MRSK of the center and Volga region remain a dividend story. "MRSK of center and Volga region" - the potential has become even more billion rubles, unless otherwise indicated

Read also

Cumulative dividends in the next 12m: 0.0311 rub.(forecast)

Average dividend growth rate 3y: 87.15%

Upcoming dividends: 0.0311 rub. (12.04%

) 25.06.2020

(forecast)

Total payments by year

| Year | Dividend (RUB) | Change to previous year |

|---|---|---|

| track 12m. (forecast) | 0.0311 | -23.78% |

| 2019 | 0.0407 | +1.24% |

| 2018 | 0.0402 | +241.28% |

| 2017 | 0.0118 | +41% |

| 2016 | 0.0083636 | +169.79% |

| 2015 | 0.0031 | -44.94% |

| 2014 | 0.00563 | +32.47% |

| 2013 | 0.00425 | +51.79% |

| 2012 | 0.0028 | +123.8% |

| 2011 | 0.0012511 | n/a |

| 2010 | 0 | n/a |

| 2009 | 0 | n/a |

| 2008 | 0 | n/a |

All payments

| Registry closing date | Dividend (RUB) | ||

|---|---|---|---|

| 06/25/2020 (forecast) | 0.0311 | ||

| 25.06.2019 | 26.07.2019 | 0.0407 | n/a |

| 12.06.2018 | 01.08.2018 | 0.0402 | n/a |

| 16.06.2017 | 01.08.2017 | 0.0118 | n/a |

| 27.06.2016 | 01.08.2016 | 0.0083636 | n/a |

| 29.06.2015 | 01.08.2015 | 0.0031 | n/a |

| 11.07.2014 | 01.08.2014 | 0.00563 | n/a |

| 08.05.2013 | 01.07.2013 | 0.00425 | n/a |

| 14.05.2012 | 01.08.2012 | 0.0028 | n/a |

| 06.05.2011 | 01.07.2011 | 0.0012511 | n/a |

Profit forecast next. 12m: 7000 million rubles.

Number of shares outstanding: 112697.82 million units.

Stability of payments: 1

Growth stability:

0.86

A comment:

The dividend policy of IDGC of Center and Volga Region provides the following formula for calculating the volume of dividends: DIV = (net profit) - (mandatory deductions) - (part of the profit allocated to investments) - (part of the profit allocated to repay losses of previous years). It is also necessary to have net profit and a debt/EBITDA ratio (at the end of the year) of less than three. Overall, the company is profitable and pays good dividends. Typically pays 25% of profit according to RAS. Based on the results of 2015, they recommended 100% of profit according to RAS. At the end of 2016, only about 43% of RAS or 36% of IFRS decided to recommend dividends. The company's free cash flow is sufficient to maintain dividend levels no lower than previous years. Based on the results of 2018, IDGC of Center and Volga Region recommended paying dividends in the amount of 50% of profits according to RAS.

Investment company DOKHOD, Joint Stock Company (hereinafter referred to as the Company) does not promise or guarantee the return on investments. Decisions are made by the investor independently. In preparing the materials contained on this page, information was used from sources that, in the opinion of Company specialists, are trustworthy. However, this information is intended solely for informational purposes, does not contain recommendations and is an expression of the private opinion of the Company’s analytical service specialists. Despite the care taken by the Company's specialists in compiling this page, the Company makes no guarantees regarding the accuracy or completeness of the information contained herein. No one should under any circumstances consider this information as an offer to enter into an agreement on the securities market or other legally binding action, either on the part of the Company or on the part of its specialists. Neither the Company nor its agents or affiliates accept any liability for any damages or expenses arising directly or indirectly from the use of this information. The information contained on the page is valid at the time of its publication, and the Company has the right to make any changes to the information at any time. The Company, its agents, employees and affiliates may, on occasion, engage in transactions in securities mentioned on this page or have relationships with the issuers of those securities. The results of investing in the past do not determine future income; the state does not guarantee the return on investment in securities. The Company cautions that dealing in securities involves various risks and requires appropriate knowledge and experience.

When forming the calculated indicators, the latest official closing prices of the relevant securities available as of the date of publication of the data, provided by the Moscow Exchange, are used.

Investment idea

IDGC of Center and Volga Region is a network company covering 9 regions with a total area of 408 thousand sq. km. with a population of 12.8 million people. The main business is electricity transmission. The controlling stake is held by Rosseti (50.4%).

- The company reported an increase in shareholder profits by 26%, to 10.3 billion rubles. thanks to higher tariffs, lower losses, and some non-recurring items. Since the beginning of the year, the company has reduced its losses by 7% compared to last year.

- Profit at the end of the year could reach a record 12.4 billion rubles. (+10% y/y), cash flow is expected to be significant, about 7 billion rubles.

- We believe that MRKP shares will remain among the leaders in dividend yield in the electric grid industry in 2018-2019. Projected earnings and positive cash flow generation will enable the company to further reduce debt and maintain strong payouts to shareholders. payment rate at a level comparable to previous years. Our forecast dividend for 2018 is RUB 0.041. with DY 14.8% to the current price.

- The shares are undervalued at forward multiples relative to the power grid complex by 55%, which we consider unjustified given the high dividend payment rates, generation of significant cash flow and maintaining high operating profitability. Current levels are attractive for opening long-term long positions on MRKP.

- The catalyst for a positive revaluation may be the publication of annual profit results and the approval of investment programs.

| Stock Key Indicators | ||||

| Ticker | MRKP | |||

| ISIN | RU000A0JPN96 | |||

| Market capitalization | RUB 31.1 billion | |||

| Qty. shares | 112.7 billion | |||

| Free float | 27% | |||

| Animators | ||||

| LTM P/E | 2,3 | |||

| P/E 2018E | 2,5 | |||

| P/B LFI | 0,6 | |||

| P/S LTM | 0,3 | |||

| EV/EBITDA LTM | 2,0 | |||

| DY 2108E | 14,8% | |||

| Financial indicators, billion rubles. | ||||

| 2016 | 2017 | |||

| Revenue | 78,4 | 91,0 | ||

| EBITDA | 13,4 | 23,6 | ||

| Net profit of shares | 3,6 | 11,4 | ||

| Dividend, kop. | 1,2 | 4,0 | ||

| Financial ratios | ||||

| 2016 | 2017 | |||

| EBITDA margin | 17,1% | 26,0% | ||

| Net Margin | 4,6% | 12,5% | ||

| ROE | 10,0% | 26,9% | ||

| Debt/own capital | 0,65 | 0,51 | ||

Brief description of the issuer

IDGC of Center and Volga Region is a network company covering 9 regions with a total area of 408 thousand sq. km. with a population of 12.8 million people. The length of power lines exceeds 271 thousand km, the total capacity of energy facilities exceeds 42.2 thousand MVA. The main business is electricity transmission.

Capital structure. The controlling stake is owned by PJSC Rosseti (50.4%). Free-float 27%.

Financial indicators of IDGC of Center and Volga Region

IDGC of Center and Volga Region disclosed fairly good financial results according to IFRS. Net profit increased in 3Q18 by 72% to RUB 3.35 billion. In just 9 months. the company earned 10.3 billion rubles. (+26%). The improvement in results was mainly due to an increase in tariffs, a decrease in losses by 7% y/y, and a reduction in labor costs by 19% over 9 months as a result of the dissolution of pension reserves by RUB 1.78 billion. and changes in the procedure for reserving remuneration at the end of the year (instead of monthly reflection, the reserve will be accrued in the 4th quarter).

The company resumed replenishing its reserve for accounts receivable in 3Q18 in the amount of RUB 293 million. or 1.4% of revenue from electricity transmission, this is a weak point, but for a total of 9 months. deductions are still small - 42.5 million rubles.

A positive effect on profit was also had by the reflection of net other income in the amount of RUB 1.6 billion. (1.0 billion rubles a year earlier) and a decrease in financial expenses by a third. Net debt increased in the 3rd quarter by RUB 1.9 billion. up to 22 billion rubles or 0.84x EBITDA, which we attribute mainly to the payment of dividends of 4.5 billion rubles. in the past quarter.

We improved our revenue forecasts, reflected the dissolution of pension reserves and raised our earnings forecasts. At the end of the year, the company's profit could reach a record 12.4 billion rubles. Overall, we remain positive on MRKP shares. Operating profitability remains at a high level, and despite progressive capital expenditures, cash flow in 2018E is expected to be positive and in a significant amount of RUB 7.0 billion. This will make it possible to repay part of the debt and make payments to shareholders at the end of the year comparable to last year.

Key financial indicators of IDGC of Center and Volga Region

| million rubles, unless otherwise indicated | 3K 2018 | 3K 2017 | Change, % | 9m 2018 | 9m 2017 | Change, % |

| Revenue | 21 094 | 22 141 | -4,7% | 68 891 | 64 113 | 7,5% |

| Operating expenses | 16 981 | 19 457 | -12,7% | 56 013 | 52 996 | 5,7% |

| EBITDA | 6 343 | 4 803 | 32,1% | 19 684 | 17 035 | 15,6% |

| EBITDA margin | 30,1% | 21,7% | 8,4% | 28,6% | 26,6% | 2,0% |

| Net profit of shareholders | 3 350 | 1 945 | 72,2% | 10 343 | 8 203 | 26,1% |

| 3K 2018 | 2K 2018 | 4K 2017 | k/k | YTD | ||

| Net debt | 22 025 | 20 155 | 20 266 | 9,3% | 8,7% | |

| Net debt/EBITDA | 0,84 | 0,81 | 0,86 | 0,02 | -0,02 |

Source: company data, calculations by FINAM Group

Forecast for key financial indicators

| billion rubles, unless otherwise indicated | 2 016 | 2 017 | 2018F | 2019F | 2020P |

| Revenue | 78,4 | 91,0 | 93,6 | 96,7 | 102,9 |

| Revenue from electricity transmission | 77,1 | 83,7 | 89,2 | 95,5 | 101,6 |

| Sales of electricity and power | 0,0 | 6,0 | 3,3 | 0,0 | 0,0 |

| EBITDA | 13,4 | 23,6 | 24,8 | 25,7 | 28,0 |

| Height, % | 7% | 77% | 5% | 3% | 9% |

| EBITDA margin | 17% | 26% | 27% | 27% | 27% |

| Net profit of shares | 3,6 | 11,4 | 12,4 | 12,4 | 14,1 |

| Height, % | 6% | 214% | 10% | -1% | 14% |

| Net Margin | 5% | 12% | 13% | 13% | 14% |

| CFO | 8,1 | 13,5 | 17,0 | 22,1 | 21,9 |

| CAPEX | 7,6 | 9,9 | 11,4 | 13,1 | 15,5 |

| FCFF | 2,6 | 5,5 | 7,0 | 10,4 | 7,6 |

| Net debt | 22,7 | 20,3 | 19,2 | 14,8 | 12,5 |

| Ch.debt/EBITDA | 1,70 | 0,86 | 0,77 | 0,58 | 0,45 |

| Dividends | 1,3 | 4,5 | 4,6 | 4,1 | 4,0 |

| Payment rate, % profit according to IFRS | 37% | 40% | 37% | 33% | 29% |

| DPS, rub. | 0,012 | 0,040 | 0,041 | 0,036 | 0,036 |

| Height, % | 41% | 241% | 1% | -11% | -1% |

| DY | 6,5% | 11,5% | 14,8% | 13,1% | 13,0% |

Source: company data, forecasts of FINAM Group of Companies

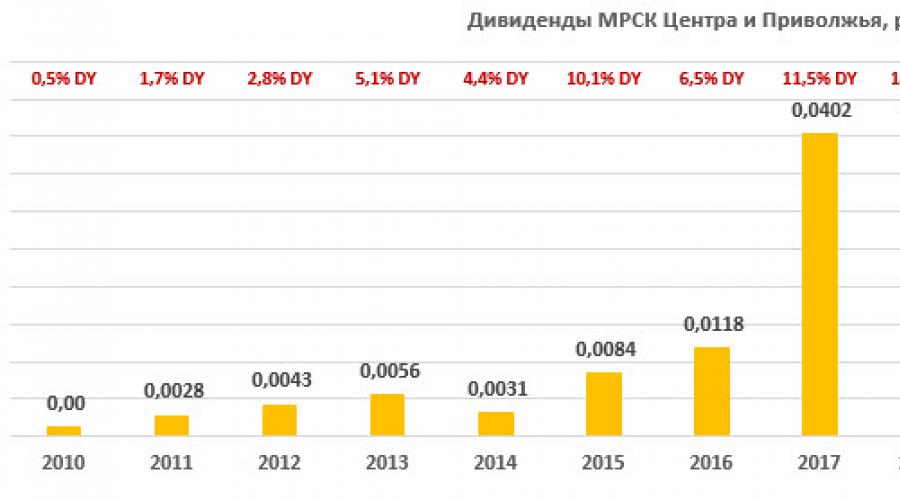

Dividends of IDGC of Center and Volga Region

In 2018, the company adopted a new dividend policy, typical for Rosseti subsidiaries. The dividend base is defined as 50% of the adjusted profit under RAS or IFRS, whichever is greater. Net profit is adjusted for a number of indicators - the investment program, flows from technical connections, revaluation of securities, etc.

Investors have received high dividends on MRKP in the last few years:

- The share of profit distribution for dividends amounted to 37% and 40% of profit under IFRS at the end of 2016 and 2017, respectively. According to RAS, the payment rate was 43% and 41% in 2016 and 2017, respectively.

- The average yield on dividends paid for 2016-2017 averaged 9.0% as of the record date.

- At the end of 2017, record dividends of 4.54 billion rubles were paid.

We have updated our dividend forecasts, making adjustments to profits for the investment program, flows from technical connections, etc. in accordance with the Rosseti formula. Payments, according to our estimates, will amount to 4.60 billion rubles, which is comparable to the volume of dividends last year of 4.54 billion rubles and assumes a distribution share of 37% of profits under IFRS. On a per share basis, the payment to shareholders in 2018E will be RUB 0.408. (+1.4%) with a yield of 14.8% to the current price.

Economist. More than 15 years of experience in finance. Date of: April 24, 2018. Reading time 5 minutes.

IDGC of Center, one of Russia's largest companies in the electric power industry, regularly pays dividends. In 2018, the company will pay dividends in the amount of 0.0208 rubles per share, allocating 0.879 billion rubles for these purposes. Payments will begin on June 14, 2018.

IDGC of Center PJSC is a large energy company in Russia that connects to power grids and transmits electricity to consumers in 11 regions of the Central Federal District, the total population of which is 13.6 million people. The organization emerged in 2004 as a result of the reform of the Russian electric power industry, and to this day it is steadily developing, improving production and financial results. The company also maintains and ensures the proper functioning of electrical distribution networks.

When IDGC of Center pays dividends

The share capital of the business company amounts to 4.2 billion rubles, the amount is divided into 42.2 billion ordinary shares. Securities are traded on the MICEX exchange under the ticker MRKC.

Briefly. The main shareholders of IDGC of Center are: PJSC Rosseti, which owns 50.2% of shares, and GENHOLD LIMITED (15%).

Over the past year, the organization has demonstrated a noticeable increase in key financial indicators:

- revenue in 2016 amounted to 86.1 billion rubles, in 2017 – 91 billion rubles;

- net profit in 2016 – 4.7 billion rubles, in 2017 – 2.98 billion rubles. (1.6 times drop);

- EBITDA in 2016 was 16.8 billion rubles, in 2017 – 19.4 billion rubles.

Company representatives explain this decrease in net profit by high income taxes. Accordingly, the high profit in 2016 was explained, among other things, by the tax benefit received.

IDGC of Center has been regularly paying dividends for the last 7 years. In the winter of 2018, management approved a new dividend policy, according to which fulfilling obligations to shareholders is the company’s priority, and at least 50% of net profit under IFRS for the reporting year will be allocated to income payments. Dividends are traditionally paid once a year, although management has the right to announce payment based on the results of the half-year, 1st and 3rd quarters.

Table 1. Timing and amount of dividend payments by IDGC of Center in 2017. Source: official website

The current yield is 10.08% and the DSI is 0.64.

Table 2. Timing and amount of dividend payments by IDGC of Center in 2018. Source: official website, investfuture.ru

What dividends will IDGC of Center pay in 2018?

Due to the decrease in net profit, a corresponding decrease in the dividend per share is expected. The forecast is shown below.

Table 3. History of dividend payments of IDGC of Center 2010-2018 Source: official website

How to receive dividends and become a shareholder?

According to the organization's dividend policy, among the main conditions necessary for the payment of income are the absence of signs of insolvency and the value of net assets exceeding the amount of the authorized capital. In accordance with generally accepted standards, the payment decision is made as follows.

- The Board of Directors of IDGC of Center makes recommendations on the amount of dividends based on an analysis of financial and economic indicators for the reporting period.

- The final decision is made by the General Meeting of Shareholders and announces the approved amount of income that investors will receive, the procedure and timing for closing the register and payment. Dividends are paid in cash.

A potential shareholder wishing to receive money for owning IDGC of Center securities must take into account the closing date of the register (dividend cut-off). At this time (information about it is published in advance on the official website www.mrsk-1.ru) a list of persons entitled to receive money is compiled. The register includes all actual shareholders who own the company's securities at that moment.

To receive dividends from IDGC of Center in 2018, you must become a shareholder before June 13, 2018 - this is the cut-off date for this year. It should be taken into account that information about the new owner is entered into the register within 2 days, which means the purchase transaction should be closed no later than June 11.

Briefly. Money is paid by bank transfer to the current bank accounts of the holders, which must be indicated in the register.

A private person can buy shares of IDGC of Center with the help of a brokerage company. This is an intermediary who has the right (certificate) to work in the stock market and carry out transactions for the purchase and sale of securities. After concluding an agreement with a broker and the client depositing money into the brokerage account, the broker will buy the company’s shares, enter all the data and send it to the registrar company IDGC of Center.

After this, the shareholder needs to follow the news on the company’s official website.

Video. Video about the policy of IDGC of Center in the field of innovation:

Higher education. Orenburg State University (specialization: economics and management of heavy engineering enterprises).

April 24, 2018.

Investment idea

IDGC of Center and Volga Region is a network company covering 9 regions with a total area of 408 thousand square meters. km with a population of 12.8 million people. The main business is electricity transmission. The controlling stake is held by Rosseti (50.4%).

We are starting to cover shares of MRSK of Center and Volga Region and recommend that investors “hold” MRKP securities with an expectation of dividends with a fairly attractive yield, which, according to our estimates, could be 9.1% and 7.9% for payments for 2018-2019. Target price for 12 months RUB 0.33. suggests 11% growth potential.

- Profit indicators in 2018-2019 According to our estimates, they will be lower than the extra-profitable year of 2017, but quite good. Net profit in 2018-2019 will be 8.1 and 7.6 billion rubles. compared to 11.4 billion rubles. in 2017, when the result was favorably influenced by a number of one-time factors. The net profit margin is expected to be quite high, above 8%.

- The current capex plan assumes progress on capex. This will remain a priority area for the use of funds, but cash flow, nevertheless, is expected to be positive and in sufficient volume, although it will decrease by 2019 to RUB 4.3 billion. from 5.5 billion rubles. in 2017

- Our conservative forecast for MRKP dividends for 2018 and 2019 is 2.7 and 2.3 kopecks. per share respectively. This is lower than the record payments for 2017 (4.0 kopecks), but suggests a rather interesting return to the current price of 9.1% and 7.9%, respectively. At the same time, we note the possibility of paying higher dividends.

|

Stock Key Indicators |

|

|

Market capitalization |

RUB 33.5 billion |

|

Qty. shares |

|

|

Animators |

|

Brief description of the issuer

IDGC of Center and Volga Region is a network company covering 9 regions with a total area of 408 thousand square meters. km with a population of 12.8 million people. The length of power lines exceeds 271 thousand km, the total capacity of power facilities exceeds 42.2 thousand MVA. The main business is electricity transmission.

Capital structure. The controlling stake is owned by PJSC Rosseti (50.4%). Free-float 27%.

|

Financial indicators, billion rubles. |

||||

|

Net profit of shares |

||||

|

Dividend, kop. |

||||

|

Financial ratios |

||||

|

EBITDA margin |

||||

|

Net Margin |

||||

|

Debt/own capital |

||||

Financial indicators

The net profit of IDGC of Center and Volga Region according to IFRS increased in 1Q2018 by 3% to RUB 4.3 billion. due to the growth of electricity transmission tariffs and the inclusion of income from the resale of electricity and capacity. Below are the main points of the reporting:

- Revenue from electricity transmission increased in the first quarter by 1.5% to RUB 23.3 billion. due to higher tariffs. Growth was limited by lower operating performance following the cancellation of last-mile contracts last year.

- Net electricity supply decreased by 2% to 13.66 billion kWh, but came out better than planned due to reduced losses.

- The company recorded revenue from the sale of electricity and capacity in the amount of RUB 3.3 billion. in connection with the performance of the functions of a supplier of last resort in the Vladimir region.

- Operating expenses showed rapid growth. As part of OPEX, expenses for the purchase of electricity to compensate for losses increased significantly (+18%) against the backdrop of rising prices for electricity and changes in the reflection of the cost of load losses in reporting, as well as electricity transmission services by 10%. In total, OPEX grew by 23% in 1Q 2018.

- EBITDA increased by 3% to RUB 7.7 billion, but the margin decreased to 28.8% (32.6%).

- Net debt has decreased since the beginning of the year by 20% to RUB 16.2 billion. or 0.68x EBITDA.

- Operating cash flow increased by 81%, to RUB 5 billion, free cash flow more than doubled, reaching RUB 4.3 billion.

|

million rubles, unless otherwise indicated |

1K 2018 |

1K 2017 |

Change, % |

|

EBITDA margin |

|||

|

Operating profit |

|||

|

Operating margin arrived |

|||

|

Net profit of shareholders |

|||

|

Net Margin |

|||

|

EPS, base. and adjustment, rub. |

|||

|

1K 2018 |

4K 2017 |

||

|

Net debt |

|||

|

Net debt/EBITDA |

|||

|

Debt/own capital |

|||

Source: company data, calculations by FINAM Group

The company's prospects in the coming years are more modest than the extra-profitable year of 2017, but quite good:

- Despite revenue growth in the first quarter, by the end of the year we expect reduction in profits from peak volumes in 2017. as a result of a decrease in production indicators against the backdrop of the cancellation of the “last mile” (useful supply -2%), growth in operating expenses faster than revenue). We also include contributions to the reserve for bad debts on accounts receivable in the amount of ~RUB 0.9 billion. (1Q 2018 reflected a decrease in the reserve by RUB 5.3 million).

As a result, the profit, according to our estimates, will be 8.1 billion rubles. (-29%). At the same time, we note that the reduction will occur from the high base of 2017 of 11 billion rubles, when the result was positively influenced by several one-time factors (restoration of the provision for doubtful debts, growth of net other income and the sale of electricity and capacity). Despite weakening revenue dynamics, profit margins and return on equity will remain in 2018-2019. at quite attractive levels - net margin is projected to average 8.4% (12.5% in 2017), ROE 15.6% (27%).

- The investment program remains a priority, and in 2018-2022. IDGC of Center and Volga Region will continue to increase capital investments. According to forecasts, capex will gradually progress over the next 5 years - from RUB 9.9 billion. in 2017 to 17.7 billion rubles. in 2022, and absorb about 80% of operating cash flow. By the end of the year, Rosseti may reveal more details on digitalization plans in the power grid complex.

- Cash flow is expected to be positive, but its dynamics will be limited. According to our estimates, FCFF in 2018 will remain virtually unchanged, but in 2019 it will decrease by 22% to RUB 4.3 billion. and will continue to stagnate due to the growing investment program.

- Net debt/EBITDA will rise moderately in 2018-2019 to 1.04-1.08x against the backdrop of declining profits and rising investments, but will remain at quite acceptable levels.

Forecast of financial indicators

|

billion rubles, unless otherwise indicated |

|||

|

Revenue (total) |

|||

|

Revenue from electricity transmission |

|||

|

Sales of electricity and power |

|||

|

EBITDA margin |

|||

|

Net profit of shares |

|||

|

Net Margin |

|||

|

Net debt |

|||

|

Ch.debt/EBITDA |

|||

|

Dividends |

|||

IDGC of Center and Volga Region is a network company covering 9 regions with a total area of 408 thousand sq. km. with a population of 12.8 million people. The main business is electricity transmission. The controlling stake is held by Rosseti (50.4%).

The company reported an increase in shareholder profits in the first half of the year by 12%, to 7 billion rubles, the level of electricity losses continues to decline, operating and cash flows have increased. We revised our earnings and dividend estimates upward and raised our target price from RUB 0.33 to RUB 0.39. and a recommendation from “hold” to “buy”, based on a growth potential of 39% over the next year.

- We believe that MRKP shares will remain among the leaders in dividend yield in the electric grid industry in 2018-2019. Projected profit volumes, positive cash flow and low debt burden allow us to maintain the payment rate at a level comparable to previous years. Our forecast dividend for 2018 is RUB 0.033. with DY 11.6% to the current price and 0.036 for 2019 with DY12.8%. An interim dividend may be paid for 9 months.

- Production figures for the first half of the year were above plan. Net supply decreased by 2.5% as a result of the cancellation of the “last mile” from July 1, 2017, but came out better than planned - partly due to a reduction in electricity losses. The loss rate, in particular, continues to decline – 7.65% in 1H2018 compared to 7.98% in 2017 and 8.97% in 2016.

- The shares are undervalued at forward multiples relative to the power grid complex by 44%, which we consider unfair given the high dividend payment rates compared to other companies in the power grid complex. Current levels are attractive for opening long-term long positions on MRKP.

Brief description of the issuer

IDGC of Center and Volga Region is a network company covering 9 regions with a total area of 408 thousand sq. km. with a population of 12.8 million people. The length of power lines exceeds 271 thousand km, the total capacity of energy facilities exceeds 42.2 thousand MVA. The main business is electricity transmission.

Capital structure. The controlling stake is owned by PJSC Rosseti (50.4%). Free-float 27%.

Financial indicators of IDGC of Center and Volga Region

| Financial indicators, billion rubles. | ||||

| 2016 | 2017 | |||

| Revenue | 78,4 | 91,0 | ||

| EBITDA | 13,4 | 23,6 | ||

| Net profit of shares | 3,6 | 11,4 | ||

| Dividend, kop. | 1,2 | 4,0 | ||

| Financial ratios | ||||

| 2016 | 2017 | |||

| EBITDA margin | 17,1% | 26,0% | ||

| Net Margin | 4,6% | 12,5% | ||

| ROE | 10,0% | 26,9% | ||

| Debt/own capital | 0,65 | 0,51 | ||

- IDGC of Center and Volga Region increased net profit to shareholders in the first half of the year by 11.7% to 7 billion rubles. and due to the growth of tariffs, reduction of losses, reflection of the sale of electricity as a supplier of last resort in the amount of 3.3 billion rubles. The effect was also caused by an increase in net other income by almost 2 times and a decrease in financial expenses by 27%.

- Production indicators for the first half of the year were better than planned. Useful sales decreased by 2.6% due to the cancellation of the “last mile” from July 1, 2017, but nevertheless came out better than planned by 2.4%, mainly due to a decrease in the volume of losses by 6.4%. Revenue from electricity transmission increased by 5.4%. Revenue from the resale of electricity as a supplier of last resort in the 1st half of the year amounted to 3.3 billion rubles instead of the planned 5.8 billion rubles.

- Operating margin decreased slightly amid outpacing growth in a number of major operating expense items, but this is the industry trend this year. In terms of OPEX, expenses for depreciation, payment of losses and services for electricity transmission, and property tax increased noticeably.

- Despite the increase in large items of operating expenses, the half of the year can be called successful. The company reduced losses by 6.4% in physical terms, operating and cash flow increased. We have improved our profit forecasts to RUB 9.38 billion. in 2018 and 9.35 billion rubles. in 2019, as well as on dividends.

- In the future, we see the opportunity to optimize the investment program. The government is currently discussing the option of paying for reserve capacity for large industrial consumers (over 670 kW). The option of paying for the reserve is being considered, starting from 2020 in the amount of 10% with an increase to 100% by 2024, and 100% immediately for new clients. We believe that this will have a limited impact on revenue indicators, but may lead to a redistribution of capacity between consumers and, accordingly, optimization of the investment program, which is on the rise and absorbs on average 80% of operating cash flow in 2018-2022. according to our estimates.

Key financial indicators of IDGC of Center and Volga Region

| million rubles, unless otherwise indicated | 1H 2018 | 1H 2017 | Change, % |

| Revenue | 47 797 | 41 973 | 13,9% |

| Operating expenses | 39 032 | 33 539 | 16,4% |

| EBITDA | 13 341 | 12 232 | 9,1% |

| EBITDA margin | 27,9% | 29,1% | -1,2% |

| Operating profit | 9 874 | 9 022 | 9,4% |

| Operating margin arrived | 20,7% | 21,5% | -0,8% |

| Net profit of shareholders | 6 993 | 6 258 | 11,7% |

| Net Margin | 14,6% | 14,9% | -0,3% |

| EPS, rub. | 0,062 | 0,056 | 10,7% |

| CFO | 7 397 | 6 319 | 17,1% |

| FCFF | 5 021 | 4 161 | 20,7% |

| 2K 2018 | 4K 2017 | ||

| Duty | 21 141 | 24 082 | -12,2% |

| Net debt | 20 155 | 20 266 | -0,5% |

| Net debt/EBITDA | 0,81 | 0,86 | -0,04 |

| Debt/own capital | 0,43 | 0,51 | -0,09 |

| ROE | 26,3% | 26,9% | -0,6% |

Source: company data, calculations by FINAM Group of Companies

Forecast of financial indicators of IDGC of Center and Volga Region

| billion rubles, unless otherwise indicated | 2 017 | 2018F | 2019F | 2020P |

| Revenue | ||||

| Revenue from electricity transmission | 83,7 | 87,6 | 92,4 | 97,3 |

| Sales of electricity and power | 6,0 | 3,3 | 0,0 | 0,0 |

| EBITDA | 23,6 | 21,3 | 21,5 | 23,2 |

| Height, % | 77% | -10% | 1% | 8% |

| EBITDA margin | 26% | 23% | 23% | 24% |

| Net profit of shares | 11,4 | 9,4 | 9,4 | 10,2 |

| Height, % | 214% | -17% | 0% | 8% |

| Net Margin | 12% | 10% | 10% | 10% |

| CFO | 13,5 | 16,3 | 16,9 | 18,1 |

| CAPEX | 9,9 | 11,4 | 13,1 | 15,5 |

| FCFF | 5,5 | 6,4 | 5,4 | 4,3 |

| Net debt | 20,3 | 19,9 | 19,7 | 21,1 |

| Ch.debt/EBITDA | 0,86 | 0,93 | 0,92 | 0,91 |

| Dividends | 4,5 | 3,7 | 4,0 | 4,3 |

| DPS, rub. | 0,040 | 0,033 | 0,036 | 0,038 |

| Height, % | 241% | -19% | 10% | 7% |

| DY | 11,5% | 11,6% | 12,8% | 13,6% |

Source: forecasts of FINAM Group of Companies

Dividends of IDGC of Center and Volga Region

In 2018, the company adopted a new dividend policy, typical for Rosseti subsidiaries. The dividend base is defined as 50% of the adjusted profit under RAS or IFRS, whichever is greater. Net profit is adjusted for a number of indicators - the investment program, flows from technical connections, revaluation of securities, etc.

Investors have received high dividends on MRKP in the last few years:

- The share of profit distribution for dividends amounted to 37% and 40% of profit under IFRS at the end of 2016 and 2017, respectively. According to RAS, the payment rate was 43% and 41% in 2016 and 2017, respectively.

- The average yield on dividends paid for 2016-2017 averaged 9.0% as of the record date.

- At the end of 2017, record dividends of 4.54 billion rubles were paid.