Pension Fund of Russia.”

✅ Seminar “Lifehacks for 1C ZUP 3.1”

Analysis of 15 life hacks for accounting in 1C ZUP 3.1:

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners:

Before you begin creating a report for the current quarter, you must set the status of the report for the previous quarter to "Submitted" if this has not been done previously. To do this, use the workplace menu item “Set state” and select the “Sent” state.

After this you can use the button “Create a set for _ sq. 201_". A form will open in a new window, which will take some time to fill in with information. After completing this process, we will receive two or more packets of information.

The uppermost pack corresponds to the general sections of RSV-1 (sections 1-5). If we position ourselves on this line, then the basic information from the general sections is presented below. To open and view/check these sections you directly need to click on the line "Sections 1-5".

If we position ourselves on the bottom line (this is a pack of individual information - section 6), then below we will see a list of all employees included in this pack. Here we can see for each its base and calculated insurance premiums.

Of course, all individual information for each individual can be viewed directly in the RSV-1, but it will be quite inconvenient to scroll through this whole “footcloth” and analyze the information in this form.

This window has three tabs. In the first - “Sections 6.4 (earnings), 6.5 (contributions)”— you can view information about the employee’s monthly earnings in the current quarter, as well as accrued contributions (in the picture above).

✅ Seminar “Lifehacks for 1C ZUP 3.1”

Analysis of 15 life hacks for accounting in 1C ZUP 3.1:

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners:

In the second tab, which is called "Section 6.7 (harmful earnings)", information is provided on earnings, which are subject to additional contributions for harmful and difficult working conditions. Naturally, this tab is filled out only for employees whose position provides for such contributions.

And finally the third tab - "Section 6.8 (experience)". The employee's length of service for the past quarter is reflected here. At the same time, the program itself can break down periods if, for example, there was sick leave or vacation at your own expense. And for pests it is important to indicate correctly in the position special working conditions code and list item code so that the corresponding fields can be automatically loaded in the experience.

To refill the report, use the button “Update” -> “Update completely”.

If for some reason you made manual changes to the report, but you need to update it, then you can do this without losing the corrections - “Update with corrections.” By the way, employees who have manual corrections will be reflected in bold.

Next to the “Update” button you can see a button "Add". It allows you to manually add another set of sections to the reporting, for example, corrective ones. But I'm back again I don't recommend doing this manually. We have a smart program that knows better how to do this. And so that it can automatically create adjustments, it is enough to reflect in the database the fact of additional accrual of contributions for previous periods, or make a correction for any other situation in connection with which an adjustment is required. The program will track this and create the pack itself (to understand how this is done, you can read the example of articles about adjustments from).

However, there is a useful button here “Add” -> “Additional files”. In my practice, there were situations when the Pension Fund of Russia demanded clarification on some situations in a regular Word file. These are the additional files that are added to the report using this button.

Next, it all depends on what program you use to send the report. If this is a third party program, then from 1C the report must first be downloaded, using the button of the same name in the workplace menu. When uploading, an internal check of the report takes place and if there are errors, the program will tell you about it. The report is then uploaded to the reporting program.

There is another option, more convenient. You can send a report directly from 1C. And confirmation of accepted reports will also come to 1C. Quite convenient and, by the way, cheaper. Connection conditions for different regions are different, so if you are interested in finding out more details, you can . I will be happy to advise you.

That’s all for today, if you have any questions about preparing reports in ZUP 3.0, you can write in the feedback form or.

To be the first to know about new publications, subscribe to my blog updates:

Let's look at how the 1C Accounting 8.3 computer program helps an accountant make quarterly reports to the Pension Fund.

If the necessary documents were entered into the 1C system in a timely and correct manner, then the generation of “pension” reporting does not present any difficulties, since it is performed automatically. In order for all the data to get to the right places in the reports, the following operations must be entered into 1C.

- First of all, the monthly calculation of contributions for compulsory health insurance and compulsory medical insurance. It is produced by the program simultaneously with the calculation of salaries to employees using the 1C document “”. The contribution rate is pre-set in the salary accounting settings (see the “Directories and Settings” item in the “Salaries and Personnel” section).

- Payment of contributions should also be included in the report to the Pension Fund. It should be reflected in 1C bank statement “ ” with the transaction type “Payment of tax” (tax “Insurance contributions to the Pension Fund” or “to the Federal Compulsory Medical Insurance Fund”, type “Contributions”).

When documents on the calculation and payment of contributions have been successfully entered into the program, you can begin generating reports to the Pension Fund. In 1C, the workplace serves this purpose:

Salary and personnel / Insurance premiums / Quarterly reporting to the Pension Fund of Russia

To create a new set of reporting packs, just set the current period and click “Create set” (the period on this button will be specified automatically).

If the 1C 8.3 program contains previously created and saved sets for other periods, they are displayed in the list. Moreover, creating a new set of forms is possible only if earlier sets have the status “Sent” or “Will not be transferred”. To change the state, use the “Set state” link.

By clicking the “Create kit” button, the program creates and automatically fills out the RSV-1 form. The window that opens displays general information about the taxable base and accrued contributions for the required period. The status of the form is “In progress”.

Get 267 video lessons on 1C for free:

Section 1 includes the amounts of contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund that were accrued and paid during the period, as well as debt (if any).

Section 2 reflects the calculation of contributions based on the tax base and the applicable tariff. If during the period in the program “Sick Leave” documents were entered, according to which benefits were calculated, the amount of benefits will automatically be reflected in section 2 in lines 201 and 211 “Amounts not subject to insurance contributions.”

How to change data in RSV-1 reporting in 1C 8.3

If we return to the form for working with RSV-1 and select the line “Pack of sections 6 RSV-1” here, we will see that a list of employees appears below with the amounts of earnings and accrued contributions. This is the data that falls into “Individual Information” (section 6).

Double-clicking on the line with the employee opens the form for editing section 6 of the RSV-1 for this employee. If necessary, all information here can be edited manually: change amounts, add new lines.

The “Section 6.8 (experience)” tab of the same form displays information about the employee’s length of service. If sick leave was entered for him, then the period of illness is automatically displayed here with the code VRNETRUD. This section is also available for manual editing. For example, if an employee, by agreement with management, was granted leave without pay, you should add lines here and indicate the required period of leave by selecting the desired code in the “Calculated length of service” section.

If necessary, information such as periods of work under special conditions or on a preferential position is also filled in. In case of work in “harmful” conditions, fill out section 6.7.

Another opportunity that allows you to edit the length of service of employees is the link “Experience” in the form of working with RSV-1:

Clicking this link opens a form for editing the length of service in the form of a list of employees. This form also contains columns for information about the appointment of an early pension. Changes made to the experience should be saved using the appropriate button.

Attention! When filling out the RSV-1 form for the 4th quarter of 2016, indicate the OKVED code, edition 2 (Order of Rosstandart dated November 10, 2015 No. 1745-st). The code is inserted automatically from the organization details.

If the OKVED code is not entered automatically, indicate it in the organization details (section Main). To apply changes in the RSV-1 form, click the "Update" button.

You can make corrections to submitted RSV-1 reports using two methods:

- Create a clarifying form RSV-1

- Add a corrective form to the current RSV-1

I remind you.

To create or edit RSV-1, you need to open

Menu / Salaries and Personnel / Insurance contributions / Quarterly reporting to the Pension Fund / and here select the current reporting period.

From Menu / Reports / 1C Reporting / Regulated reporting / you can view the finished report and upload or send it.

Method No. 1 - Create a clarifying form RSV-1

This method can only be used if two conditions are met:

- The error resulted in an understatement of contributions payable.

- No more than two months have passed since the end of the reporting period (not to be confused with the deadline for submitting reports).

And so, in 1C: Accounting 3.0 we open the window “Menu / Salaries and personnel / Insurance contributions / Quarterly reporting to the Pension Fund of the Russian Federation”. And click the button “Create corrective form RSV-1”.

The program uses only the name “Corrective”, I specifically use the different names “Clarification” and “Corrective” to emphasize the differences.

When choosing an adjustment period, be careful; do not forget to select not only the quarter, but also the year. Once the form is created, it will not be possible to change the period. You will have to delete this form and create a new one.

This form should contain:

- One pack of sections 1-5 with Type – KORR,

- And two packs of section 6:

- the second Type is CORR., only those employees for whom there is an adjustment will be added. This pack is filled in the same way as the original one.

To go to the printed form, click on the line “Sections 1-5” in the “Sections” column. On the title page, do not forget to fill out the “Reason for clarification” field.

Method No. 2 - Correct errors in the current RSV-1

If the conditions for creating a corrective form are not met, then all corrections are made when submitting the next RSV-1 report, but with an additional batch of section 6 (or several, if you are adjusting several reporting periods at once). The first pack will be for the current period, and there will be additional packs for each adjusted period.

To do this, first do everything as usual, in the form “Quarterly reporting to the Pension Fund of the Russian Federation” you create a set for the reporting period. After opening the form and checking the data for the reporting period, click the “Add / Pack of sections 6” button. A new line appears, but for now it has a TYPE of OUT. Open this line and start making corrections. The “Reporting period” field indicates the current reporting period. “Information type” select “Corrective”. But in the field “Correct. period" indicate the period in which adjustments are made.

« Reg. number in corr. period» - After changing the legal address, the Pension Fund of Russia can assign a new registration number to the organization. If you are creating an adjustment for a period when you still had an old registration number, then this old registration number must be indicated in this field. If you have not had such adventures, leave this field blank.

To automatically generate RSV-1 in 1C 8.2, you must perform the following steps:

- In the Reports → section you need to select Regulated reports;

- By function<Добавить элемент списка>– the RSV-1 PFR form is selected;

- Period – the reporting period is set;

- Next click<Ок>;

- When you press<Заполнить>– the RSV-1 report will be generated automatically in 1C 8.2;

- After this, you need to check the completion of the report and, if necessary, make adjustments to it.

In order to create the printed form RSV-1 in 1C 8.2 Accounting, you need to perform the following steps:

- There is a button at the bottom of the form<Печать>;

- If you select Show form, the print service will open. Then you can print all the sheets in the report, or only those that are checked;

- Print via<Печать>.

How to check the correctness of filling out a report to the Pension Fund of the Russian Federation according to the RSV-1 form in the 1C 8.2 Accounting program is discussed in the form of step-by-step instructions.

Instructions for filling out the RSV-1 form in the Pension Fund of the Russian Federation

Step 1. Filling out the title page

At the first step, information indicators about the taxpayer and the reporting period are generated. A sample title page of the RSV-1 form is presented below:

Step 2. Completing Section 2

In the second section of the RSV-1 form, the calculation established for the taxpayer is made.

Filling out the section on compulsory pension insurance

In the line Base for calculating insurance contributions for compulsory pension insurance (lines 240 and 241), the base is calculated by age:

- For workers 1966 and older according to the formula (page 201+ page 203 – lines 211 -213 -221 -223 -231 -233)

- Let’s say, for example: 80,539.21 + 0 – 0 – 0 – 0 – 0 – 0 – 0 = 80,539.21 rubles. – page 240;

- For persons born in 1967 and younger according to the formula (page 202 – lines 212 – 222 -232)

- Let’s say, for example: 321,295.54– 3,195.63 (sick leave benefit) – 0 – 0 = 318,099.91 rubles. – page 241;

In the line Accrued insurance contributions for compulsory pension insurance, contributions are calculated: insurance and savings part (line 250, line 251), if their amount is more than the maximum base value (line 252) according to the formula: Amount of contributions = Base for contributions * Tariff for contributions.

- So, in our case, the calculation of contributions for the insurance part: 80,539.21 * 22% + 318,099.91 * 16% = 68,614.62 rubles.

- The calculation of contributions for the funded part was: 318,099.91 * 6% = 19,086.00 rubles.

Filling out the section on compulsory health insurance

In the line Amount of payments and remunerations in favor of individuals (p. 271) - the amount of payments is written down by month in the reporting period (columns 4-6) and in total on an accrual basis (column 3). Filling is similar to the indicators of the lines on the OPS (lines 201 + 202 + 203 are summed up).

In the line Base for calculating insurance premiums for compulsory medical insurance (p. 275), the base is calculated using the formula (p. 271 - lines 272 – 273 – 274).

- In our case: 401,834.75 – 3,195.63 – 0 – 0 = 398,639.12 rubles – p. 275;

In the line Accrued insurance premiums for compulsory health insurance, contributions to the FFOMS are calculated using the formula: Amount of contributions = Base for contributions * Tariff for contributions.

- Checking the calculation of contributions to the Federal Compulsory Medical Insurance Fund: 398,639.12 * 5.1% = 20,330.60.

You can also check the amounts of contributions with the balance sheet for the credit turnover of accounts 69.03.01 “Federal Compulsory Medical Insurance Fund”. Similarly, you can check calculations for all columns by month of the period:

Example of filling out Section 2 of RSV-1:

Step 3. Completing Section 1

In the first section of the RSV-1 form, the accrued and paid contributions for compulsory pension and health insurance are calculated, and the balance for them is also indicated.

In the line Accrued insurance premiums from the beginning of the reporting period (p. 110) – the total amount of accrued premiums on a cumulative basis from January 1. The data in the line must match:

- amounts from section 2 column 3:

- contributions for compulsory medical insurance – page 276;

- the sum of the data from section 1 page 110 of the calculation of the previous period and the data from section 1 page 114 of the calculation of the reporting period.

In lines 111, 112, 113 – the amounts of contributions accrued for the three previous months are entered. The data in the lines must correspond to the data from section 2, columns 4, 5, 6:

- insurance part – p.250 + p.252;

- accumulative part – page 251;

- contributions for compulsory medical insurance – page 276;

Line 114 reflects the amount of insurance premiums for the last three months of the reporting period, which is determined by the formula (lines 111 + 112 + 113).

In line 130 - the total amount of insurance premiums payable, which is determined by summing lines 100+110+120.

In line 140 - you need to indicate the amount of contributions paid on an accrual basis from January 1 to the reporting date. The data in the line must correspond to:

- debit turnover on accounts 69.02.1, 69.02.1, 69.03.1 in correspondence with account 51;

- the sum of the data from section 1 page 140 of the calculation of the previous period and the data from section 1 page 144 of the calculation of the reporting period;

In lines 141, 142, 143 - you need to enter the amount of contributions paid for the last three months. The data in the lines must correspond to the amounts of monthly contributions (debit turnover on accounts 69.02.1, 69.02.1, 69.03.1);

Line 144 reflects the summation of lines 141 + 142 +143.

Sample of filling out RSV-1 Section 1:

Drawing up a payment order for payment of contributions to the Pension Fund

The procedure for filling out the fields of the payment order when paying monthly insurance premiums to the Pension Fund of the Russian Federation (insurance part):

KBK for payment of contributions to the Pension Fund

In field 104 “KBK” you need to enter the budget classification code for the contribution being paid.

Attention! BCC is an important detail; if it is indicated incorrectly, the insurance premium will not be credited correctly and will entail the accrual of penalties.

In our example, the following BCCs are indicated:

Details for payment of insurance contributions must be found in your pension fund or on the official website of the pension fund. For Moscow, you can use the website www.pfrf.ru/ot_moscow.

Example of a payment order for the payment of insurance premiums to the Pension Fund (insurance part)

To automatically generate a payment order in 1C 8.2, you can use the Generation of payment orders for taxes payment processing through the Bank menu:

Full list of our offers:

Calculation of insurance premiums for 2017 is provided in the form approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551@. The calculation must be submitted to the tax authorities no later than January 30, 2018.

Calculation of insurance premiums for 2017 is provided in the form approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551@:

- persons making payments and other remuneration to individuals (organizations, individual entrepreneurs, individuals who are not individual entrepreneurs);

- heads of peasant (farm) households.

In accordance with paragraph 7 of Art. 431 of the Tax Code of the Russian Federation, persons making payments and other remuneration to individuals submit calculations for insurance premiums no later than the 30th day of the month following the billing (reporting) period to the tax authority:

- at the location of the organization;

- at the location of separate divisions of organizations that accrue payments and other remuneration in favor of individuals. If a separate division is located outside the Russian Federation, then the organization submits the calculation for such division to the tax authority at its location;

- at the place of residence of the individual making payments and other remuneration to individuals (including individual entrepreneurs).

The largest taxpayers who have separate divisions (which calculate payments and other remuneration in favor of individuals) submit calculations to several tax inspectorates (letter of the Federal Tax Service dated January 10, 2017 No. BS-4-11/100@):

- at its location;

- at the location of the separate units.

Calculation of insurance premiums for 2017 must be submitted to the tax authorities no later than January 30, 2018. The deadline for submitting calculations is the same for all payers of insurance premiums and does not depend on the form of reporting - on paper or electronically.

Note! If the payer of insurance premiums does not have payments in favor of individuals during the billing (reporting) period, the payer is obliged to submit a calculation with zero indicators to the tax authority within the prescribed period (letters of the Federal Tax Service dated March 24, 2017 No. 03-15-07/17273, dated April 12 .2017 No. BS-4-11/6940@).

For late submission of a calculation of insurance premiums to the tax office, the payer of insurance premiums may be subject to a fine of 5 to 30 percent of the amount of contributions that was not paid, based on the calculation. In this case, the minimum fine is 1,000 rubles (Article 119 of the Tax Code of the Russian Federation). In a letter dated 05/05/2017 No. PA-4-11/8611, the Federal Tax Service of Russia explained how much the fine should be paid to each of the funds (PFR, FFOMS, FSS).

Calculation of insurance premiums

Insurance premium calculations include:

- Title page;

- Sheet“Information about an individual who is not an individual entrepreneur”;

- Section 1"Summary data on the obligations of the payer of insurance premiums";

- Appendix No. 1 to section 1 “Calculation of the amounts of insurance contributions for compulsory pension and health insurance” to section 1;

- Appendix No. 2 to section 1 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity” to section 1;

- Appendix No. 3 to section 1 “Expenses for compulsory social insurance in case of temporary disability and in connection with maternity and expenses incurred in accordance with the legislation of the Russian Federation” to section 1;

- Appendix No. 4 to section 1 “Payments made from funds financed from the federal budget” to section 1;

- Appendix No. 5 to section 1 “Calculation of compliance with the conditions for applying the reduced tariff of insurance premiums by payers specified in subparagraph 3 of paragraph 1 of Article 427 of the Tax Code of the Russian Federation” to section 1;

- Appendix No. 6 to section 1 “Calculation of compliance with the conditions for applying the reduced tariff of insurance premiums by payers specified in subparagraph 5 of paragraph 1 of Article 427 of the Tax Code of the Russian Federation” to section 1;

- Appendix No. 7 to section 1 “Calculation of compliance with the conditions for applying the reduced tariff of insurance premiums by payers specified in subparagraph 7 of paragraph 1 of Article 427 of the Tax Code of the Russian Federation” to section 1;

- Appendix No. 8 to section 1 “Information necessary for the application of a reduced rate of insurance premiums by payers specified in subparagraph 9 of paragraph 1 of Article 427 of the Tax Code of the Russian Federation” to section 1;

- Appendix No. 9 to section 1 “Information necessary for applying the tariff of insurance premiums established by the second paragraph of subparagraph 2 of paragraph 2 of Article 425 (the second paragraph of subparagraph 2 of Article 426) of the Tax Code of the Russian Federation” to section 1;

- Appendix No. 10 to section 1 "Information necessary to apply the provisions of subclause 1 of clause 3 of Article 422 of the Tax Code of the Russian Federation by organizations making payments and other rewards in favor of students in professional educational organizations, educational organizations of higher education in full-time study for activities carried out in a student group (included in the federal or regional register of youth and children's associations enjoying state support) under employment contracts or civil contracts, the subject of which is the performance of work and (or) the provision of services" to Section 1;

- Section 2"Summary data on the obligations of insurance premium payers of heads of peasant (farm) households";

- Appendix No. 1 to section 2 “Calculation of the amounts of insurance premiums payable for the head and members of a peasant (farm) enterprise” to section 2;

- Section 3"Personalized information about insured persons."

Sections 1 And 3 are filled out by insurance premium payers making payments to individuals and submitted quarterly.

Section 2 filled out by insurance premium payers - heads of peasant farms - annually.

Compiling calculations for insurance premiums in the program "1C: Salary and Personnel Management 8" (ed. 3)

The program provides a regulated report for calculating insurance premiums Calculation of insurance premiums(chapter Reporting, certificates - 1C-Reporting) (Fig. 1).

The program provides a regulated report for calculating insurance premiums Calculation of insurance premiums(chapter Reporting, certificates - 1C-Reporting) (Fig. 1).

To compile a report, you must be at your workplace 1C-Reporting enter a command to create a new report instance using the button Create and select from the list of available reports Types of reports report with title Calculation of insurance premiums by button Choose.

In the start form, indicate the organization (if the program maintains records for several organizations) for which the report is being compiled and the period for which it is being compiled.

As a result, the form of a new instance of the report is displayed on the screen. Calculation of insurance premiums(Fig. 2). To automatically fill out a report based on infobase data, use the button Fill.

Note! If two or more directory elements are identified in the accounting data when automatically filling out a report Individuals a message is issued with the same completed SNILS, while the report remains blank.

Calculation of insurance premiums in other programs:

- in the program 1C: Salaries and personnel management 8 (rev. 2.5)

- in program 1C: Salaries and personnel of budgetary institutions 8 (rev. 1.0)

- in program 1C: Salaries and personnel of government institutions 8 (ed. 3)

Submission of calculation of insurance premiums to the tax authority

Payers who have an average number of individuals in whose favor payments and other remunerations are made for the previous billing (reporting) period exceeds 25 people, as well as newly created (including during reorganization) organizations whose number of specified individuals exceeds this limit, submit a calculation of insurance contributions to the tax authority in electronic form using an enhanced qualified electronic signature via telecommunication channels (clause 10 of article 431 of the Tax Code of the Russian Federation).

Payers who have an average number of individuals in whose favor payments and other remunerations are made for the previous billing (reporting) period exceeds 25 people, as well as newly created (including during reorganization) organizations whose number of specified individuals exceeds this limit, submit a calculation of insurance contributions to the tax authority in electronic form using an enhanced qualified electronic signature via telecommunication channels (clause 10 of article 431 of the Tax Code of the Russian Federation).

Payers and newly created organizations (including during reorganization), whose average number of individuals in whose favor payments and other remunerations are made, for the previous settlement (reporting) period is 25 people or less, have the right to submit calculations in electronic form , and on paper.

Regardless of the activity carried out, payers of insurance premiums must submit as part of the calculation:

- Title page;

- Section 1 "Summary of the obligations of the payer of insurance premiums";

- subsection 1.1 "Calculation of contributions for compulsory pension insurance", subsection 1.2 "Calculation of contributions for compulsory health insurance" of appendix 1 to section 1;

- Appendix 2 to Section 1 "Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity";

- Section 3 "Personalized information about insured persons."

The remaining appendices and subsections are presented if they contain data (subsections 1.3.1, 1.3.2, 1.4 of appendix No. 1 to section 1, appendices 3 - 10 to section 1).

Submission of calculations for insurance premiums to the tax authority in the program "1C: Salaries and Personnel Management 8" (ed. 3)

Setting up the composition of the calculation

Setting up the composition of the calculation

If individual sections of the calculation are not filled out and submitted in accordance with the Procedure, then you can set a mode for them in which they will not be displayed in the report form or printed.

To do this, click on the button Settings(button More - Settings), located in the top command bar of the report form, and on the tab Partition properties uncheck the boxes Show And Print for these sections (Fig. 3).

Checking the calculation

Before submitting the calculation, it is recommended to check it for errors. To do this, use the button Examination - Check reference ratios. After pressing the button, the result of checking the control ratios of the indicators is displayed. In this case, you can see either those control ratios of indicators that are erroneous, or all control ratios of indicators (by unchecking Show only erroneous relationships) (Fig. 4).

When you click on the required ratio of indicators, in the column Tested ratio or Explanation of meanings, a transcript is displayed that shows where these numbers came from, how they came together, etc. And when you click on a certain indicator in the transcript itself, the program automatically shows this indicator in the report form itself. For report form Calculation of insurance premiums check of control ratios of indicators introduced by letters of the Federal Tax Service of Russia dated June 30, 2017 No. BS-4-11/12678@, dated December 13, 2017 No. GD-4-11/25417@ and letter of the Federal Tax Service of the Russian Federation dated June 15, 2017 No. 02-09- 11/04-03-13313.

Print calculation

Organizations submitting calculations without using telecommunication channels (or using third-party programs for electronic exchange) should prepare files for transmission to the tax authority in electronic form. Organizations submitting calculations on paper should prepare a printed calculation form (Fig. 5).

To generate a printed calculation form with a PDF417 two-dimensional barcode, click on the button Seal located at the top of the report form. To print machine-readable forms of regulated reports with a two-dimensional PDF417 barcode, it is necessary that a single module for printing machine-readable forms and machine-readable form templates be installed on the computer. The print module installation kit is included in the configuration. As soon as the need to use the print module arises, it is automatically launched for installation. Templates for machine-readable forms of regulated reports are included in the configuration and are installed along with it, so there is no need to install templates separately.

The calculation form for insurance premiums can be printed without a barcode, if in the report settings (button More – Settings– bookmark General) check the box Allow printing without PDF417 barcode. After setting this setting, click the button Seal will be available for printing PDF417 barcode form (recommended)(Fig. 5) or Form without barcode PDF417.

When you select the second option, the program displays the report form on the screen for preview and additional editing, generated for printing sheets (if necessary) (Fig. 6). Next, to print the calculation, click on the button Seal. In addition, from this report form (preview), you can save the edited calculation as files to the specified directory in PDF document format (PDF), Microsoft Excel (XLS) or in spreadsheet document format (MXL) (by clicking on the button Save).

Uploading calculations electronically

If the calculation must be uploaded to an external file, then in the form of a regulated report Calculation of insurance premiums The function of uploading in electronic form is supported in a format approved by the Federal Tax Service of Russia. It is recommended to first check the upload to ensure that the report is formatted correctly using the button Examination – Check upload. After clicking this button, an electronic report will be generated. If errors are detected in the report data that prevent the upload from being completed, the upload will be stopped.

In this case, you should correct the detected errors and repeat the upload. To navigate through errors, it is convenient to use the error navigation service window, which is automatically brought up on the screen. To download the calculation for subsequent transfer through an authorized operator, you must click on the button Unload - Electronic submission and indicate in the window that appears the directory where you should save the calculation file. The program assigns a name to the file automatically. When you press the button Upload - Data on individuals section 3, a file with data on individuals in section 3 will be uploaded. The file can be used in the organization’s “Personal Account” on the Federal Tax Service website to check the full name and SNILS (Fig. 7).

Sending a calculation to the tax authority

In programs 1C, containing a subsystem of regulated reporting, a mechanism has been implemented that allows directly from the program (without intermediate uploading to an electronic presentation file and using third-party programs) to send a calculation of insurance premiums to the tax authority in electronic form with an electronic digital signature (if the 1C-Reporting service is connected). Before sending, it is recommended to perform format and logical control of filling out the calculation. To do this, click on the button. Examination