Bank reporting under IFRS - new requirements. Bank reporting under IFRS - new requirements Bank reporting under IFRS

- “Accounting (financial) reporting must give reliable an idea of the financial position of an economic entity as of the reporting date, the financial result of its activities and cash flows for the reporting period, necessary for users of these statements to make economic decisions"

Art. 13.1 of the Law “On Accounting in the Russian Federation”

Almost all major market participants reported for 2015 according to international financial reporting standards (IFRS). Significant discrepancies in financial results according to the national methodology and according to IFRS, despite the convergence of the two approaches, forced Banki.ru to delve deeper into this topic. This review examines the results of the 20 largest Russian credit institutions.

The table below shows the financial results of banks (top 20 by asset size, according to the financial rating of Banki.ru) according to RAS and IFRS.

Bank's name | License number | Profit/loss for 2015 according to RAS (thousand rubles) | Profit/loss for 2015 according to IFRS (thousand rubles) |

|

Sberbank of Russia | ||||

Gazprombank | ||||

FC Otkritie | ||||

Rosselkhozbank | ||||

Alfa Bank | ||||

Bank of Moscow | ||||

UniCredit Bank | ||||

Credit Bank of Moscow | ||||

Promsvyazbank | ||||

Raiffeisenbank | ||||

Bank "Saint-Petersburg" | ||||

Russian standard | ||||

Sovcombank |

N/A - no data. Bank Rossiya commented that it does not disclose IFRS statements for 2015 due to the international sanctions in force against it.

As you can see, the financial results using the two methods in almost all cases differ significantly from each other, and sometimes are completely different: for example, some banks show a profit under RAS and at the same time record a loss under IFRS, and vice versa.

This discrepancy is explained by significant differences in the principles of accounting and reporting under IFRS and according to the Russian methodology. Let's look at the main ones.

Form vs content

One of the fundamental differences between IFRS and RAS is the difference in determining the main priority when preparing financial statements. The conceptual framework establishes a general requirement: transactions must be recorded in accordance with their content, and not on the basis of the legal form alone.

This principle is clearly visible in many IFRSs: according to international standards, it is not so important what legal form a particular fact of economic activity is given - it is much more important what it represents from an economic point of view.

In Russian accounting, the situation is different: the emphasis is invariably placed on the form, rather than on the economic meaning of the transaction, which can lead, for example, to an incomplete reflection of the potential liabilities of the enterprise and, as a result, to incorrectly assessed risks and benefits.

Reflection of transactions according to the “Priority of economic content over legal form” approach allows you to objectively assess the state of affairs in order to make correct and effective investment decisions.

Fair value vs historical cost

IFRS adheres to the concept of fair value, the main purpose of which is to provide information about the financial condition and performance of an entity based on fair value. This approach estimates the value of assets and liabilities at the reporting date and provides a realistic view of the value of the business - vital information for any investor.

The concept of fair value is found in RAS, but there is no single concept, as well as the procedure for its application. In reality, the Russian methodology operates only with historical cost.

Professional judgment vs primary document

In IFRS, the decisive factor in the formation of accounting entries is the opinion of a specialist. In RAS, professional judgment of management is reduced to a minimum, and the basis for recording in accounting is the primary document. The fact that most financial specialists view Russian reporting solely as tax reporting cannot but have a corresponding impact on the reliability of the latter.

Discounting vs nominal payments

When accounting according to IFRS, value discounting is used, that is, amounts are recalculated taking into account the time value of money. This allows you to adhere to the vector mentioned above - generating reports for investors and creditors.

RAS does not oblige organizations to reflect any reporting items on a discounted basis (with the exception of long-term estimated liabilities).

Thus, in IFRS, discounting can be used when accounting for deferred payment for property, plant and equipment, intangible assets or inventories. According to RAS, such income/expenses are calculated based on the nominal amount of payments. The result may be a gap in the value of assets between RAS and IFRS.

Shareholder Help: Equity vs Profit and Loss

According to IFRS, contributions to capital made by owners/participants are recognized directly in equity, as are dividends distributed to owners/participants.

RAS does not provide for a separate procedure for accounting for income and expenses when carrying out transactions with owners, therefore, in practice, contributions to capital are reflected in the income statement.

Impaired long-lived assets vs overvalued book value

IFRS principles govern asset impairment. According to international standards, the economic “exhaust” from an asset is always greater than its book value: otherwise, its acquisition is simply impractical.

In the RAS methodology, the provision that intangible assets can be checked for impairment exists only in the form of a recommendation, that is, it is not mandatory. There are no rules at all regarding fixed assets, as a result of which the book value is often overstated.

Consolidation vs financial investments

IFRS provides the opportunity to generate consolidated reporting - unified reporting of the group (parent company and its subsidiaries). Consolidation is formed to provide information not only about those assets and liabilities that are legally owned by the parent company itself, but also about those that it controls. Thus, it is important to understand that the consolidated financial statements under IFRS, in addition to the parent organization, also include the results of subsidiaries, which also contributes to the emergence of discrepancies in financial results.

RAS does not contain the concept of consolidation (when preparing consolidated statements, Russian companies always rely on IFRS). All investments of the company in the authorized capital of other organizations are reflected as part of financial investments. At initial recognition they are measured at the cost of their acquisition. If shares are traded on an organized securities market, then at each reporting date they are reflected in the statements at market value.

Conclusion: same goals, different results

Currently, the declared goals of reporting in accordance with IFRS and reporting according to Russian standards are the same - to provide a reliable picture of the activities of the enterprise/organization. Moreover, IFRS is now “developing” almost according to the Russian version, namely: it provides more and more detail - the number of pages in the collection of IFRS standards has increased more than tenfold over the past ten years.

However, many of the banks examined show a completely different picture when analyzing their statements under RAS and IFRS. The discrepancies are due to the fact that in the domestic approach the emphasis is on the compliance of financial statements with the provisions of legislative acts, while in IFRS attention is paid to the usefulness of information in making economic decisions for a wide range of users. That is, the economic essence of financial information.

It turns out that the declared goals are the same, but the results are different.

From theory to practice

Declining profitability and losses

It is important to separately note that the main reason for the reduction in profitability and losses of Russian banks in 2015 was the decrease in solvency and the level of real income of borrowers, which led to an increase in overdue debt and, as a consequence, the need to form reserves for possible losses. Thus, according to the Central Bank of the Russian Federation, overdue loans (including interbank loans) as of January 1, 2016 amounted to more than 3 trillion rubles, which is 54% higher than the previous year. At the same time, reserves for possible losses at the end of 2015 increased by more than 1 trillion rubles, amounting to 4.53 trillion rubles as of January 1, 2016, which significantly worsened the profitability indicators of banks.

Another, no less important reason is the decrease in net interest income due to the significantly increased cost of funding and raising resources for banks (as a result of a sharp increase in the key rate by the Bank of Russia in December 2014). According to the 102nd form of banks as of January 1, 2016, net interest income of the banking sector for 2015 decreased by about 430 billion rubles (-17.1%), amounting to 2.09 trillion rubles.

Discrepancies in the amount of reserves

The amount of accrued reserves under IFRS in most cases turns out to be higher than the reserves accrued under RAS. The key point that determines the difference is the fact that according to IFRS, the calculation of the reserve does not take into account the property pledged as collateral: the emphasis is on the assessment of the borrower himself (or his business) and its ability to generate cash flows. (Property can be taken into account only if it has a reliable valuation and high liquidity.) According to Russian standards, if a number of requirements are met, the pledge of property can significantly reduce the amount of the actually created reserve. Thus, there are often cases when the amounts of the calculated and actually created reserves differ radically due to the accounting of property, which leads to a distortion of the real economic meaning.

In this regard, a number of problems arise in Russian practice: difficulties in the professional assessment of property and the fairness of its collateral value, its liquidity, quality of monitoring, etc. The most striking confirmation of the current situation is the creation today of separate banking departments for working with non-core assets that are desperately trying to sell those same “highly liquid” pledges and return at least part of the funds to the bank.

Separately, we note that according to IFRS, in the bank’s balance sheet, the amount of loans provided to customers is adjusted by the amount of reserves created for possible losses and is reflected at the “net” or “cleared” value in the line “Loans and receivables”.

Below is a table reflecting the amount of formed reserves for 2015 (banks from the top 20 in terms of assets, according to the financial rating of Banki.ru) according to RAS and IFRS.

Position by net asset size | Bank's name | License number | Volume of formed reserves for the reporting period (RAS), (thousand rubles) | Volume of formed reserves for the reporting period (IFRS), (thousand rubles) |

Sberbank of Russia | ||||

Gazprombank | ||||

FC Otkritie | ||||

Rosselkhozbank | ||||

Alfa Bank | ||||

National Clearing Center | ||||

Bank of Moscow | ||||

UniCredit Bank | ||||

Credit Bank of Moscow | ||||

Promsvyazbank | ||||

Raiffeisenbank | ||||

Bank "Saint-Petersburg" | ||||

Khanty-Mansiysk Bank Opening | ||||

Russian standard | ||||

Sovcombank |

VTB (IFRS-profit 1.7 billion rubles; RAS-profit 49.1 billion rubles)

Let us remind you that according to RAS, VTB does not provide consolidated statements, but only the results of the parent bank. It is the consolidation of reporting under IFRS that largely explains such a significant discrepancy in financial results. The VTB Group includes about 20 organizations operating in different segments of the financial sector, including outside Russia. The financial results of the subsidiaries determined such significant discrepancies in the indicators. There was also a significant difference in the volume of reserves formed for possible losses: according to RAS, the figure was 54.9 billion rubles, and according to IFRS - 167.5 billion rubles.

Rosselkhozbank (IFRS-loss of 94.2 billion rubles, RAS-loss of 75.2 billion rubles)

Note that interest income and expenses of Rosselkhozbank according to RAS for 2015 were significantly higher than according to IFRS. This fact is explained by the fact that in IFRS reporting, interest income and expenses for all debt instruments are reflected using the effective interest rate method (which includes all commissions and fees, as well as transaction costs, discounts, etc.). If the bank has doubts about the timely repayment of issued loans and other debt instruments, they are written off to their recoverable amount, with subsequent recognition of interest income based on the effective interest rate.

Representatives of Rosselkhozbank did not provide comments on this issue.

BM Bank (formerly Bank of Moscow) (IFRS-profit 1.2 billion rubles, RAS-loss of 63.7 billion rubles)

An interesting fact is that according to IFRS the group showed positive net interest income after deducting reserves, but according to RAS they were negative. It is also worth noting that according to RAS the bank shows a positive revaluation of foreign currency (about 16.3 billion rubles), while according to IFRS the group suffered significant losses on this item. This is explained by the fact that when calculating the revaluation of foreign currency assets, as well as RAS standards, the bank used preferential rates established by the Central Bank of the Russian Federation in order to reduce regulatory risks that arose as a result of the sharply increased volatility of the ruble in the period of late 2014 - early 2015. Please note that from April 1, 2016, preferential rates were abolished.

Representatives of the bank explained the above discrepancies as follows: “The difference in the financial result is caused by approaches to risk assessment: according to IFRS, the assessment is more conservative; the creation of reserves for loan losses was carried out in the previous period (in 2014). Also, according to IFRS, the necessary reserves for assets included in the Volga Federal District were created at the beginning of the process of financial rehabilitation of the bank, and according to RAS they are created evenly in accordance with the agreed schedule.”

"Russian Standard" (IFRS-loss of 14.097 billion rubles, RAS-profit 14.364 billion rubles)

The key factor that contributed to such a large discrepancy in the results obtained was the financial assistance provided to the bank by its shareholder. The bank’s press service explained to us that “financial assistance to the bank from a shareholder in RAS is reflected through the “Profits and Losses” section; in IFRS it is reflected directly in the bank’s capital.”

The amount of contributions to reserves for possible loan losses also had a significant impact on the bank’s financial results. Thus, according to RAS, the volume of reserves (24.623 billion rubles) turned out to be noticeably less than the deductions generated under IFRS (48.559 billion rubles).

It should be noted that in order to reduce operating costs, the bank seriously reduced the number of employees over the year (from 18,924 to 8,492 people), the number of divisions (from 312 to 161) and stopped implementing individual investment projects, switching to the development of new products in the hope of increasing profitability in the future .

Sovcombank (IFRS-profit 19.295 billion rubles; RAS-profit 10.240 billion rubles)

In the case of Sovcombank, it is important first of all to note that the IFRS indicators are the consolidated results of the Sovcombank group, which, in addition to the credit institution, also presents data from subsidiaries, affiliates and joint ventures and enterprises of the group. A significant portion of Sovcom's profits in 2015 came from transactions with securities - the group's portfolio showed significant growth over the year. The volume of accrued reserves under IFRS (9.021 billion rubles) was less than those reserves that the bank accrued under RAS (13.463 billion rubles), and the bank's net interest income was slightly higher than the results obtained under RAS. These factors combined contributed to the difference in profits received.

The clarity and efficiency of banking accounting make it possible to monitor the safety of funds, cash flow and the state of settlement and credit relations.

Main tasks of accounting in banks

Banking accounting in credit institutions is characterized by efficiency and unity of form of construction. This is manifested in the fact that all settlement, credit and other transactions carried out in the bank during operating hours are reflected on the same day in the personal accounts of analytical accounting and are controlled by drawing up the daily balance sheet of the bank. A uniform accounting system for all banks is a necessary condition for analyzing banking activities.

Accounting in banks is closely related to accounting in other sectors of the economy. This connection is determined by the activities of banks in settlement, cash and credit services to enterprises, organizations and institutions. Operations carried out by banks on lending, settlements, etc. are reflected in the accounting records of business entities. Banking transactions reflected in the assets of the bank's balance sheet correspond to liabilities in the balance sheets of enterprises and organizations and show the amount of bank loans received. At the same time, the funds of enterprises and organizations on settlement, current and other accounts are reflected in their balance sheets as an asset, and in the bank’s balance sheet as a liability.

To prepare financial statements in accordance with IFRS on the basis of Russian financial statements, credit institutions are recommended to use the transformation method, the essence of which is to regroup the items of the balance sheet and profit and loss statement. At the same time, banks themselves make the necessary adjustments and apply professional judgments (professional opinions of responsible persons of a credit institution, formed on the basis of an objective interpretation of available information about specific operations and transactions of a credit institution in accordance with IFRS requirements). As a result, the credit organization’s accounting system generates information for external and internal users. Such users may include actual and potential investors, employees, creditors, clients and authorities, as well as the public at large. They may have different interests: investors and their representatives are interested in information about the riskiness and profitability of their actual and planned investments; Lenders are interested in information to determine whether the loans they make will be repaid on time and interest paid. Since the interests of users vary significantly, accounting cannot satisfy all the information needs of these users in full, so the collected accounting information is focused on meeting the most common needs.

With regard to information for internal users, international standards see the purpose of accounting as generating information useful to management for making management decisions. It is assumed that information for external users is also formed on the basis of information intended for internal users, which relates to the financial position of the credit institution, results of operations and changes in financial position.

In accordance with the Methodological Recommendations “On the procedure for the preparation and presentation of financial statements by credit institutions” (Letter of the Central Bank of the Russian Federation dated December 23, 2003 No. 181-T), the management body of the credit institution approves the accounting policy for the preparation of financial statements in accordance with IFRS, as well as the structure and the contents of the forms of said financial statements.

The preparation of financial statements in accordance with IFRS must be properly regulated. Such regulations must contain the procedure for preparing and approving financial statements in accordance with IFRS, including statements of regrouping and adjustments of balance sheet and profit and loss account items, documented professional judgments, as well as the procedure for storing said documentation for the periods established for Russian reporting by Russian legislation. Federation and regulations of the Central Bank of the Russian Federation.

In addition to such purely formal procedures as the signing of the bank’s financial statements by the head and chief accountant (these persons, according to the legislation of the Russian Federation, are responsible for the reliability of the financial statements), the regulations establish the procedure for execution, endorsement, approval, signing, storage of documentation, including regrouping statements, professional judgments and adjustments to the Russian financial statements based on these professional judgments, as well as other adjustments included in the financial statements of the credit institution in accordance with IFRS.

International standards place great emphasis on professional judgment. Therefore, it is recommended to identify the circle of responsible persons in a credit institution, to whom the head of the credit institution grants the right to form professional judgments in each of the areas of the organization’s activities and to make adjustments to Russian financial statements based on these professional judgments. This circle should include officials from among the managers of the credit institution, who are required to verify the objectivity of the professional judgments formed and the adjustments made to the Russian financial statements based on these judgments.

And most importantly, within the credit organization there must exist (or be created) a unit responsible for summarizing all adjustments to Russian financial statements received from the relevant divisions of the credit organization, as well as officials of the credit organization who check the correctness of summarizing all adjustments to Russian financial statements for the purpose of preparing financial statements in accordance with IFRS.

Accounting is maintained by the bank continuously from the moment of its registration as a legal entity until its reorganization or liquidation. In accordance with IFRS, financial statements are considered prepared if all standards in force at the beginning of the reporting period for which the financial statements are prepared are used.

General characteristics of financial reporting elements

In order to understand the specifics of preparing financial statements in credit institutions in accordance with international standards, let’s consider its elements. The elements of financial statements are economic categories that are concerned with providing information about the financial condition of a bank and the results of its operations. They represent financial transactions grouped into classes according to their economic characteristics. These elements are necessary to assess the financial position and performance of the bank.

The elements of financial statements prepared under IFRS that are directly related to the measurement of a bank's financial position are assets, liabilities and equity, which are determined accordingly.

The definitions of assets and liabilities show their basic characteristics, but do not attempt to reveal the criteria they must satisfy before they are recognized on the balance sheet. Thus, the definitions include items that are not recognized as assets or liabilities on the balance sheet until they satisfy the recognition criteria.

When deciding which definition (asset, liability or capital) the item in question meets, special attention should be paid to its underlying essence and economic reality, and not just to its legal form. Thus, for example, in the case of a finance lease, the essence and economic reality is that the lessee receives the benefit of using the leased asset for the majority of its useful life in exchange for an obligation to pay for this right an amount approximately equal to the fair value of the asset , and related finance charges.

Balance sheets prepared in accordance with international standards may include items that do not meet the definitions of an asset or liability and are not shown as part of equity.

In addition, the financial statements must reflect the income and expenses of the credit institution.

Recognition of elements of financial statements

Recognition is the process of including in the balance sheet or income statement an item that meets the definition of an accounting element and satisfies the recognition criterion. The recognition criterion has the following components:

- it is probable that the bank may or may not realize future economic benefits attributable to the item;

- the article can be reliably assessed.

Certain transactions that have the essential characteristics of an element but do not qualify for recognition may nonetheless merit disclosure in notes, explanatory material or supplementary tables accompanying the financial statements. This is necessary when information about the transaction is considered relevant for assessing the financial position of the credit institution and the results of its operations.

Requirements for the structure and content of financial statements

In accordance with the requirements of IFRS, financial statements must provide information about the financial position, results of operations of a credit institution and its cash flows. This information should be useful to a wide range of users when making economic decisions.

Financial statements must be clear and understandable. It is based on accounting policies, which may differ from the accounting policies of other credit institutions. Therefore, for a correct understanding of financial statements, it is necessary to consider the most important principles of accounting policies on the basis of which these statements are prepared. In accordance with international standards, analysis of accounting policies is an integral part of financial statements.

- balance sheet as of the reporting date;

- profit and loss statement for the reporting period;

- cash flow statement for the reporting period;

- report on changes in equity (capital) for the reporting period (that is, a report showing all changes in capital, or not related to the authorized capital);

- Notes to the financial statements (including the accounting policies applied in preparing the financial statements).

- financial review, which includes current results, financial positions, and emerging uncertainties;

- environmental report;

- value added reports, etc.

The financial statements also need to reflect the methods of control and management of liquidity and solvency, as well as the methods of control and management of risks associated with banking operations.

Particular attention should be paid to disclosing credit risk management methods. Such methods include:

- analysis of the loan application and feasibility study of the loan project;

- analysis of the borrower's credit history;

- analysis of the borrower's financial statements in order to determine its creditworthiness;

- choosing a form of loan security;

- setting interest rates;

- creation of loan reserves.

- the agreed exchange rate is a condition included in the loan agreement, according to which the payment amount changes depending on the change in the exchange rate of the payment currency;

- hedging is a method of insuring risk by entering into an alternative transaction for the same amount and the same period.

The identifying data of the financial statements are:

- name of the credit institution;

- type of reporting: consolidated/unconsolidated;

- reporting date, reporting period;

- reporting currency;

- units of measurement (for example, thousand, million).

The Central Bank of the Russian Federation has proposed approximate forms included in financial statements in accordance with IFRS. These forms can be changed by a credit institution in order to ensure the best reflection in financial statements prepared in accordance with international standards of the structure and specifics of the credit institution’s operations, the volume of transactions performed, etc. This can be done, for example, by excluding or combining individual items of the bank’s financial statements due to the absence or insignificance of the volumes of individual transactions, as well as introducing additional items of financial statements for transactions, the size and nature of which, based on the principle of materiality, is such that their separate presentation in the financial statements reporting will enhance the transparency and quality of the information presented in these financial statements. This is done to ensure that financial statements are adequately understood by users.

Main contents of financial statements

Balance sheet. The financial position of a credit institution varies depending on the funds it has, the ratio of short-term and long-term assets and liabilities, as well as the ability to restructure its activities in relation to market conditions. Information on the financial position is reflected in the balance sheet, intended to provide information on the financial position of the credit institution as of the reporting date.

There are two methods of presenting assets and liabilities on the balance sheet:

- by classification: current (current) and long-term;

- in descending order of liquidity.

In accordance with IFRS, the balance sheet includes:

- fixed assets;

- intangible assets;

- financial investments;

- accounts receivable;

- capital and reserves;

- stocks;

- provisions for impairment of assets;

- tax liabilities and assets;

- accounts payable.

Other requirements for subclassification are contained in individual standards.

In relation to the authorized capital, the following information must be disclosed in the balance sheet:

- number of authorized shares;

- number of issued and fully placed shares;

- number of shares issued but not fully placed;

- par value of the share;

- reconciliation of changes in the number of shares;

- rights, priorities and restrictions on shares;

- treasury shares;

- shares under options or for sale (conditions and amounts).

Gains and losses report. An assessment of the current state of affairs in a credit institution can be based on an analysis of the current and previous financial situation. Information about the results of operations is contained in the income statement. The profit and loss statement is intended to present information about the bank's performance for the reporting period. It also contains information about profit-generating activities and funds earned or spent during a certain period. It reflects not only the final financial results of activities obtained during the reporting period, but also the absolute and relative levels of profitability achieved during the time that has passed since the date of the previous report.

IFRS impose certain minimum requirements for the content of the income statement, according to which this report must contain the following information:

- revenue;

- operating results;

- share of profits and losses of associates and joint ventures accounted for using the equity method;

- tax expenses;

- income and expenses from ordinary activities;

- performance results in emergency circumstances;

- net profit or loss for the period.

Classifying expenses by origin means that items such as wages, depreciation, etc., reflected in the income statement, are simple amounts of homogeneous costs. Classification of expenses by function implies their analysis in terms of three main items that should be indicated:

- depreciation charges for tangible assets;

- depreciation charges for intangible assets;

- staff costs.

The main idea of the income statement is to adjust the revenue received in the reporting period by adding the amount of income received and subtracting the amount of expenses incurred, which ultimately gives the amount of net profit for the reporting period.

Statement of changes in capital. A credit institution must present a statement of changes in equity showing the increase or decrease in net assets between two reporting dates.

This report is an integral part of the financial statements. The form for its provision contains separate information for each element of share capital. In accordance with IFRS, the statement of changes in capital must contain the required minimum information on the following results of the bank’s activities:

- net profit (loss) for the period;

- items of income (expenses) included in capital, as well as the amount of these items;

- changes in accounting policies and their consequences;

- results of corrections of fundamental errors.

- transactions with owners in relation to capital and transactions for the distribution of capital with owners and shareholders;

- reconciliation of the balance of profit or loss at the beginning and end of the period;

- reconciliation of the carrying amount of share capital, share premium and each reserve at the beginning and end of the period.

Cash flow statement. The bank's cash flow statement is important for assessing its activities for the reporting period. When preparing a cash flow statement, changes in cash balances can be identified according to their impact on the bank's operations. This report provides a basis for assessing a bank's ability to generate cash and cash equivalents and its need to utilize those cash.

To prepare a cash flow statement, IFRS 7 has been developed, which bears the same name. The purpose of this standard is to reflect in financial statements information about changes in cash and cash equivalents.

Notes to the financial statements

The notes to the financial statements include material, complete and most useful information for users of the financial statements of the credit institution. Typically, notes to financial statements consist of the following main blocks.

1. General information about the credit institution and the nature of its activities, including:

- location and legal form of the credit institution;

- description of the nature of the operations and main activities of the credit institution;

- the name of the parent company of the credit institution and the main parent company of the group (the parent company is considered to be an economic entity that has a significant stake in the authorized capital, or, in accordance with the concluded agreement or otherwise, has the opportunity to exercise a decisive influence on the decisions made by the credit institution);

- average annual number of personnel for the reporting period or number of personnel as of the reporting date;

- other information of a general nature, at the discretion of the credit institution (for example, information about available licenses, the number and location of branches, etc.).

2. Statement of reporting compliance with IFRS requirements, which records the compliance of the prepared financial statements with the requirements of IFRS, information on the basis for the preparation of financial statements (for example, the presented financial statements are unconsolidated or consolidated).

3. Supporting transcripts to information for articles presented in the main reports.

4. Auxiliary (additional) information that is not presented in the financial statements themselves, but is necessary for the perception of financial statements by users (for example, a description of the economic situation in the country (countries) or region (regions) in which the credit institution operates.

5. Information on the principles of accounting policies adopted by the credit institution for the purposes of preparing financial statements. Information about accounting policies is necessary for a correct understanding of financial statements. In this case, the accounting policy pursued must be based on relevant international standards or their interpretations. The accounting policy must reflect the following main aspects of the credit institution’s activities:

- revenue recognition;

- principles of consolidation;

- acquisitions and mergers (business combination);

- joint ventures;

- recognition and amortization of tangible and intangible assets;

- capitalization of interest or other expenses;

- construction contracts;

- investment property;

- financial instruments and investments;

- leasing and rental;

- R&D;

- stocks;

- taxes, including deferred taxes;

- reserves;

- employee benefits;

- foreign exchange transactions and hedging transactions;

- principles of segment reporting;

- identification of highly liquid assets;

- accounting for inflation;

- additional funding from the state.

6. Additional analytical information on all significant items of the balance sheet, profit and loss statement, cash flow statement and statement of changes in equity (capital) in accordance with IFRS requirements.

7. Characteristics of the credit institution’s activities by segments in accordance with the requirements of IFRS 14 “Segment Reporting”.

8. Description of the activities of the credit institution in managing financial risks, including credit, market, country, currency, liquidity and interest rate.

9. Description of the credit institution’s contingent liabilities and transactions with derivative financial instruments. This block discloses information about current and possible legal proceedings; tax and credit obligations, as well as those related to the financing of capital investments and operating leases; transactions with derivative financial instruments; transactions with assets held in custody, pledged, etc.

10. Information on the fair value of financial instruments, determined in accordance with the requirements of IFRS 39 “Financial instruments: recognition and measurement”.

11. Information on transactions with related parties in accordance with the requirements of IFRS 24 “Disclosure of information about related parties”.

12. Information on significant events that occurred after the reporting date, but before the date of signing of the financial statements by the management of the credit institution and the conclusion of the audit organization.

13. Other significant information about the activities of the credit institution in the reporting period. Such information may be necessary for users of financial statements for a comprehensive and objective assessment of the performance of a credit institution in the past, as well as for a reliable forecast of the effectiveness of its activities in the future.

The notes to the financial statements should be presented in an orderly manner. For each line item in the credit institution's balance sheet, income statement, cash flow statement, and statement of changes in equity, reference should be made to any relevant information in the notes.

It should be noted that, in accordance with IFRS, the management of a credit institution is encouraged to, in addition to reporting, provide an analysis of the financial performance and position of the organization, as well as describe the main difficulties that management has to deal with. This analysis may include issues such as the main factors influencing the institution's performance, changes in the environment in which it must operate, dividend policies, and financing and risk management policies.

A.V. Suvorov, MSUTU, Ph.D.

When preparing reports for 2008, banks were guided by the Methodological

Russian recommendations “On the procedure for drawing up and presenting credit

financial reporting organizations" set out in the Letter of the Bank of Russia dated

February 16, 2009 No. 24-T, which contain the requirements of IFRS as of

January 1, 2008

Every year the Bank of Russia prepares new Methodological Recommendations, but they

do not contain explanations on possible early application of new standards

and interpretations, as well as changes made to existing standards.

Authorized capital of banks created in the form of companies

with limited liability

In February 2008, the IASB issued amendments

to standards that allow banks created in the form of limited companies

assigned responsibility, show capital in reporting, i.e.

improve financial performance and ratio analysis. These amendments

Not a single bank applied early.

Taking into account the requirements of IFRIC 2 “Equity participation in cooperatives

and similar financial instruments" (Members’ Shares in Co-operative Entities and

Similar Instruments), authorized and additional capital, accumulated unrealized

bathroom profit and other capital items of LLCs registered in Russian-

legislation, were previously usually classified in reporting according to

IFRS as debt instruments. Such banks did not have a “Capital” section

in the balance sheet, but only the subsection “Net assets attributable to owners”

in the “Long-term liabilities” section.

This requirement is established by the data legal regulation document

organizations. So, according to Art. 26 of the Law “On Limited Liability Companies”

“1 participant of the company has the right to leave it at any time independently

Simo from the consent of its other participants or society. The company is obliged to pay

show the participant who submitted an application to withdraw the actual cost

his shares or give him property of the same value within six months

from the end of the financial year in which the application for withdrawal was submitted

company, unless a shorter period is provided for by its charter.

According to the requirements of IAS 32 “Financial instruments: presentation

information" and KIMFO 2, these organizations do not have the right to obstruct

to pay off the obligation, so they cannot show in the financial statements

capital and must recognize liabilities to participants in the amount of net

assets.

1 Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies”

ness."

This interpretation did not allow Russian banks to report

according to IFRS capital, except for consolidated groups where the parent company,

created in the form of an LLC, was a resident of other countries, in legislation

which probably do not have a norm on the possibility of unhindered exit.

In February 2008, the IASB published changes to IAS 1

Presentation of Financial Statements and IFRS 32 and related financial

instruments similar in characteristics to ordinary shares and accounting

included in financial liabilities. These changes are mandatory

for use from reporting periods that begin on January 1, 2009. Rules

their early application is similar to any early application of IFRS,

i.e. with disclosure of this fact and additional information in the notes

to financial statementsb

In the Methodological Recommendations “On the procedure for compiling and presenting

credit organizations financial statements” is set out in force before

January 1, 2009, the procedure for reflecting LLC capital. The data is presented in table. 1.

Table 1

Rules for reflecting the capital of a bank created in the form of an LLC

Reflection in financial statements under IFRS of obligations to participants

kami of the relevant LLCs in the amount of net assets cannot fully

reveal the essence and nature of these financial instruments. Contributions to statutory

capitals of limited liability companies inherently correspond

contributions to the capital of any other companies, with the exception of simplified procedures

leaving society.

The changes made by the IASB do not affect compliance with all

requirements established in IFRS 32 necessary for classifying data

instruments as equity instruments, i.e. as part of capital.

The requirements for participants to receive a portion of their net assets are set out in clause 16(a)

IFRS 32. These include the following:

2 Letter of the Central Bank of the Russian Federation dated February 16, 2009 No. 24-T “On methodological recommendations “On the procedure for compiling

registration and presentation of financial statements by credit institutions." P. 52.

Ownership of an equity instrument gives the holder the right to receive

proportional share in net assets in the event of liquidation of the LLC;

- the instrument belongs to the class of instruments that are the least valuable

priority over other claims in respect of assets, based on the established

the priority established by law for the execution of creditors’ claims,

whereas the demands of all participants are equal and are determined only by the share of participants

Nika;

- the requirements of society participants have the same properties, not

have no more characteristics (except that a member of society has the right

leave the society at any time, regardless of the consent of its other participants

or a company with payment of his share), which would satisfy the criteria

classification as a financial liability;

- expected cash flows for the instruments under consideration are determined

are mainly profit or loss, changes in the value of net

assets or changes in the fair value of recognized and unrecognized

net assets of the company during the term of the instrument (not including

any influence from the instrument itself);

- the company has not issued any other instruments with terms similar to

reasonable terms of shares in companies that significantly limited or

would establish fixed compensation for residual income of holders

tools.

These criteria are met for most Russian LLCs, especially

for banks, since the Central Bank of the Russian Federation sets requirements for the amount of the authorized

capital. In this regard, we believe that it is advisable for banks to use

amendments to IFRS 1 and IFRS 32 and classify the net assets of companies

as equity rather than liabilities in the 2009 accounts.

Presentation of financial statements

New edition of IAS 1 Presentation of Financial Statements

contains major amendments related to the separation of operations with property

nicks and shareholders from other changes in equity capital. Data

changes enhance user capabilities for analysis and comparison

financial reporting data.

The release of a new edition of the standard is associated with the implementation of a joint project

The IASB and the US Financial Accounting Standards Board (FASB) on conversion

IFRS and US GAAP geniuses. The changes made are aimed at bringing

in accordance with IFRS 1 and FAS 130 “Statement of Comprehensive Income”3.

In the new edition of IFRS 1, the names of the reporting forms have been changed: “accountant

"balance sheet" to "statement of financial position"

position); in the English version - the name of the cash flow statement

(cash flow statement to statement of cash flows). Despite the fact that IFRS 1 uses

The terms “other comprehensive income”, “profit or loss” and “total

total income", credit organizations have the right to use other terms

3 FAS 130 Statement of Comprehensive Income was adopted in June 1997 and is effective for reporting periods

starting from December 15, 1997

To indicate the total amounts, provided that their meaning embedded in the standard

darte, is not distorted.

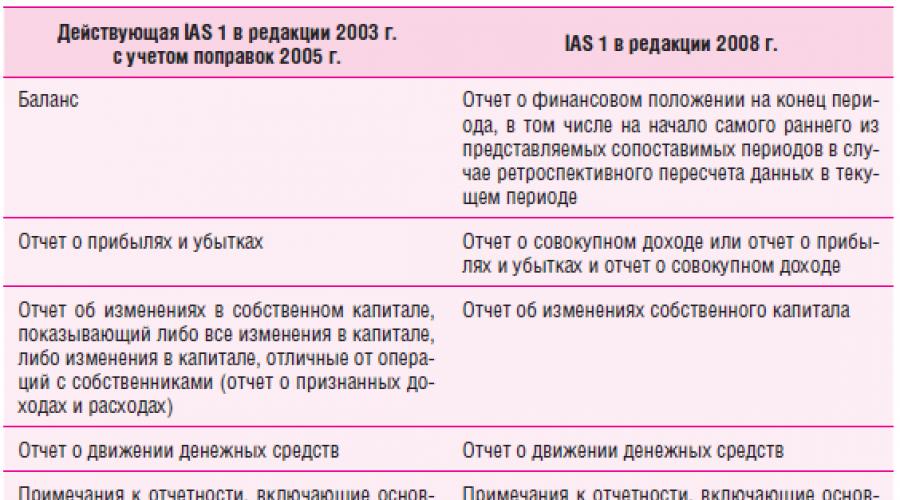

A comparison of editions of IFRS 1 is presented in table. 2.

table 2

Comparison of editions of IFRS 1

.png)

Changes in the presentation of capital are caused by new requirements for

identification of financial reporting components based on the aggregation of similar

characteristics within one report. In addition, a new form has been introduced - report

about total income. Changes in the capital of a credit institution during the reporting period

periods relating to transactions with owners must be presented

as part of the statement of changes in equity. Other changes in capital

income that are not related to the owners are reflected in the statement of comprehensive income.

The concept of “comprehensive income” is similar to that

US GAAP concept and means the change in the volume of the company’s net assets over

reporting period as a result of transactions or other events, the source of which

are not its owners. Total comprehensive income includes all components

nents of “profit or loss” and “other comprehensive income” that cannot

be included in the income statement due to the fact that they do not meet

criteria for recognizing it in profit or loss. In terms of components

other comprehensive income refers to those types of income and expenses that

previously reflected directly in capital.

Other comprehensive income includes:

- changes in the amount of the reserve for revaluation of fixed assets, with the exception of

the impairment recorded in profit/loss;

- actuarial gains and losses on defined benefit plans

payments recognized in accordance with IAS 19 Remuneration

employees";

- profits and losses arising from the restatement of financial statements -

of foreign operations IAS 21 “The Impact of Changes in Currency

courses";

- profits and losses arising from the revaluation of financial assets,

classified as available for sale (IAS 39)

“Financial instruments: recognition and evaluation”);

- change in the value of the cash flow hedging instrument,

profit or loss on the hedging instrument attributable to its effectiveness

tive part (IFRS 39).

Sample form of a statement of other comprehensive income for the option with two

reports are presented in table. 3.

Table 3

Sample form of a statement of other comprehensive income for the year,

.png)

In accordance with Appendix 4 to the Regulations of the Bank of Russia dated March 26

2007 No. 302-P “On the rules of accounting in credit institutions”

ations located on the territory of the Russian Federation" the profit and loss statement contains

components that, according to the new requirements of IFRS 1, must be reflected

in the statement of other comprehensive income.

The new edition of the standard changes the requirements for information disclosure.

They relate to both reclassification adjustments and presentation

comparable data.

Reclassification adjustments are those amounts that have been reclassified

included in profit or loss of the current period that was recognized

included in other comprehensive income in the current or previous periods.

The components of other comprehensive income included in equity are

upon disposal of financial assets should be included in the statement of other items

total income. For example, transferring a reserve from capital to the statement of other

total income, called recycling of components of other total

income, in the new edition of IFRS 1 received the name “reclassification”

reclassification adjustment.

At the same time, such operations did not have any new content; only the

requirements for their disclosure. They must be reflected for each component

other comprehensive income in the statement of comprehensive income or in the notes.

This is necessary for users to have a clearer understanding of the report structure

on profits and losses and to avoid double counting. This approach allows

see the results of managing resources entrusted to the management of the organization.

An approximate form for disclosing reclassification adjustments attributable to

related to the components of other comprehensive income is presented in table. 4.

Table 4

Sample Disclosure Form for Reclassification Adjustments

in the statement of comprehensive income for the year ending December 31, thousand rubles.

.png)

In addition, the new edition contains requirements for disclosing the influence

income tax on each component of other comprehensive income. This

the impact may be presented in the statement of comprehensive income or in

requirements in two versions: each component is allowed to be disclosed as after

accounting for the tax effect, and before it is taken into account - with a reflection of the general tax

effect in one sum. An approximate form of disclosure is presented in table. 5.

Table 5

Sample form for disclosing the impact of income taxes

to components of other comprehensive income for the year,

ending December 31, thousand rubles.

.png)

To comply with the requirements of the new edition of the standard, banks only need

will make adjustments to the reporting model and to the working chart of accounts (in terms of

accounts used directly for transfer to reporting lines).

Since credit institutions have been submitting reports for several years,

they should wait for the new amendments to IFRS 1, which are currently being worked on

IFRS works. If such amendments are adopted before the end of 2009, then banks

It is worth applying them ahead of schedule in the reporting for 2009.

Reporting in unstable market conditions

Banks face special challenges for disclosing information.

strong market situation. In such conditions, it is necessary to make financial

reporting is more informative.

The most important part of the reporting of most banks is the statement of

provision of information on the sustainability of financial results and financial

provisions. Key cash flow information needs to be disclosed

and financing strategies, including information on ongoing implementation

necessary assessment of the availability of funding sources.

It is necessary to provide detailed information about the tests performed on

the subject of impairment and references to external sources of information, as well as an explanation

understand the current market situation and changes that have occurred over the past

12 months and their impact on business.

For example, the amount of the allowance for impaired loans is based on an estimate

management of these assets at the reporting date after analyzing the cash flows

funds that may arise as a result of the alienation of the debtor’s property

minus the costs of obtaining and selling collateral. Market in Russia for pain

Most types of collateral, in particular real estate collateral, are highly

suffered from the resulting instability in global financial markets, which

led to a decrease in the level of liquidity of certain types of assets. As a result

tate actual sale price after alienation of the debtor's property

may differ from the value used in calculating provisions for impairment

opinion.

The following examples of information disclosure can be given.

The fair value of investments quoted in an active market is based on

van at current demand prices (financial assets) or supply prices

(financial obligations). In the absence of an active market for financial

The bank determines the fair value of instruments using methods

assessments. These techniques include the use of information from recent operations

transactions made on market conditions, analysis of discounted cash

flows, option pricing models and other valuation techniques, widely

used by market participants. Valuation models reflect current market

conditions at the valuation date that may not be indicative of market conditions

conditions before or after the valuation date. As of the reporting date, management analyzed

reviewed the models used to ensure they were properly

reflect the current market situation, including relative liquidity

market and current credit spreads.

As a result of instability in financial markets, the

be carried out on a regular basis, arm's length transactions for financial

instruments available for sale and therefore, in the opinion of management

industry, financial instruments are no longer considered to be quoted on active

market in accordance with IFRS 39.

Management cannot reliably determine the impact on financial

the bank's position further reduces the liquidity of financial markets

and growing instability in currency and stock markets. It believes that they

all necessary measures are taken to support sustainability and growth

business under the current circumstances.

Of particular importance is the disclosure of information about professional

judgments and estimates in the field of accounting.

In accordance with the Federal Law dated July 27, 2010 No. 208-FZ “On Consolidated Financial Statements”, since 2012 the following are required to keep records of their activities in accordance with IFRS:

- credit companies;

- insurance organizations;

- legal entities whose shares, bonds and other securities are traded at organized auctions by being included in the quotation list;

- legal entities whose constituent documentation establishes the mandatory presentation and publication of consolidated financial statements.

In 2014, this list was supplemented by organizations that issue only bonds that are admitted to participation in organized trading through their inclusion in the quotation list.

From January 2015, legal entities that will be required to prepare and submit financial statements in accordance with IFRS will also be companies whose securities are traded in organized trading through their inclusion in the quotation list, and which prepare consolidated financial statements in accordance with US GAAP standards. ).

A complete list of legal entities required to submit financial statements in accordance with IFRS standards since January 2015:

- Management companies of investment funds, mutual funds and non-state pension funds;

- Organizations engaged in clearing and insurance activities;

- Non-state pension funds;

- Federal State Unitary Enterprises (FSUEs), the list of which is approved by the highest collegial executive body of the Russian Federation;

- Open joint-stock companies (OJSC), the securities of which are in federal ownership and the list of which is approved by the Russian Government.

It should be noted that medical insurance companies whose activities are related exclusively to compulsory medical care were excluded from the list of insurance organizations. insurance.

As for the inclusion of non-state pension funds and parent companies in the list, this action by the legislation of the Russian Federation is intended to increase control over their activities and strengthen the degree of protection of incompetent investors.

Rules for reporting under IFRS

Annual consolidated financial statements in accordance with IFRS in 2015 are submitted for consideration to the highest management bodies (shareholders, founders, general directors) or owners of the company's property. In addition, all organizations from the list approved by Law No. 208-FZ (with the exception of FSUEs and OJSCs whose shares are recognized as federal property) must submit annual reports to the Central Bank of Russia.

IFRS reporting is submitted to the Central Bank of Russia in electronic format and must contain an enhanced qualified electronic signature.

Annual consolidated financial statements in accordance with IFRS must be submitted before the general meeting of the highest management bodies of the organization (shareholders, investors, etc.), but no later than 120 days after the end of the calendar period for which these statements were prepared.

Publication and disclosure of financial statements under IFRS 2015

IFRS reporting for 2015 must be posted on public information resources and (or) published in the media accessible to persons interested in its use. In addition, other actions may be taken with respect to the reporting to ensure that its contents are disclosed to all interested parties. The publication of consolidated financial statements must be posted no later than 30 days from the date of submission of the statements to the highest management bodies of the company.

Organization of preparation of financial statements according to IFRS

Today, in December 2014, it seems that there is still a lot of time to prepare financial statements under IFRS. After all, the first reporting of organizations obliged to switch to international standards from January 2015, in accordance with paragraph 7 of Art. 4 Federal Law No. 208-FZ should be submitted in April 2016. But today these persons must determine who will be responsible for preparing the statements, what is the level of professionalism of this specialist, and whether the available information is sufficient to prepare statements in accordance with IFRS and disclose its contents.

When switching to IFRS, specialists responsible for preparing financial statements need to decide in advance:

- Should you use your own resources or those of an outsourced contractor when preparing the first reports?

- Is it rational to form a department to regularly work with IFRS or is it better to turn to third-party contractors as needed?

- How can IFRS reporting indicators affect the company's activities? What key indicators should you pay special attention to?

- What information is subject to mandatory publication?

- Who will be responsible for auditing IFRS statements?

It should be noted that the choice of the person responsible for preparing financial statements in accordance with IFRS depends on the professionalism of the personnel working in the company and their workload. If there are specialists in the field of IFRS on staff, then, of course, it would be more advisable to involve them.

Employees of the organization have a much better understanding of the specifics and nuances of its activities, the essence of the content of commercial contracts, and also have more time for specialized work. External consultants (auditors), of course, have more practice and experience, but their involvement in the company’s activities will be superficial, and the methods used will be formulaic.

Formation of an IFRS department: training of operating personnel

or selection of ready-made specialists?

The need to report according to international standards forces the management of organizations to form specialized units. Such departments, of course, should be headed by highly qualified specialists with many years of experience working with IFRS. As for ordinary employees, they can be attracted from other departments, accounting or financial departments.